Bank of England monitors UK housing boom as it weighs inflation risk

The Bank of England is carefully monitoring Britain’s booming housing market as it weighs up the possibility that a rapid recovery from the Covid-19 pandemic will lead to a sustained period of inflation, one of its deputy governors has said.

In an interview with the Guardian, Sir Dave Ramsden said the Bank expected price pressures to be temporary but he and his colleagues on Threadneedle Street’s monetary policy committee were aware of the risks.

Ramsden, the deputy governor responsible for markets and banking, said: “There is a risk that demand gets ahead of supply and that will lead to a more generalised pick-up in inflationary pressure. That’s something we are absolutely going to guard against. We are looking carefully at the housing market and a raft of real-term indicators.”

Inflation, as measured by the UK’s consumer prices index, is at 1.5% and is expected to rise above its 2% target for a short period over the coming months.

The average UK house price climbed 10.2% in the year to March, the highest annual growth rate since August 2007, with the stamp duty holiday pushing up demand.

Ramsden said the Bank would not be complacent about inflation. “If it is not temporary we know what to do about that. We can push bank rate up from its historically low level [0.1%] and we know what that will do to demand.”

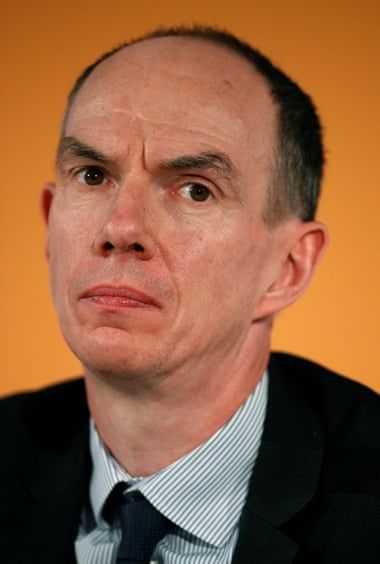

Sir Dave Ramsden says the Bank of England will not be complacent about inflation.

Sir Dave Ramsden says the Bank of England will not be complacent about inflation.

He said that while he was increasingly optimistic about the recovery, there was also a possibility that inflationary pressure may prove to be lower than anticipated if the economy slowed after an initial burst of post-lockdown activity.

“That could happen if new variants emerge or we get psychological scarring, where some of the behaviour of the past 15 months becomes habitual. There is a risk that people will continue to be cautious.”

He added: “The uncertainties are less than they were but they haven’t gone away. Covid-19 is still with us and we are seeing that with the variants. The link seems to be on its way to being broken between cases and hospitalisations, and worse, but we can’t say for sure yet. We can’t rule out more variants and we have to bear that in mind.”

Ramsden said there were plenty of media reports of inflation hotspots, including the rising cost of computer chips, building materials and wages, but there was nothing at the moment to suggest a persistent threat.

“We have to recognise that in the 1970s we had an inflation history, but since inflation targeting started in 1992, and particularly after Bank independence in 1997 our record of achieving low inflation is pretty good.”

From August the Bank’s monetary policy committee will have the ability to push bank rate below zero but Ramsden hinted strongly that he would be wary about such a groundbreaking step. “Having a policy ready is distinct from whether you actually use it,” he said, noting that financial markets were expecting the next move in borrowing costs to be up.

“Negative rates would certainly come as a surprise to the markets but we will be governed by our assessment of the state of the economy as it is then.”

In addition to cutting interest rates to their lowest-ever level after the pandemic began, Threadneedle Street has stepped up its asset purchase programme, a money creation scheme begun in 2009 in response to the financial crisis.

Ramsden said this was necessary given the need to calm the financial markets and boost the economy in the early stages of the Covid crisis, and dismissed claims that the Bank was printing money to cover record peacetime borrowing.

“Both the Treasury’s and the Bank’s actions were because the economy needed it. I absolutely reject the suggestion that the Bank was somehow in cahoots with the government. It wasn’t in 2009 and it isn’t now.”

He added that Threadneedle Street was seeking to use its £20bn holdings of corporate bonds to help the government achieve a net zero economy by 2050. The Bank wants to encourage firms to decarbonise but reserves the right to disinvest bonds to incentivise that transition.