UK government borrowing surges again as Covid cases soar

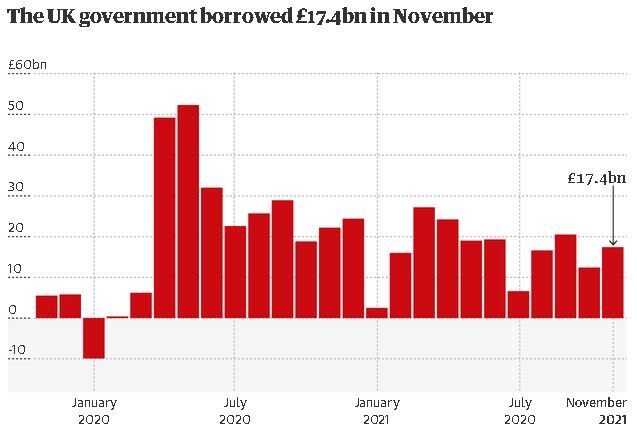

The UK government borrowed £17.4bn in November, outstripping economists’ predictions and suggesting debt could far overshoot officials’ forecasts if the Omicron coronavirus variant slows the economy as expected.

It was the highest November borrowing since comparable records began 30 years ago, barring last year. During the furlough scheme in 2020, the Treasury under Rishi Sunak set successive peacetime records for monthly borrowing as it covered the costs of 80% of salaries for millions of people as well as support schemes for businesses.

Significant borrowing has continued in 2021, with £136bn borrowed between April and November, with the vaccine and test-and-trace programmes adding to costs, according to data published by the Office for National Statistics (ONS). That was the second highest since records began in 1993.

The November borrowing was higher than the £16bn a poll of economists by Reuters predicted.

The government spent £32bn during November, £2bn more than it did a year before, thanks in part to spending on the vaccine programme and test and trace. Those costs are likely to rise in the coming months after the government raced to accelerate the uptake of booster jabs to try to reduce the number of hospitalisations in the Omicron wave.

Rising inflation also drove higher debt interest costs of £4.6bn. Higher inflation raises borrowing costs because the government issues some of its debt via inflation-linked bonds, the returns of which follow the retail price index (RPI) measure. Annual RPI inflation – acknowledged by authorities to be a flawed measure – hit 7.1% in November, far above the 5.1% rate of consumer price index inflation.

Government borrowing is likely to come under further scrutiny in the coming months from within the Conservative party. Public sector net debt – the amount borrowed over the years – was £2.3tn at the end of November, or 96.1% of GDP. That was the highest debt-to-GDP ratio since March 1963, when it was 98.3%.

Sunak and the Treasury are thought to have pushed back against proposals for more coronavirus restrictions partly because of the cost to the government of reintroducing financial support for businesses that would be forced to close, and officials have previously briefed about the costs of regular booster jabs.

Yet businesses have argued that they are suffering from a quasi-lockdown anyway, with customers deserting crowded spaces in order to avoid catching coronavirus before Christmas. Sunak on Wednesday revealed an extra £1bn in spending to help affected businesses.

In his budget in October, Sunak said he wanted to cut borrowing from 7.9% of GDP in the current financial year, which ends in April, to 3.3% next year.

However, the arrival of the Omicron variant is likely to slow GDP growth and to lower tax receipts, as people spend much less in pubs and restaurants. That will mean that official forecasts by the Office for Budget Responsibility are likely to have underestimated the amount the government will need to borrow to cover spending in the coming year.

Bethany Beckett, a UK economist at Capital Economics, said: “These data predate the recent surge in coronavirus infections caused by the Omicron variant, with a near-term tightening of virus restrictions once again a possibility. Although the economy has got better at coping with restrictions with each new wave, we still suspect it would prompt a deterioration in the public finances via lower tax revenues and the potential reintroduction of government support schemes.”

The ONS has revised down borrowing over the financial year so far by £9bn, but Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, said it was “likely to overshoot the OBR’s forecast” of £183bn.

The drop in borrowing between November 2020 and November 2021 was the smallest so far this fiscal year, despite the absence of the furlough scheme, Tombs said. He also pointed out that tax receipts rose more slowly than anticipated by the forecaster, and that “the trend in public borrowing is about to deteriorate markedly” with slower economic growth likely.