UK forced to borrow more than expected as soaring inflation bites

UK government borrowing increased by more than expected in August as rising inflation pushed up debt interest payments.

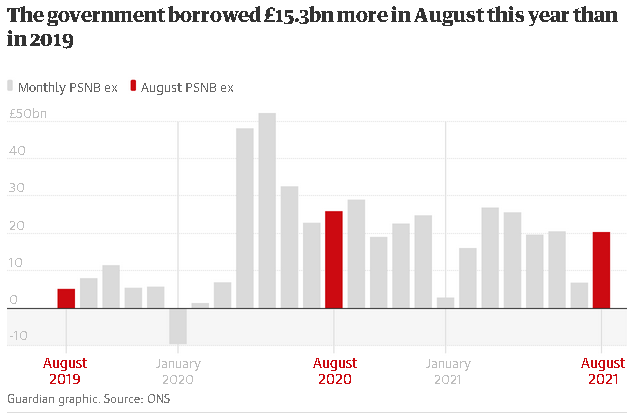

The Office for National Statistics said the government’s budget deficit – the gap between spending and income – dropped to £20.5bn in August from about £26bn in the same month a year earlier as Britain’s economy recovers from lockdown.

However, the latest snapshot showed that the gains from a rebound in tax receipts were offset by inflation driving up interest payments on the national debt by 84% compared with the same month a year ago.

City economists had forecast a lower August borrowing figure of about £15.6bn.

The figures come as Rishi Sunak prepares to scale back emergency Covid support schemes and set out the government’s post-pandemic tax and spending plans at next month’s autumn budget and three-year spending review.

The chancellor has indicated that inflation is a significant risk to the public finances. “We are determined to get our public finances back on track – that’s why we have set out the focused and responsible steps we are taking to keep debt under control,” he said.

Economists said the drop in the August budget deficit was driven by stronger tax receipts and lower spending on pandemic support as the economy recovers from lockdown. For the year so far, borrowing stood at £93.8bn, almost £32bn below a forecast made by the Office for Budget Responsibility in March.

Figures published by the Treasury showed businesses have now returned £1.3bn in furlough cash they did not ultimately need, with £300m paid back in the past three months as employers return more staff to work. The government has paid out a total of £68.5bn on furlough so far.

However, officials said the fallout from higher inflation eroded some of the gains. According to the latest snapshot from the ONS, interest payments on government debt rose by £2.9bn from the same month a year ago to stand at £6.3bn in August, lower than a monthly record of £8.7bn spent on servicing the national debt in June.

Reflecting the surge in government borrowing during the pandemic, public sector net debt stood at £2.2tn at the end of August, or about 97.6% of GDP, the highest ratio since March 1963.

Britain’s economic recovery from lockdown has faltered as shortages of workers and supplies weigh on growth. Inflation has also risen to the highest level in a decade. Although this is largely owing to temporary factors as the economy recovers from lockdown, some economists warn that persistent disruption from Covid and Brexit will maintain pressure on living costs.

The ONS said recent high levels of debt interest were mainly due to movements in the retail prices index (RPI) measure of inflation, to which some government bonds are pegged. The RPI jumped to 4.8% in August, up from 0.5% a year earlier to stand at the highest level in a decade.

The OBR said the rise in inflation meant debt interest for the financial year to date was £4.7bn, or 20.5%, higher than its March forecast.

However, annual debt interest payments remain at historically low levels. Even though the national debt has hit the highest GDP ratio since the 1960s, servicing costs are at a 320-year low. The OBR’s March forecast estimated debt interest would hit £24.8bn this year, £13bn lower than its forecast for 2021-22 made before Covid-19 struck.

Jo Michell, associate professor in economics at Bristol Business School, said interest payments in August amounted to less than 1% of tax received in the past 12 months, and that much of the national debt was held by the Bank of England, effectively incurring interest at Threadneedle Street’s 0.1% base rate.

“Although gilt interest payments have been pushed up by recent increases in inflation, nominal figures for individual months should be seen in the context of ongoing very low borrowing costs,” he said.

The ONS also revised upwards its estimate for borrowing in the financial year to the end of March 2021 by £27.1bn, taking the deficit to £325.1bn, in a reflection of the hit from Covid-19.

It said this was driven mainly by the inclusion of expected losses on government-backed emergency Covid loans to businesses worth £20.9bn, which it had included in the estimates for the first time. Although representing about a quarter of the total £80bn lent through Covid business loan schemes, the estimated losses are lower than the previous £27bn forecast made by the OBR.