Markets react to PM's political crisis and oil falls 10% as investors fret over global recession

Global financial markets are enduring a day of turmoil over rising fears of a recession for the US and Europe, while a slump in the value of the pound has accelerated amid the crisis engulfing Boris Johnson's government.

There was a rush for safe havens in Europe on Tuesday, later mirrored in the US, with stock markets plunging and the pound and euro coming under intense pressure from the dollar - a traditional place of shelter in volatile times.

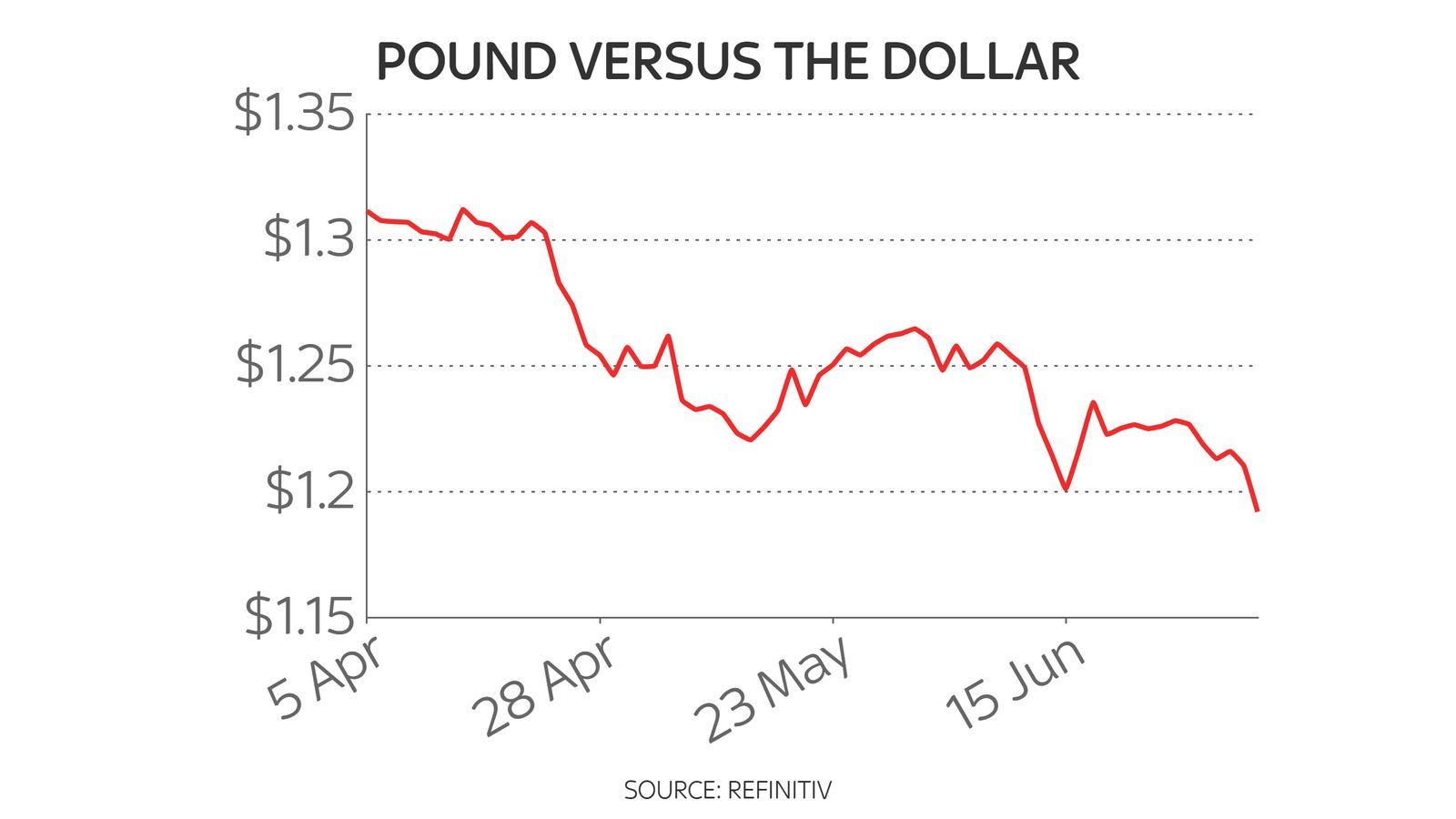

Sterling hit its lowest level against the greenback since the start of the pandemic at $1.18.9 - a plunge of almost two cents on the day - while the single currency slumped to a 20-year low versus the dollar.

The pound's value barely moved when it emerged that Sajid Javid and Rishi Sunak had quit their government roles, leaving the UK without a health secretary or chancellor and the PM clinging precariously to power.

Traders reported that while a strong dollar was evident in the currency market, there were particular concerns in Europe over mounting gas prices.

However Norway, the second-largest supplier on the continent after sanctions-hit Russia, later alleviated fears around tightness of supply after a union claimed the country's government had used its power to impose a settlement and end a strike that had threatened crucial exports.

The Bank of England also added to the general gloom when its latest Financial Stability Report warned that the economic outlook for the UK and the wider world had darkened because of the backdrop of surging inflation - much of it energy linked.

