Four more small energy firms could go bust next week

Industry sources have told the BBC that four firms have asked larger players to bid to take over the supply to one million customers.

The price rise has left some companies unable to provide their customers with the energy they have paid for.

Industry rules mean supplies will continue for affected customers, and they will not lose money owed to them.

The new company is also responsible for taking on any credit balances the customer may have.

But paying that credit out to customers is a further disincentive for companies to take on new business.

Business Secretary Kwasi Kwarteng tweeted: "Some energy companies are facing pressure. Ofgem has robust measures in place to ensure that customers do not need to worry, their needs are met, and their gas and electricity supply will continue uninterrupted if a supplier fails."

The government added that if the company is not taken over there were processes in place to appoint a special administrator to temporarily run the suppliers.

It came after the government held talks with representatives from the energy industry amid growing concern about the impact of the spike in wholesale gas prices on households and businesses, including food manufacturers.

The government said the business secretary was reassured that security of supply was not a cause for immediate concern within the industry.

"The UK benefits from having a diverse range of gas supply sources, with sufficient capacity to more than meet demand... the UK's gas system continues to operate reliably and we do not anticipate any increased risk of supply emergencies this winter."

Mr Kwarteng said: "Our largest single source of gas is from domestic production, and the vast majority of imports come from reliable suppliers such as Norway...

"However, our exposure to volatile global gas prices underscores the importance of our plan to build a strong, home-grown renewable energy sector to further reduce our reliance on fossil fuels."

The business secretary said he will have further talks with Ofgem on Sunday to discuss the issues raised by the industry, and on Monday he will seek a further meeting with industry figures "to plan a way forward".

Four small suppliers ceased trading in recent weeks, including Edinburgh-based People's Energy, which supplied gas and electricity to about 350,000 homes and 1,000 businesses, and Dorset-based Utility Point which had 220,000 domestic customers.

At the beginning of 2021 there were 70 energy suppliers in the UK. Industry sources say there may be as few as 10 left by the end of the year.

Government sources have said the impact on small energy companies that might be the most exposed was being monitored.

What to do if your energy supplier goes bust

* Customers will still continue to receive gas or electricity even if the energy supplier goes bust. Ofgem will move your account to a new supplier but it may take a few weeks. Your new supplier should then contact you to explain what is happening with your account

* While you wait to hear from your new supplier: check your current balance and - if possible - download any bills; take a photo of your meter reading

* If you pay by direct debit, there is no need to cancel it straight away, the Citizens Advice Bureau says. Wait until your new account is set up before you cancel it

* If you are in credit on your account, your money is protected and you'll be paid back. If you were in debt to the old supplier, you'll still have to pay the money back. The new supplier should contact you to arrange a payment plan

* Once you have been informed of your new supplier, make sure you're on the best tariff for you. You can switch if you're not happy with your new supplier or tariff without any penalties, but don't do this until the account has been moved over.

Source: Citizens Advice

Many smaller companies have not insured - or hedged - their exposure to rapidly rising prices and some of the ones that have are cashing in that insurance now to survive - leaving them vulnerable to further shocks.

The end of summer is the time of year when credit balances are at their highest as customers have been paying their usual monthly amount but not using much energy for heating their homes.

Ofgem may have to allow the cost of those balances to be spread across the industry - adding hundreds of millions of pounds to energy bills through industry-wide levies.

Under normal circumstances there is a competitive auction process with the company offering the lowest energy price being rewarded with the additional customers. That is not the case in current market conditions.

As one industry executive put it: "With energy prices having rocketed, and the energy price cap [the maximum price suppliers can charge customers on a standard tariff] already having been set for this year, no-one is that keen to take on new business. The cap is now the cheapest price in the market."

When this has happened in the past, the companies involved have failed and Ofgem has asked larger players to bid to take on the new customers.

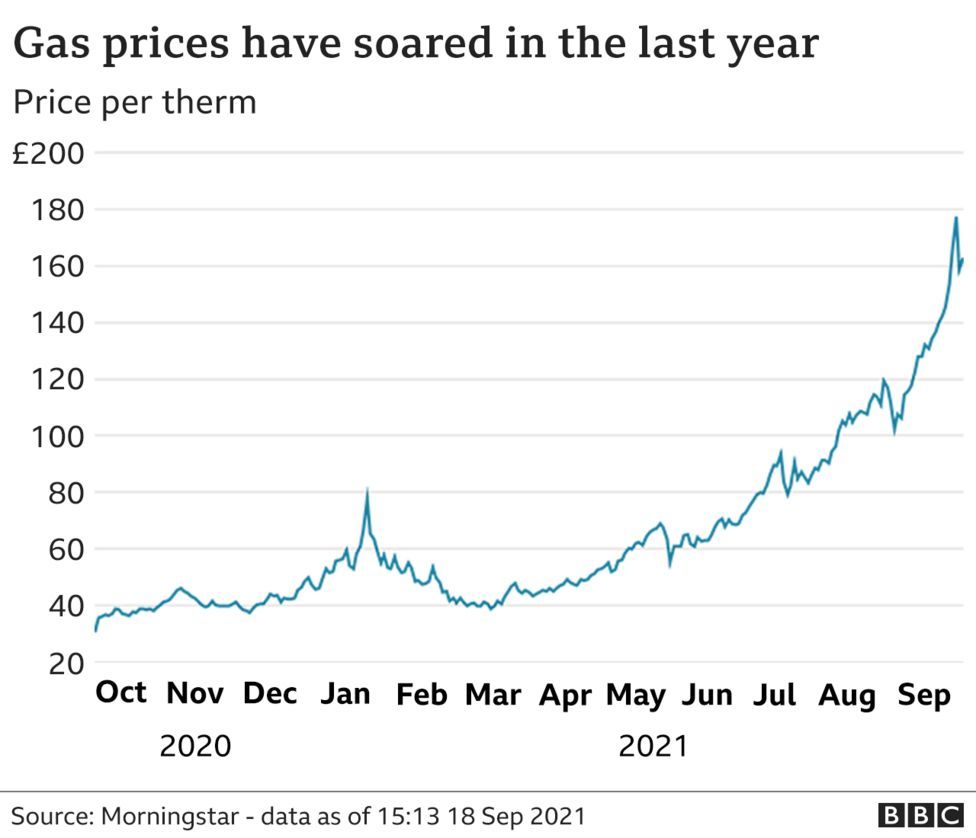

Industry group Oil & Gas UK said wholesale prices for gas are up 250% since January - with a 70% rise since August.

High global demand, maintenance issues at some gas sites and lower solar and wind output are blamed for the rise.

Emma Pinchbeck, chief executive of trade association Energy UK, told BBC Radio 4's PM programme: "There is a longer conversation to be had about our retail market design and how we make sure we are not vulnerable to volatile, international commodity prices again."