Gold, oil rise on Ukraine crisis; U.S. stocks end flat

Stronger-than-expected U.S. retail sales data and higher inflation readings from Canada and Britain added to the outlook for tighter monetary policy worldwide, but geopolitical tensions kept markets for the most part focused on the Ukraine standoff.

Fed policymakers agreed it was time to raise interest rates but that any decision would depend on an analysis of inflation and other data each time they met, minutes from their two-day meeting in late January showed.

"The reading of the Fed minutes is less hawkish, less aggressive rate hikes, at least initially," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder.

"The minutes are little bit more dovish than we heard (Fed Chair Jerome) Powell talk in the post Fed meeting press conference in January," Ghriskey added.

On Wall Street, the Dow Jones Industrial Average (.DJI) fell 0.16%, the S&P 500 (.SPX) gained 0.09% and the Nasdaq Composite (.IXIC) dropped 0.11%. All 11 sectors of the S&P early in the session were higher, with the exception of the energy index (.SPNY), but stocks pared losses after the Fed minutes came out.

MSCI's gauge of stocks across the globe (.MIWD00000PUS) reversed course to post a 0.32% gain, while its emerging markets index (.MSCIEF) rose 1.23%.

Sharp gains earlier in Asian equity markets on Tuesday's news that Russia was withdrawing some troops faded in the European session, with the STOXX 600 pan-European index (.STOXX) ceding some early gains to close barely up 0.04%.

NATO questioned Moscow's stated willingness to negotiate a solution to the crisis, one of the deepest in East-West relations in decades, and accused Russia of increasing its massive military build-up surrounding Ukraine.

U.S. Secretary of State Antony Blinken backed the assessment, an outlook that lifted the price of safe-haven gold and boosted crude oil along with related assets as supply would be further constrained by an invasion.

"There are not really any signs of de-escalation. That's going to put commodities likely on firmer footing given that extent supply and inventories are really low," said Bipan Rai, North America head of FX strategy at CIBC Capital Markets.

U.S. crude futures rose $1.59 to settle at $93.66 a barrel, while Brent settled up $1.53 at $94.81.

The Russian ruble gained 0.64% to 75.12 per dollar as fears of immediate military action waned, for the moment.

Earlier, U.S. retail sales rebounded sharply in January amid a surge in purchases of motor vehicles and other goods, but higher prices could blunt the impact on economic growth this quarter. L1N2UR17V

Data showed retail sales rose 3.8% last month, almost double the consensus forecast by economists of a 2.0% gain.

Spot gold , which on Tuesday hit the highest level since June 2021 at around $1,879 per ounce, added 0.8% to $1,867.51.

U.S. gold futures settled down 0.8% at $1,871.50.

Inflation was still a market concern as data in Britain showed consumer prices increased at the fastest annual pace in nearly 30 years, reinforcing chances that the Bank of England will raise rates for a third meeting in a row.

Canada's annual inflation rate accelerated again in January to hit a fresh 30-year high of 5.1%, bolstering the case for a steady series of interest rate hikes.

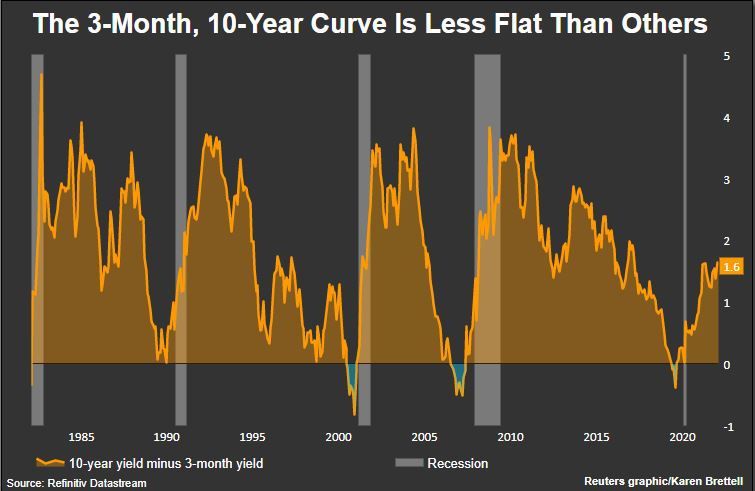

U.S. Treasury and euro zone government bond yields extended their decline. The yield on 10-year Treasury notes was down 0.5 basis points to 2.040%.

The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, fell 3.4 basis points to 1.535%. Earlier it touched a low of 1.496%.

The dollar index fell 0.215%, with the euro up 0.18% to $1.1376.