Liz Truss resignation sparks recovery for pound, shares and government borrowing costs

There has been a positive market reaction to the resignation of Liz Truss after just 44 days in office, following the fierce backlash against her economic plan and humiliating climbdown.

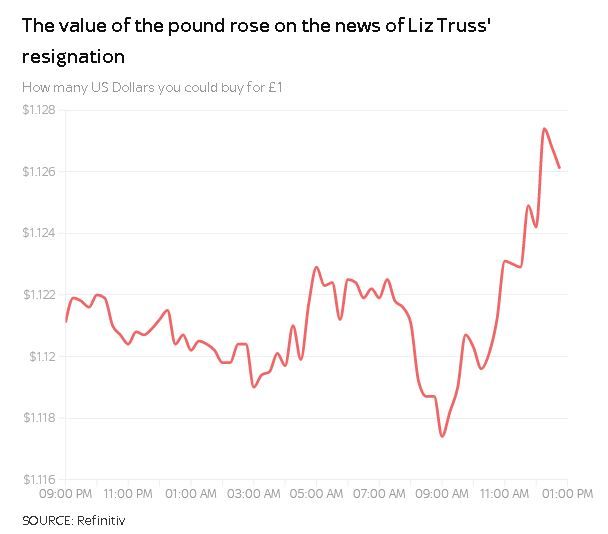

News that the prime minister was to make a Downing Street statement sparked a rally for sterling versus the dollar - leaving the UK currency almost a cent up on the day at one stage at almost $1.13 before settling at $1.12 in the late afternoon.

It originally rose half a cent following confirmation she was to leave office.

Shares also moved upwards initially on the FTSE 100 before closing higher than opening trading while government borrowing costs fell.

The 30-year gilt yield fell back to 3.8% - continuing its recovery since the post mini-budget highs of around 5% that sparked Bank of England intervention. As the afternoon progressed the figure rose to the 3.9% of Thursday morning.

It took a series of U-turns on the tax-cutting growth plan, demanded by new Chancellor Jeremy Hunt after the sacking of Kwasi Kwarteng, for market damage to ease.

The reaction to the departure of Ms Truss signalled a measure of relief that the architect of the Growth Plan - outlined during her campaign for the Tory leadership - was on her way out.

Nevertheless, there was also a measure of uncertainty at play for values, given the complete lack of vision on who would replace the prime minister in Number 10.

It will not be Mr Hunt, who has ruled himself out, leaving him free to continue preparations for the Halloween statement that is to set out the government's new medium-term fiscal plan.

There will be some jitters over whether its direction is likely to change - or even be delayed to allow the new Tory leader to get their feet under the desk.

There has been no indication that the statement will be delayed as it is expected that the successor will be in place before 31 October.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said of the market moves: "Sterling is highly sensitive to economic policy uncertainty and even though the ship Britannia will still be left largely rudderless, with a successor still to be chosen, as far as investors are concerned, the future is marginally brighter without her in charge.

"Ten-year gilt yields eased further today, as speculation soared about her resignation, a sign of tacit approval from the bond vigilantes who punished the UK by deserting its government's debt as worries raced up about fiscal responsibility."

Business appealed for a more stable period ahead.

Tony Danker, the director-general of the CBI, said: "The politics of recent weeks have undermined the confidence of people, businesses, markets and global investors in Britain.

"That must now come to an end if we are to avoid yet more harm to households and firms.

"Stability is key. The next prime minister will need to act to restore confidence from day one.

"They will need to deliver a credible fiscal plan for the medium term as soon as possible, and a plan for the long-term growth of our economy."

Pantheon Macroeconomics, the economic research consultancy, said in its October UK economic chartbook: "The economy is heading for a prolonged recession … the MPC [the interest rate setting Monetary Policy Committee] will hike Bank Rate further, but will relent at about 4%."