Bank of England: Economy to rebound strongly due to vaccine

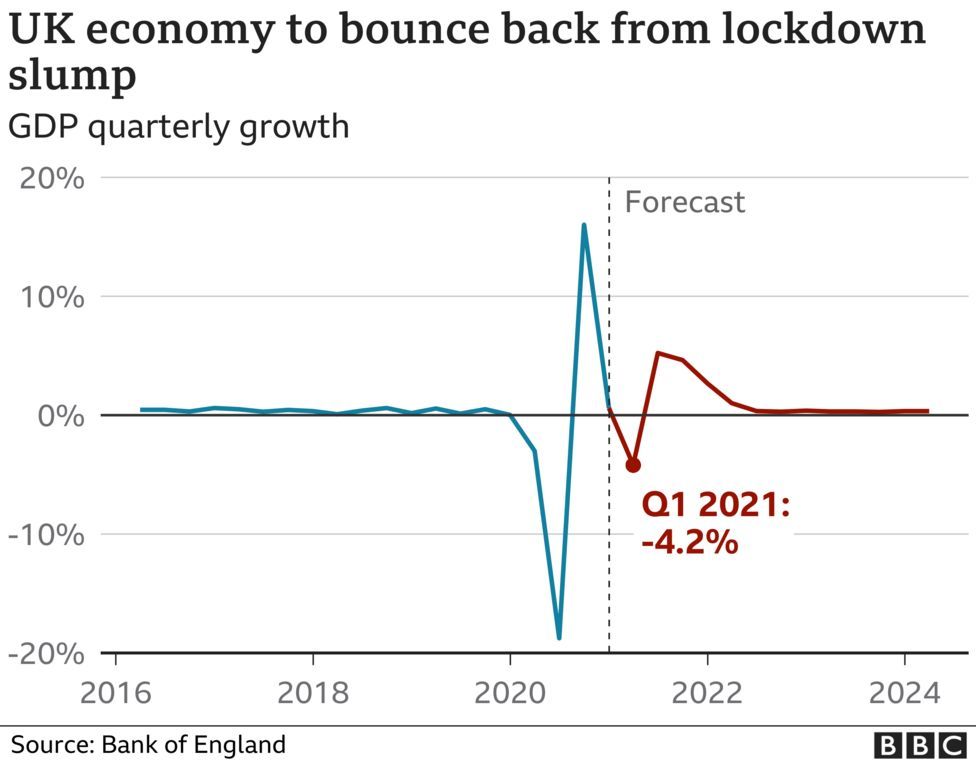

The economy is expected to shrink 4.2% in the first three months of 2021, amid tighter lockdown restrictions to slow the spread of the virus.

But policymakers expect a rebound this spring as consumer confidence returns.

The Bank also told High Street lenders to prepare for negative interest rates, even as it ruled out an imminent move.

What does this mean for households?

The UK economy is expected to "recover rapidly" in 2021, with a successful vaccination programme supporting a "material recovery in household spending".

Andrew Bailey, the governor of the Bank of England, described the vaccine rollout as "excellent news" that would speed up a return to normal life.

"We do think that that is going to support a sustained recovery throughout the rest of the year," he said.

Its latest Monetary Policy Report said the positive vaccine news had driven an increase in UK holiday bookings later this year, although overseas bookings remained muted.

