Swiss central bank throws financial lifeline to Credit Suisse after shares pummelled

In a joint statement, the Swiss financial regulator FINMA and the nation's central bank sought to ease investor fears around Credit Suisse, saying it "meets the capital and liquidity requirements imposed on systemically important banks." They said the bank could access liquidity from the central bank if needed.

The statement came after a major government and at least one bank put pressure on Switzerland to act, said people familiar with the matter, as the lender became caught up in a crisis of confidence after the collapse of Silicon Valley Bank last week.

Credit Suisse said it welcomed the statement of support from the Swiss National Bank and FINMA.

Credit Suisse would be the first major global bank to be given such a lifeline since the 2008 financial crisis - though central banks have extended liquidity more generally to banks during times of market stress including the coronavirus pandemic.

SVB's demise, followed by that of Signature Bank two days later, sent global bank stocks on a roller-coaster ride this week, with investors discounting assurances from U.S. President Joe Biden and emergency steps giving banks access to more funding.

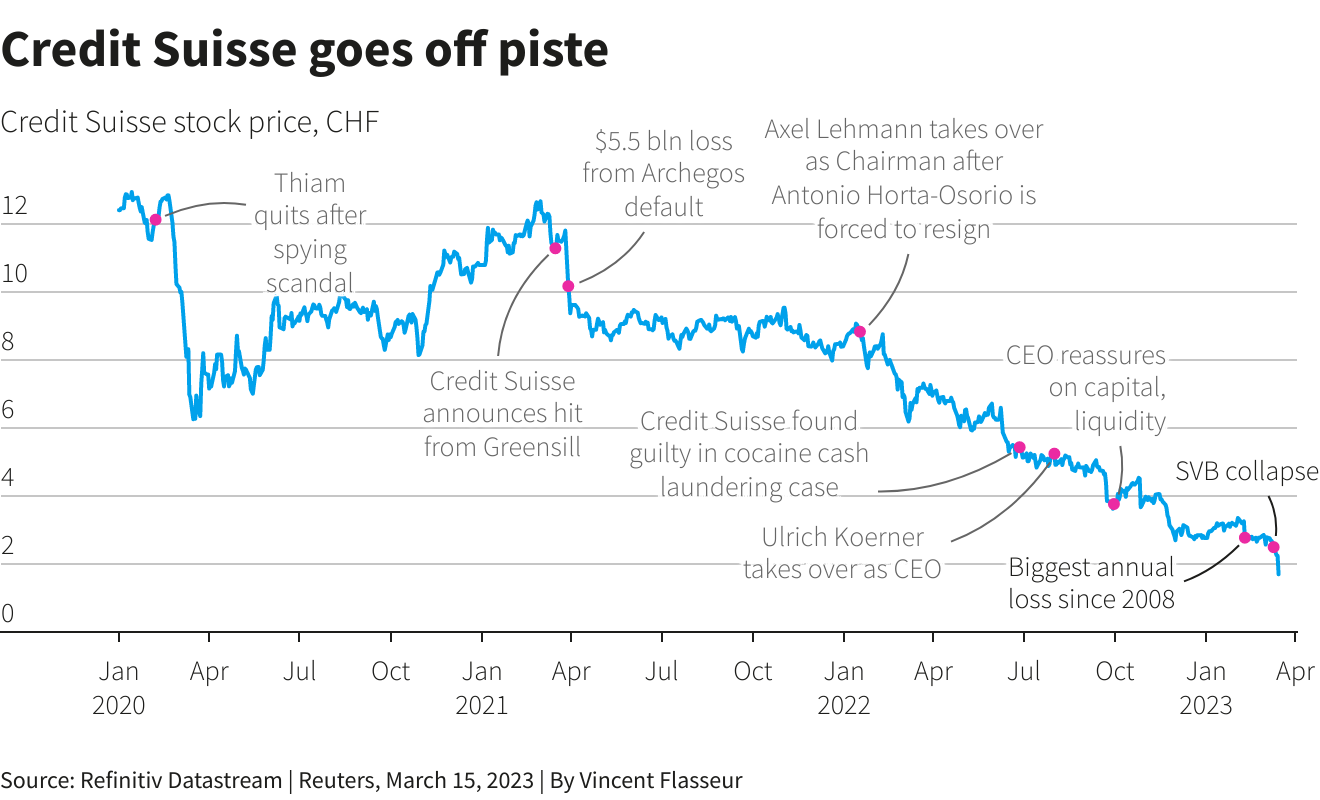

By Wednesday, focus had shifted from the United States to Europe, where Credit Suisse led a rout in bank shares after its largest investor said it could not provide more financial assistance because of regulatory constraints.

Hoping to quell concerns, FINMA and the Swiss central bank said there were no indications of a direct risk of contagion for Swiss institutions from U.S. banking market turmoil.

Earlier, Credit Suisse shares led a 7% fall in the European banking index (.SX7P), while five-year credit default swaps (CDS) for the flagship Swiss bank hit a new record high.

The investor exit for the doors prompted fears of a broader threat to the financial system, and two supervisory sources told Reuters that the European Central Bank had contacted banks on its watch to quiz them about their exposures to Credit Suisse.

One source said, however, that they saw Credit Suisse's problems as specific to that bank, rather than being systemic.

"(The) SVB collapse is a firm- and U.S.-specific problem, but now markets have reawakened to global banks’ risks – from interest rate/duration to liquidity and credit risk – and European banks are engulfed by a confidence crisis," said Davide Oneglia, senior economist at TS Lombard.

The U.S. Treasury is monitoring the situation around Credit Suisse and is in touch with global counterparts, a Treasury spokesperson said.

