Elon Musk crowns himself 'Technoking of Tesla' - as finance chief Zachary Kirkhorn becomes 'master of coin'

Elon Musk has crowned himself "technoking of Tesla" in a regulatory filing that also appears to celebrate the firm's cryptocurrency investments.

The document, which added the bizarre title to the list covering Mr Musk, was sent to stock market regulator the US Securities and Exchange Commission (SEC).

Tesla also said finance chief Zachary Kirkhorn would be known as "master of coin".

No explanation was offered for the change.

The filing stated: "Effective as of March 15, 2021, the titles of Elon Musk and Zach Kirkhorn have changed to Technoking of Tesla and Master of Coin, respectively.

"Elon and Zach will also maintain their respective positions as Chief Executive Officer and Chief Financial Officer."

In another document Tesla said its president of automotive, Jerome Guillen, had become the boss of its heavy trucking division.

Mr Musk, Tesla's eccentric founder and chief executive, has been credited with driving a surge of interest in cryptocurrencies.

Values have hit record levels this year.

Mr Musk has been among a few US corporate leaders to have endorsed Bitcoin

Mr Musk has been among a few US corporate leaders to have endorsed Bitcoin

Last month, Tesla revealed it had purchased $1.5bn (£1.1bn) of bitcoin and would soon accept it as a form of payment for cars.

Mr Musk has also recently promoted another digital currency, dogecoin, on Twitter. But his posts have often placed him on a collision course with the SEC.

He was fined $20m in 2018, and had to give up his dual chairman role at the company, after being accused of making "false and misleading" tweets about potentially taking Tesla private.

The SEC, as part of a settlement to avoid a fraud lawsuit, made a further condition that Mr Musk would agree to clear market sensitive posts before publication.

At the weekend, it was revealed that an investor was suing Mr Musk and Tesla for allegedly violating that agreement with the regulator.

Chase Gharrity's claims relate to several tweets, such as Mr Musk's assessment in May last year that Tesla's stock price was "too high".

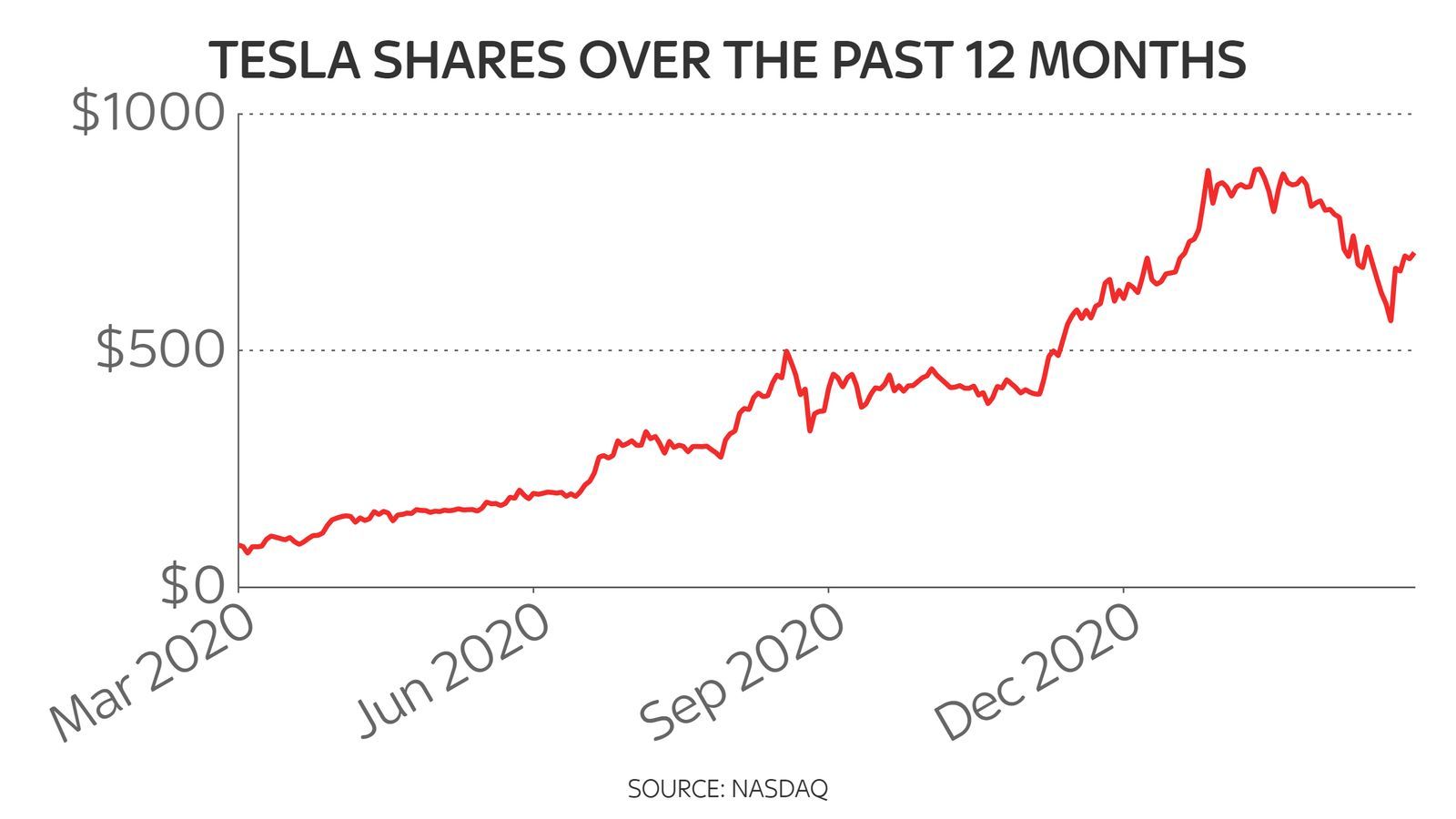

Tesla's market value lost $13bn (£9.35bn) at the time, though it has since hit record levels.

Bitcoin, meanwhile, hit fresh highs of almost $62,000 (£44,000) over the weekend but retreated by 5% early on Monday.