UK shoppers face Brexit duties on holiday and online purchases

Holidaymakers or online shoppers who buy items from the EU that are valued at more than £390 will have to pay customs duties, the government has revealed.

VAT and handling fees may also apply on some items, while parcels may be held up in post offices until all duties and fees have been cleared by the recipient in the UK.

The additional red tape and charges from 1 January will be one of the most visible consequences of Brexit for consumers, hitting them in just the same way as business, albeit on a smaller scale, with implications for online shopping.

It will also herald the end of “booze cruises” to the wine shops of Calais to stockpile drink for special occasions, as unlimited alcohol allowances are ending. Alcohol from the EU for personal consumption will be restricted to 42 litres of beer, 18 litres of wine and 4 litres of spirits or liquors over 22% in alcohol. Personal tobacco allowances will be limited to 200 cigarettes.

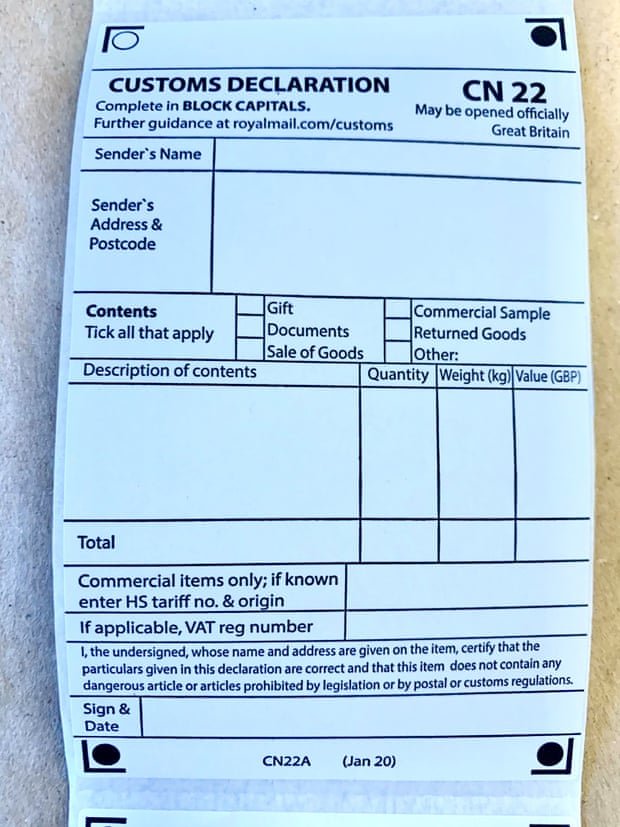

Posting to friends and family in the EU including Ireland is also going to become more bureaucratic. Those sending parcels from 1 January will be required to complete customs declaration forms, CN22 or CN23, detailing the type of good, its value and its weight.

Letters and documents can be sent to the EU as normal but the Post Office is advising customers to complete customs declaration forms on all goods destined for the EU from 29 December so the parcels are Brexit-compliant on arrival.

Royal Mail says all consumers who receive goods from the EU will have to ensure they comply with customs regulations and warn they may have to pay duty, VAT or handling fees before they can pick up their package.

This could have unforeseen consequences for online shopping for UK customers buying goods from the EU and for EU residents buying goods from the UK.

Newly published government guidance on bringing goods into the UK spells out the post-Brexit rules.

Goods up to the value of £390, or £270 for those arriving by private plane or boat, will be allowed through the green channel at airports. The notice states: “If a single item is worth more than your allowance you pay duty or tax on its full value, not just the value above the allowance.”

Those importing goods purchased on a holiday or a business trip will be charged 2.5% duty on goods worth between £390 and £630, with other rates applying for more expensive goods depending on the type of good. Any amount over will incur excise duty and VAT.

There may also be VAT charges and handling fees depending on the value of the item they are sending and whether it is a gift or commercial goods, said Royal Mail.

It said: “For items under £135 (with the exception of gifts), VAT will be collected directly when they buy the goods online. For goods with a value over £135 (and gifts over £39), Royal Mail may collect the VAT and customs duties from the customer prior to delivery. These charges are applied on behalf of HM Revenue & Customs.”

The government says it is “well placed” to manage the impact of changes to customs processing which already apply to goods going to non-EU countries, adding: “We are working closely with government and other stakeholders to ensure that all cross-border mail continues to flow efficiently.”