Asked about the impact of Credit Suisse's problems on the U.S. banking system, U.S. Senator Bernie Sanders told Reuters: "Everybody is concerned."

On Wall Street, major indexes closed down on Wednesday, with big U.S. banks including JPMorgan Chase & Co (JPM.N), Citigroup (C.N) and Bank of America Corp (BAC.N) falling. The KBW regional banking index (.KRX) declined 1.57%.

'FLIGHT TO SAFETY'

In the United States, large banks have managed their exposure to Credit Suisse in recent months and view risks emanating from the lender as manageable so far, according to three industry sources who declined to be identified because of the sensitivity of the situation.

Rapid rises in interest rates have made it harder for some businesses to pay back or service loans, increasing the chances of losses for lenders who are also worried about a recession.

Traders are now betting that the Federal Reserve, which just last week was expected to accelerate its interest-rate-hike campaign in the face of persistent inflation, may be forced to hit pause and even reverse course.

Futures tied to the Fed's policy rate were pricing a slightly better-than-even chance that policymakers will leave their benchmark lending rate in its current 4.5%-4.75% range at their upcoming meeting on March 21-22.

Traders' bets on a large European Central Bank interest-rate hike at Thursday's meeting also evaporated quickly as the Credit Suisse rout fanned fears about the health of Europe's banking sector. Money market pricing suggested traders now saw less than a 20% chance of a 50 basis point rate hike at the ECB meeting.

Unease sparked by SVB's demise has also prompted depositors to seek out new homes for their cash.

Ralph Hamers, CEO of Credit Suisse rival UBS (UBSG.S) said market turmoil has steered more money its way.

"In the last couple of days as you might expect we've seen inflows," Hamers said. "It is clearly a flight to safety from that perspective, but I think three days don't make a trend."

Deutsche Bank (DBKGn.DE) CEO Christian Sewing said that the German lender has also seen incoming deposits.

Focus is also shifting increasingly to the possibility of tougher rules for banks, particularly mid-tier ones like SVB (SIVB.O) and New York-based Signature Bank (SBNY.O), whose collapses triggered the market tumult.

U.S. Congress needs to act on bipartisan legislation strengthening banking industry controls, Senate Majority Leader Chuck Schumer said, though Senate Banking Committee Chairman Sherrod Brown downplayed the likelihood of Congress passing a "significant" banking bill anytime soon.

Comments