Brexit charges: Why is my online shopping more expensive?

It's because not all charges are covered by a Brexit trade deal between the UK and EU.

So what are these fees and how can you avoid them?

I want to buy a £50 jumper from the EU, what do I need to know?

Value added tax (VAT), a sales tax, has always been required on EU goods.

And since Brexit, the way it is applied has changed.

Previously, you would have paid the local VAT rate.

So if you bought your jumper from a shop in Sweden, for example, you would have paid Swedish VAT.

Now, you pay UK VAT, which is 20%.

But for anything under £135, the VAT should still automatically be part of the final price you pay at the online checkout.

What if I'm spending more than £135 on my jumper?

Most things over £135 now require UK VAT to be paid at the point of delivery - it is no longer included at the online checkout.

So if you bought a very expensive jumper from an EU seller, the delivery company will now ask you to pay the VAT before it's handed to you.

And this could come as a shock if the retailer did not make this clear before you made your purchase.

You should also check your invoice to make sure the retailer's systems have worked correctly and you have not been charged twice, Martin Shah, a partner at law firm Simmons & Simmons, says.

"If a delivery driver asks for a VAT payment on purchased goods worth £135 or below, you should check your receipt, as you should have already paid the VAT at the point of sale," he adds.

What if I'm buying from an online marketplace?

Small sellers now need to charge UK VAT when they list their items on online marketplaces such as Amazon, eBay or Etsy.

So the cost might increase when you put in a UK delivery address.

Are there any other charges I should know about?

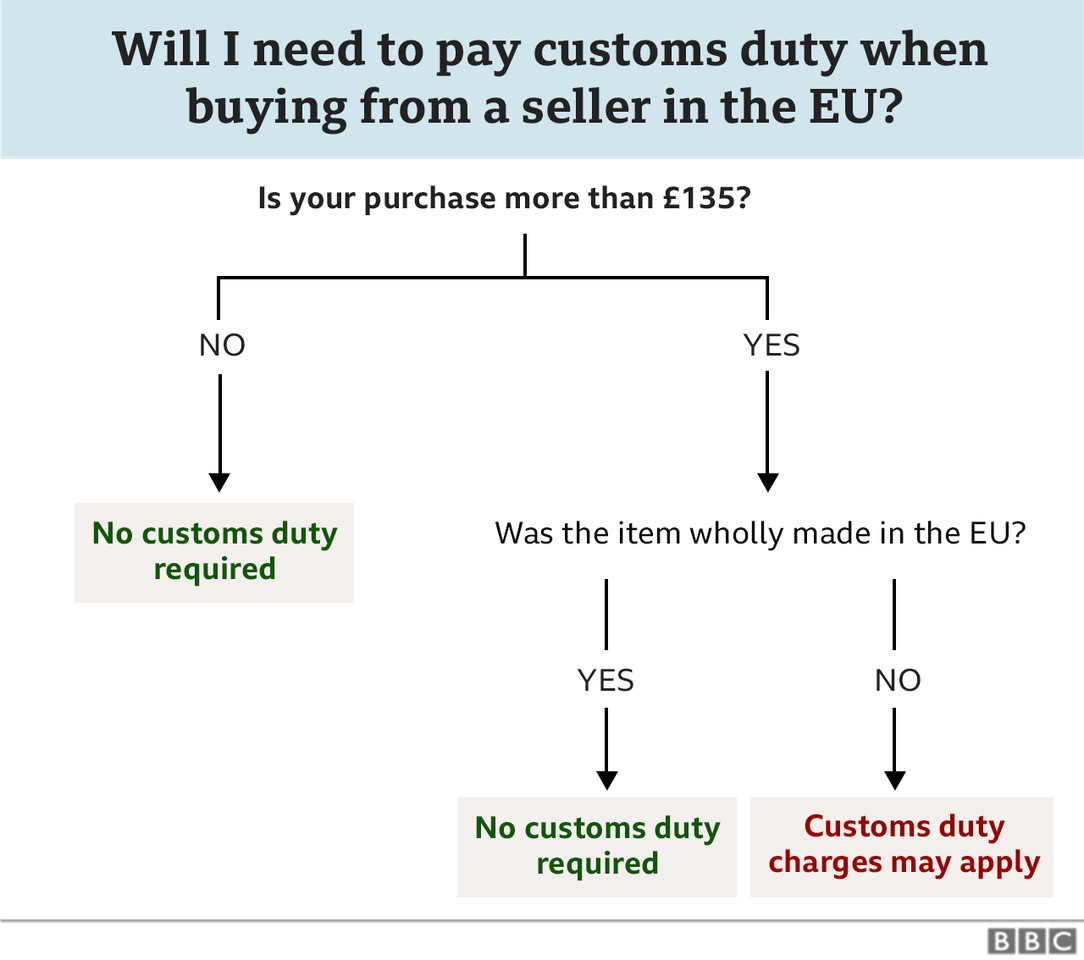

Custom duty also applies to goods worth over £135.

No customs charge needs to be paid if your expensive jumper was made and manufactured wholly in the EU.

But customs duty might need to be paid if the EU seller originally imported it from a non-EU country.

And the same charge might apply if a certain percentage of the materials used to make the jumper came from outside the EU (under what are known as rules of origin).

You can contact the retailer before you buy to ask if you will need to pay any customs duty.

If you have to pay, the delivery company should send you an invoice.

How much extra will I pay?

There are different rates depending on what you are buying.

And some things have no customs duty charges at all.

"Custom duties can be as little as 1.7%," Trade and Borders consultancy founder Anna Jerzewska, says.

"But textiles, food and drink can be higher.

"Very few are above 20%."

A knitted cotton pullover has a 12% custom duty charge.

Before Brexit, the tariff would have been paid by whoever first imported it into the EU.

And it could then have been moved to other EU countries - including the UK - with no further charges.

I'm being charged an admin fee, what's that?

Companies may also charge extra for delivery - because they now need to spend time filling in paperwork.

Delivery options and fees should be listed on the retailer's website.

Can I still buy clothes in different sizes and send back the ones I don't want?

If you return a purchase, you can claim back any duties by completing a C285 form from HM Revenue & Customs.

What if I'm being sent a gift, from the EU?

Any gift from outside the UK worth over £39 is liable for VAT.

If a friend buys a present directly from a German retailer and asks them to ship it to you in the UK, the courier will probably ask you to pay any VAT or customs duty owed.

If your friend sends the gift from a local post office, they will also need to fill in a customs form.

But the person sending the gift can ask the seller or shipping company if they can pay upfront - known as delivered duties paid - to avoid the potential embarrassing situation of you having to pay to receive their gift.