Rishi Sunak talking to EU over threat to UK electric cars

The UK is lobbying the EU over a Brexit trade deal deadline that carmakers have warned pose a threat to UK industry.

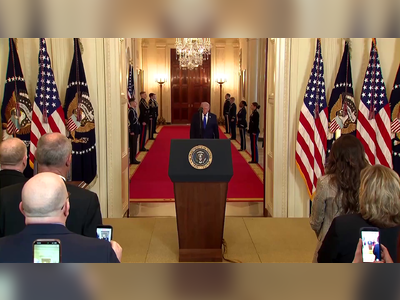

Prime Minister Rishi Sunak said the UK was "engaged in a dialogue" with the EU about a looming rule change that could affect UK electric car hopes.

Carmakers in Britain and the EU have been asking for the rule change to be pushed back.

Stellantis, which owns Vauxhall, Peugeot, Citroen and Fiat, has said that its UK factories are at risk.

The company has previously committed to making electric vans in the UK, but now says these plans are under threat.

It has warned it could face tariffs of 10% on exports to the EU due to rules on where parts are sourced from.

Under current rules, 40% of the value of an electric vehicle should originate in the UK or EU to qualify for trade without tariffs.

However, this percentage will rise to 45% from the beginning of next year, while for battery packs the threshold will be 60%.

From 2027, the bar is raised even higher, to 55% for the value of an electric vehicle and 70% for battery packs.

Stellantis said it was "now unable to meet these rules of origin" due to the recent surge in raw material and energy costs.

Europe's car trade body, the European Automobile Manufacturers' Association, has also asked the EU to extend the deadline, arguing that the supply chain is not ready.

Speaking to reporters in Japan where he is attending a G7 summit, Mr Sunak said the approaching deadline was "something that car manufacturers across Europe, not just in the UK, have raised as a concern".

"And as a result of that we are engaged in a dialogue with the EU about how we might address those concerns when it comes to auto manufacturing more generally," he added.

Mike Hawes, chief executive of UK trade body, the Society of Motor Manufacturers and Traders (SMMT), said he hoped "some degree of common sense would prevail".

"It doesn't need a full renegotiation of the Brexit deal, it just needs an agreement that you won't [implement] some of the rules that were due to change next year," he told the BBC's Today programme.

"It's hard to see how you can make sure that your plant is competitive for the long term if you're facing these additional costs. It undermines the investments either that have been made or potentially will be made."

Industry experts have expressed concern that the UK is running out of time to develop its own battery manufacturing industry, given heavy investment being made in the US, China and the EU.

Mr Hawes said the UK had not missed the boat yet, "but the boat has got its engines fired up, ready to go".

"What we've seen over the last few years is these massive investments being made in terms of gigafactories and indeed product allocation. That window isn't shut, but it's closing."

Regarding these concerns, Mr Sunak said: "Nissan have invested a billion pounds in battery manufacturing capability in the North East.

"I'll be talking to the Nissan CEO and other Japanese business leaders later about investment into the UK."

Business and Trade Secretary Kemi Badenoch said on Thursday that the issues raised by the car industry were not to do with Brexit.

"The issue that the automotive industries are talking about is around rules of origin. This is something that the EU are also worried about because the costs of the components have risen," she told the Commons during business and trade questions."This isn't to do with Brexit, this is to do with supply chain issues following the pandemic and the war in Russia and Ukraine."I actually have had meetings with my EU trade counterpart, we are discussing these things and looking at how we can review them."

Ahead of Mr Sunak's meeting with business leaders in Japan, the government announced that Japanese firms had committed to invest nearly £18bn in the UK.

The government said the investment would create jobs, fund offshore wind, other clean-energy projects and affordable housing, with Mr Sunak calling it a "massive vote of confidence" in the UK economy.

However, Labour said foreign investment in the UK had plummeted under the Conservatives.

Carmakers in Britain and the EU have been asking for the rule change to be pushed back.

Stellantis, which owns Vauxhall, Peugeot, Citroen and Fiat, has said that its UK factories are at risk.

The company has previously committed to making electric vans in the UK, but now says these plans are under threat.

It has warned it could face tariffs of 10% on exports to the EU due to rules on where parts are sourced from.

Under current rules, 40% of the value of an electric vehicle should originate in the UK or EU to qualify for trade without tariffs.

However, this percentage will rise to 45% from the beginning of next year, while for battery packs the threshold will be 60%.

From 2027, the bar is raised even higher, to 55% for the value of an electric vehicle and 70% for battery packs.

Stellantis said it was "now unable to meet these rules of origin" due to the recent surge in raw material and energy costs.

Europe's car trade body, the European Automobile Manufacturers' Association, has also asked the EU to extend the deadline, arguing that the supply chain is not ready.

Speaking to reporters in Japan where he is attending a G7 summit, Mr Sunak said the approaching deadline was "something that car manufacturers across Europe, not just in the UK, have raised as a concern".

"And as a result of that we are engaged in a dialogue with the EU about how we might address those concerns when it comes to auto manufacturing more generally," he added.

Mike Hawes, chief executive of UK trade body, the Society of Motor Manufacturers and Traders (SMMT), said he hoped "some degree of common sense would prevail".

"It doesn't need a full renegotiation of the Brexit deal, it just needs an agreement that you won't [implement] some of the rules that were due to change next year," he told the BBC's Today programme.

"It's hard to see how you can make sure that your plant is competitive for the long term if you're facing these additional costs. It undermines the investments either that have been made or potentially will be made."

Industry experts have expressed concern that the UK is running out of time to develop its own battery manufacturing industry, given heavy investment being made in the US, China and the EU.

Mr Hawes said the UK had not missed the boat yet, "but the boat has got its engines fired up, ready to go".

"What we've seen over the last few years is these massive investments being made in terms of gigafactories and indeed product allocation. That window isn't shut, but it's closing."

Regarding these concerns, Mr Sunak said: "Nissan have invested a billion pounds in battery manufacturing capability in the North East.

"I'll be talking to the Nissan CEO and other Japanese business leaders later about investment into the UK."

Business and Trade Secretary Kemi Badenoch said on Thursday that the issues raised by the car industry were not to do with Brexit.

"The issue that the automotive industries are talking about is around rules of origin. This is something that the EU are also worried about because the costs of the components have risen," she told the Commons during business and trade questions."This isn't to do with Brexit, this is to do with supply chain issues following the pandemic and the war in Russia and Ukraine."I actually have had meetings with my EU trade counterpart, we are discussing these things and looking at how we can review them."

Ahead of Mr Sunak's meeting with business leaders in Japan, the government announced that Japanese firms had committed to invest nearly £18bn in the UK.

The government said the investment would create jobs, fund offshore wind, other clean-energy projects and affordable housing, with Mr Sunak calling it a "massive vote of confidence" in the UK economy.

However, Labour said foreign investment in the UK had plummeted under the Conservatives.