It told UK banks to ramp up capital buffers - a requirement for cash to be held in reserve - to help them withstand the slowdown ahead.

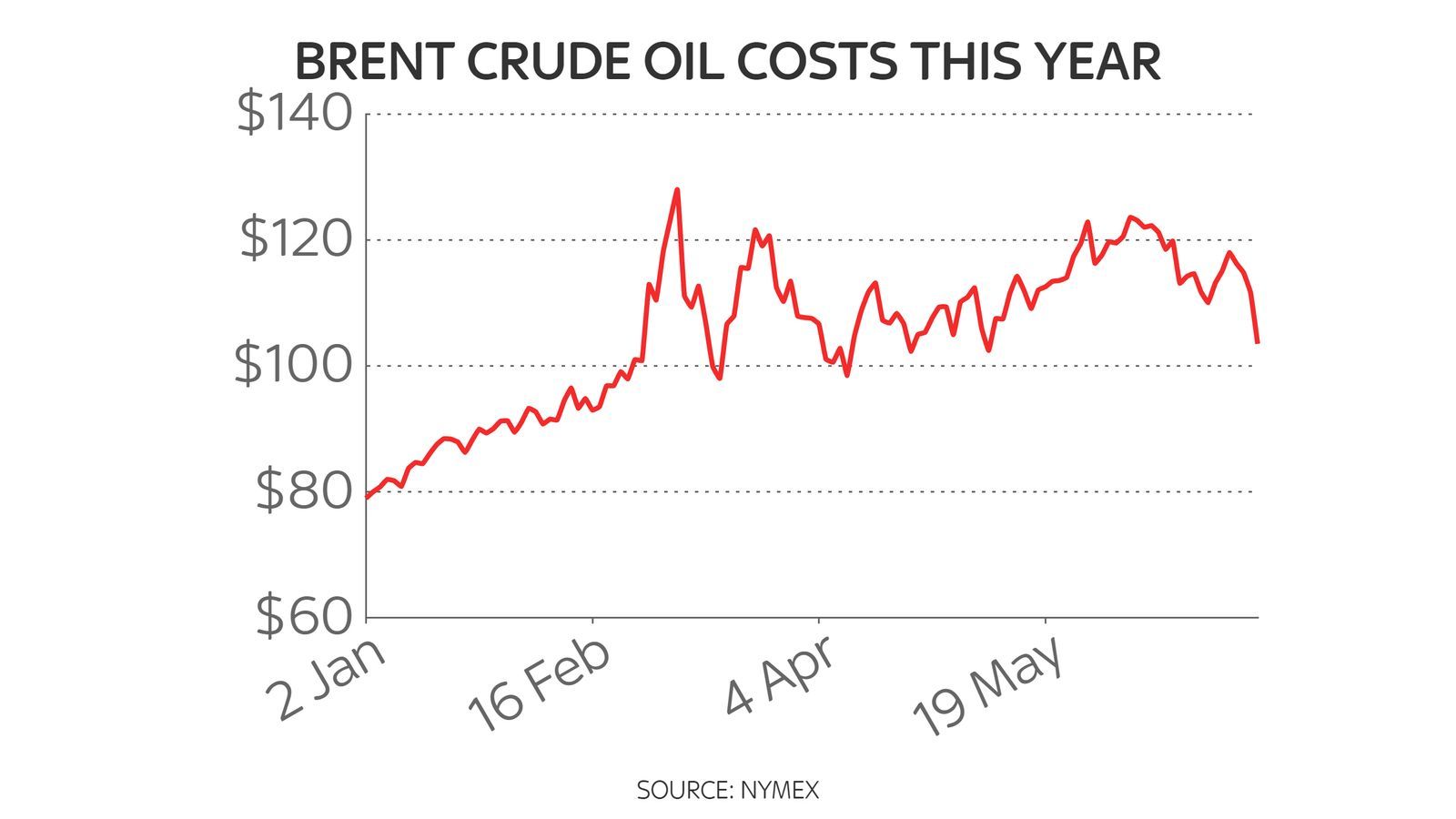

The growing fears of an inflation-led slump did help Brent crude oil, which reached 14-year highs in the wake of Russia's invasion of Ukraine, fall by more than 10% on the day to $101 a barrel in anticipation of falling demand.

A sustained period around that level could help bring down the cost of fuel at the petrol pumps but there are many other factors at play for forecourt costs despite accusations from motoring groups that retailers had already been slow to pass on falling wholesale costs.

Stock markets were widely down by more than 2% across Europe.

The FTSE 100 in London closed the day 2.9% lower at 7,025 points, with mining and energy stocks enduring the worst of the pain.

It meant that £54bn was erased from the market value of the index.

Chris Beauchamp, chief market analyst at online trading platform IG, said there was evidence of a 4th July bank holiday hangover.

"The return of US traders from their holiday has dealt the death blow to hopes of a European market rally that lasts longer than about 24 hours.

"This recurrence of selling has put indices across the board into the red, as growth and inflation fears return right on cue.

"Normally July provides some welcome relief to markets after a choppy June, but so far the instinct to sell any bounce, no matter how small, remains all-encompassing," he wrote.