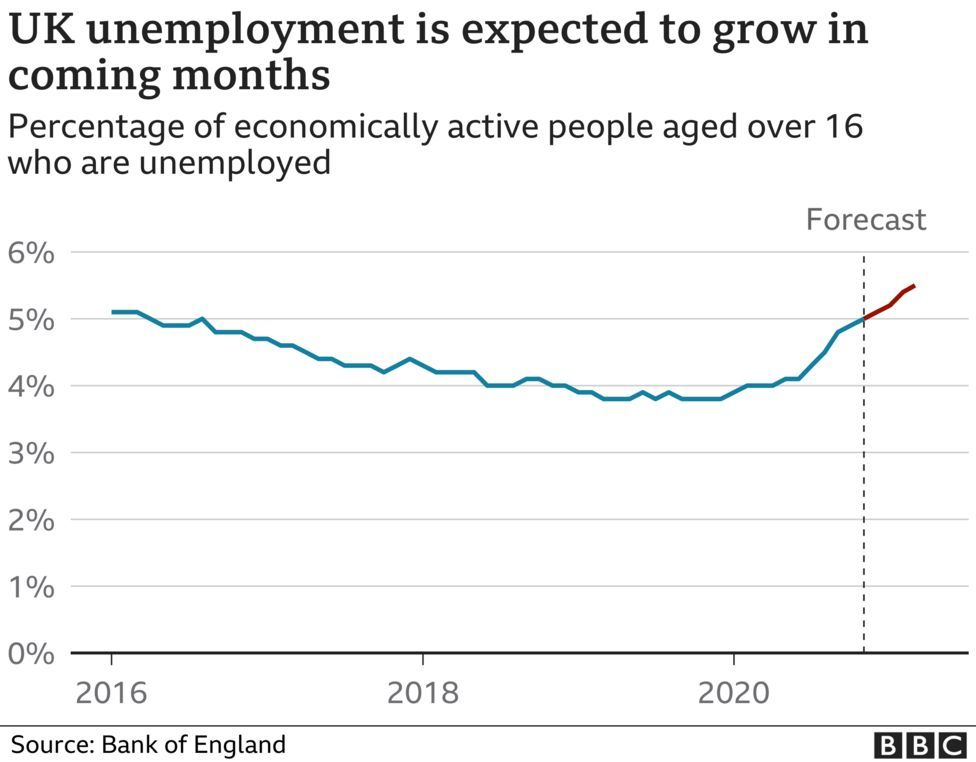

While government support schemes are expected to limit any immediate increase in unemployment, the jobless rate is still projected to rise to 7.8% later this year as the furlough scheme winds down.

The most recent unemployment rate - for September to November - was 5.0%,

However, policymakers said the outlook for the economy remained "unusually uncertain".

What problems lie ahead?

The Bank said the rebound in economic activity would depend on controlling any new strains of the virus, as well as households' willingness to spend.

It said most people now expect "life to return to normal" within a year.

But some voluntary social distancing was likely to persist, as it has done in economies where restrictions have already been eased substantially.

In New Zealand, for example, spending on restaurants and hotels has still not recovered to pre-pandemic levels.

The Bank said: "The Covid vaccination programme would be expected to lead to an easing of social distancing restrictions, reduced economic uncertainty and higher activity, although the timing of those effects is hard to predict."

Are people more likely to spend or to save as the economy recovers?

Millions of workers remain on the government's furlough scheme, while redundancies increased sharply at the end of last year.

However, many high earners working from home have saved more during the pandemic.

The Bank said £125bn more was squirrelled away in UK savings accounts last year.

The Bank said concerns about using public transport has pushed up demand for second-hand cars.

The Bank said concerns about using public transport has pushed up demand for second-hand cars.

"That figure is likely to rise substantially further over the first half of 2021," the Bank said.

Policymakers believe retired households, which have received vaccines sooner, will start spending first.

Greater job security is also expected to lead to higher spending.

However, the Bank noted that 70% of the people it surveyed planned to keep their extra money in savings instead of spending it.

Sales of new cars are also expected to remain subdued, though concerns about using public transport have pushed up sales of second-hand vehicles.

What's happening with interest rates?

