Developer Shimao's fire sale, new rating cuts keep China property on edge

More unwelcome surprises this month have meant no let up in the Chinese property crisis that wiped over a trillion dollars off the sector last year.

Monday's twists saw Shimao Group's credit rating cut again by both S&P and Moody's after it unexpectedly defaulted on a "trust loan" last week, although its shares surged nearly 20% (0813.HK) on reports it was in talks about asset sales with state-backed giant China Vanke.

China Evergrande (3333.HK), the world's most indebted developer that first triggered the turmoil last year, said it had moved out of its Shenzhen headquarters to cut costs.

The company kept a glimmer of hope alive that its first "onshore" Chinese yuan bond default might still be avoided by extending until Thursday a deadline for bondholders to agree to a six-month, 4.5 billion yuan ($157 million) payment deferral.

Chinese property firms have faced unprecedented pressure over the last six months following efforts by Beijing to curb overborrowing in the sector.

Reuters reported last week that the government now plans to make it easier for state-backed property developers to buy up assets of struggling private rivals.

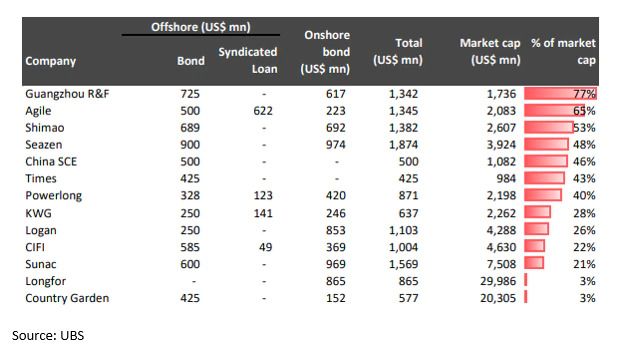

But the sector's cash crunch is expected to intensify too with firms needing to make nearly $40 billion of international bond payments over the next six months according to brokerage Nomura, including almost $1.5 billion this week alone.

One of those likely to be highlighted alongside Evergrande on Thursday will be Guangzhou R&F Properties (2777.HK). Its bonds have slumped to deeply distressed levels ahead of a $750 million bond payment due that day . It also has a number of unfinished mega projects in global cities like London.

"I think the worst might be yet to come" said Himanshu Porwal, emerging markets corporate credit analyst at Seaport Global.

"A lot will depend on what the Chinese government does in terms of liquidity measures... But it has been four months already so I don't know what they would be waiting for."

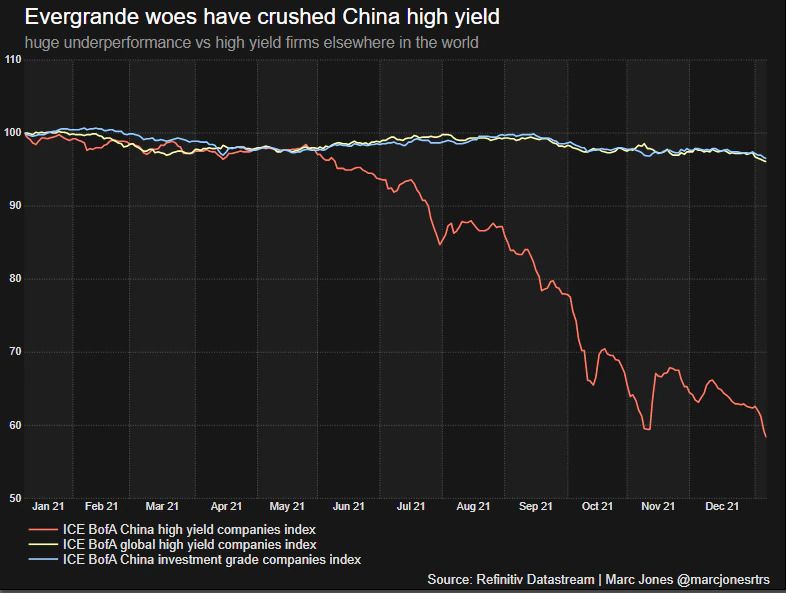

China high yield crushed by property collapse

China high yield crushed by property collapseNEW LOWS

The woes of recent days have seen ICE's China high-yield debt index (.MERACYC), which is dominated by homebuilders, hit an all-time low, while Evergrande and fellow-defaulter Kaisa have seen their bonds ejected from J.P. Morgan's closely followed emerging market corporate debt index.

S&P and Moody's both cut Shimao's rating deeper into the junk category on Monday and warned of potential for a further downgrade.

S&P, which had rated Shimao investment grade as recently as November, cut it by a full two notches. It said, "The decline is worse than we previously anticipated. We now assess the company's liquidity to be weak."

Moody's and Fitch also downgraded Yuzhou Group (1628.HK) due to increased refinancing risk while Moody's withdrew the rating of another firm, Yango, due to "insufficient information."

Separately, small developer Modern Land (1107.HK), which missed payment for its 12.85% notes due in October said in a filing on Monday that it has received notices from certain noteholders demanding early repayment of their senior notes.

The developer said it has been discussing a waiver with these creditors and has appointed financial advisers to formulate a plan. It is also in talks on a restructuring plan for $1.3 billion of its offshore bonds, the firm added.

Modern Land shares, which resumed trading after being suspended since Oct. 21, sank 40% in Hong Kong to HK$0.23.

"It's going to be the peak of repayment period and we'll see more developers default," said Kington Lin, managing director of the asset management department at Canfield Securities Limited.

"The market is watching how many SOEs (state-owned enterprises) will get more M&A loans to help the developers in distress."

Chinese property firms face big bills

Chinese property firms face big bills