Two indicators slowdown already under way after Bank of England warns of 15-month recession

Just a day after the Bank of England warned of a 15-month recession, there are signs in housing and recruitment that the slowdown is already well under way.

Figures out on Friday showed that house prices fell in July (in monthly terms) for the first time in more than a year, with warnings that the market is likely to weaken further following the bank's hiking of interest rates from 1.25% to 1.75%.

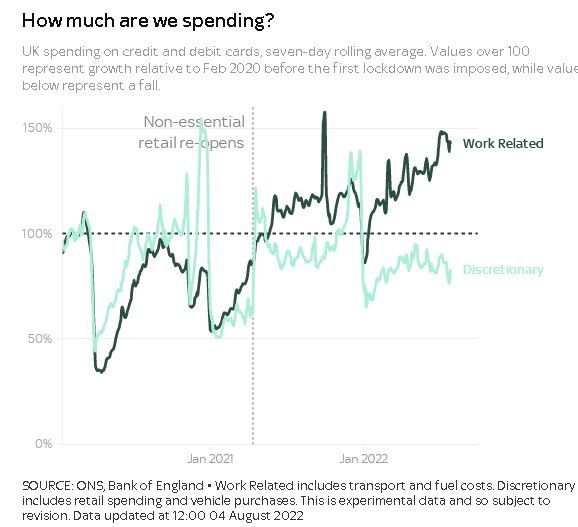

The bank rate is now at its highest level since 2008, as the bank tries to fight inflation which is running at 9.4% - well above its 2% target - and is forecast to pass 13% later this year.

It comes as households face record-breaking increases in energy bills, and mortgage lender Halifax said that this rapidly-spiralling cost of living would have its effect on the market, as buyers look to rein in spending.

In July the average house price stood at £293,221 - down £365 or 0.1% from the previous month's record high. In annual terms, however, prices still rose by 11.8%, compared to the 12.5% seen in June.

Russell Galley, Halifax managing director, said: "House prices are likely to come under more pressure as those market tailwinds fade further and the headwinds of rising interest rates and increased living costs take a firmer hold.

"Therefore a slowing of annual house price inflation still seems the most likely scenario."

It comes after a report from rival lender Nationwide which showed house prices rose in July, but at the slowest monthly pace seen in a year.

Bank of England data has also shown the lowest number of new mortgage approvals in two years during June.

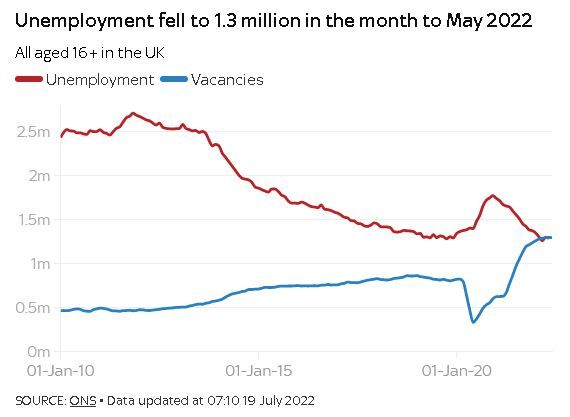

The gloomy outlook is also resulting in fewer staff being hired by businesses, as they too become more cautious.

A study of 400 recruiters by the Recruitment and Employment Confederation and KPMG showed that businesses - facing increasing costs from energy prices and inflation - are "rightly hesitant" about their hiring plans.

Claire Warnes, of KPMG, said: "The trend of uncertainty in the UK jobs market of the last few months continues, as overall hiring activity saw another slowdown in July.

"Given the challenging economic outlook, employers are rightly hesitant about their hiring plans, but, to compound this, a lack of suitable candidates and an overall skills shortage in most sectors are keeping starting salaries high."

Kate Shoesmith, deputy chief executive of the REC, said: "The jobs market remains solid. Demand for staff continues to rise, as it has done since early 2021, rising in every sector.

"Starting salaries are still growing too, making this a good time for jobseekers to be looking for their next role.

"However, growth in permanent hiring has softened in recent months. We've seen that rising fuel and energy prices, inflation and labour shortages are impacting employer confidence.

"Labour and skills shortages are also restricting opportunities for both the private and public sector to meet consumer demand."

In the past week, the closely-watched PMI surveys have also shown signs of slowdown in the services, manufacturing and construction sectors.

It all presents a massive challenge for the next prime minister, as Conservative Party members prepare to choose between Rishi Sunak and Liz Truss for the role.

In Sky News's Battle for Number 10 Leadership Special on Thursday night, Ms Truss insisted a recession is not inevitable, adding: "We can change the outcome and we can make it more likely that the economy grows".

When her rival Mr Sunak was asked whether there is anything that can be done about a recession, he said: "Of course there is, of course."

He said "gripping inflation" would be the best way of preventing a recession, saying: "So what I'm not going to do is embark on a borrowing spree worth tens of billions of pounds, put that on the country's credit card, ask our kids and our grandkids to pick up the tab, because that's not right. That's not responsible."