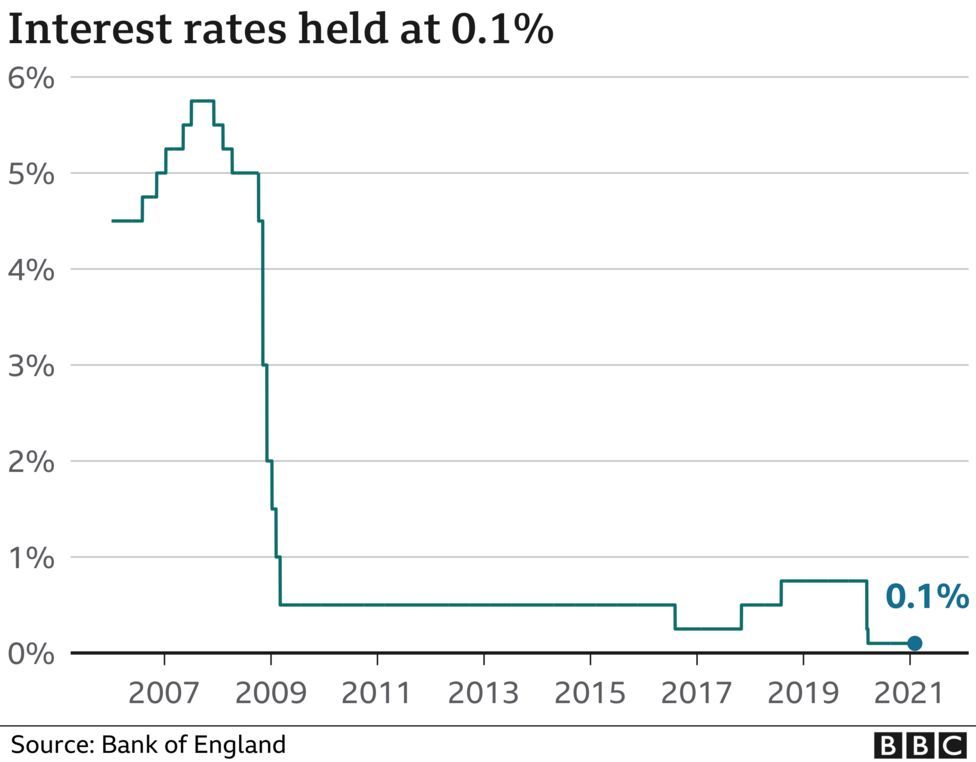

The Bank's Monetary Policy Committee (MPC) held interest rates at a record low of 0.1% on Thursday.

Following a review, it has also asked High Street banks to get ready for the possibility that they could fall below zero in the future.

What are negative interest rates?

The term "interest rates" is often used interchangeably with the Bank of England base rate.

Described as the "single most important interest rate in the UK", the base rate determines how much interest the Bank of England pays to financial institutions that hold money with it, and what it charges them to borrow.

High Street banks also use it to determine how much interest they pay to savers, as well as what they charge people who take out a loan or mortgage.

The Bank of England usually lowers interest rates when it wants people to spend more and save less.

In theory, taking interest rates below zero should have the same effect. But in practice, it's a bit more complicated.

After all, why would anyone pay to stash money in a savings account or lend someone money, when they can keep the cash at home for free?

Are negative interest rates coming to the UK?

The Bank stressed that commercial lenders needed at least six months to prepare and this did not mean that negative rates were "imminent, or indeed in prospect at any time".

Mr Bailey added: "My message to the markets is you really should not try to read the future behaviour of the MPC from these decisions and these actions we're taking on the toolbox.

"Nobody should take any signal from this."

What is the reasoning behind the Bank's strategy?

The Bank of England is not just counting jobs and prices, but vaccinations too.

On this basis, despite the current three months seeing a lockdown-inflicted fall in the economy, policymakers are more confident about the timing of recovery, in the middle of this year.

Indeed, that recovery will be mathematically sharper than previously predicted, because of the further drop right now. As the Bank concludes in its forecast "GDP picks up strongly" as restrictions are assumed to ease between April and September.

In terms of its decisions, that means the Bank has held fire, leaving interest rates at historic lows. Not one of the nine panel members deciding rates voted for the much-hyped "negative rates" seen in Europe.

Commercial banks will be asked to prepare in the next months, so the lever is an option, but the Bank of England was at pains to say this was not a signal of intentions.

The Bank was also clear that the post-Brexit trading rules will hit the economy, and that there are new "barriers" likely to lower trade between the UK and EU, some which are yet to emerge. This goes beyond the government's repeated claims that such changes are "teething problems".

The big message, though, is a more confident assertion that the economy, as well as the people, will be inoculated by the summer.