UK Financial Conduct Authority Opens Formal Investigation into WH Smith After Accounting Errors

Travel retailer faces regulator scrutiny over profit misstatements and potential breaches of listing and disclosure rules

Britain’s Financial Conduct Authority has launched a formal investigation into WH Smith, the iconic travel retail and bookseller, following significant accounting errors that forced the company to restate its financial results and triggered leadership changes.

The regulator’s action comes as WH Smith seeks to rebuild investor confidence after an independent review uncovered profit overstatements at its North America division and the subsequent market fallout.

The Financial Conduct Authority said it was examining whether WH Smith breached United Kingdom listing and disclosure rules related to its financial reporting, particularly in relation to how supplier income and other items were recognised in profit figures.

The accounting discrepancies prompted the company to revise its results for the years ending August 2023 and August 2024 and led to the departure of chief executive Carl Cowling.

The probe highlights concerns about corporate governance and transparency at one of the FTSE 250’s best-known retail groups.

WH Smith has said it will “co-operate fully” with the FCA’s investigation while implementing measures to strengthen financial controls and oversight.

Interim chief executive Andrew Harrison acknowledged that the company must “rebuild confidence” among shareholders and stakeholders, emphasising plans to streamline operations and focus on its most profitable travel retail segments in airports, train stations and hospitals.

Harrison’s comments underline a broader effort to stabilise the business after a tumultuous period that saw the company’s shares fall sharply and its annual dividend cut.

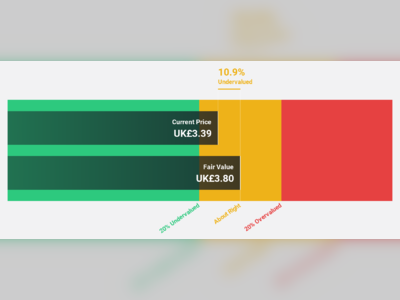

Market reaction to the regulatory scrutiny has been notable, with WH Smith’s shares having lost substantial value since the accounting issues first emerged in August.

The company is also seeking to recover overpaid bonuses from former senior executives through malus and clawback provisions in response to the restated results.

Investors and analysts are watching the situation closely as the retailer sets out projections for fiscal 2026 and works to restore financial discipline and transparency.

The regulator’s action comes as WH Smith seeks to rebuild investor confidence after an independent review uncovered profit overstatements at its North America division and the subsequent market fallout.

The Financial Conduct Authority said it was examining whether WH Smith breached United Kingdom listing and disclosure rules related to its financial reporting, particularly in relation to how supplier income and other items were recognised in profit figures.

The accounting discrepancies prompted the company to revise its results for the years ending August 2023 and August 2024 and led to the departure of chief executive Carl Cowling.

The probe highlights concerns about corporate governance and transparency at one of the FTSE 250’s best-known retail groups.

WH Smith has said it will “co-operate fully” with the FCA’s investigation while implementing measures to strengthen financial controls and oversight.

Interim chief executive Andrew Harrison acknowledged that the company must “rebuild confidence” among shareholders and stakeholders, emphasising plans to streamline operations and focus on its most profitable travel retail segments in airports, train stations and hospitals.

Harrison’s comments underline a broader effort to stabilise the business after a tumultuous period that saw the company’s shares fall sharply and its annual dividend cut.

Market reaction to the regulatory scrutiny has been notable, with WH Smith’s shares having lost substantial value since the accounting issues first emerged in August.

The company is also seeking to recover overpaid bonuses from former senior executives through malus and clawback provisions in response to the restated results.

Investors and analysts are watching the situation closely as the retailer sets out projections for fiscal 2026 and works to restore financial discipline and transparency.