S&P 500 ends 2021 with a nearly 27% gain, but dips in final trading day

The Dow Jones Industrial Average on Friday fell 59.78 points, or 0.16%, to 36,338.30. The S&P 500 pulled back 0.26% to close at 4,766.18. The Nasdaq Composite dipped 0.61% to 15,644.97.

All three indexes finished the month higher. December marked the Dow’s fifth-straight monthly gain and the Nasdaq recorded a six-month winning streak.

The major averages posted double-digit returns this year, as the global economy began its recovery from the 2020 Covid lockdowns, while the Federal Reserve maintained supportive measures first implemented at the onset of the pandemic.

The S&P 500 rose 26.89% in 2021, marking the benchmark’s third straight positive year. The Dow and Nasdaq also notched three-year winning streaks, gaining 18.73% and 21.39% for the year, respectively.

“2021 was another exceptional year for U.S. equity markets,” Wells Fargo Investment Institute’s Chris Haverland said in a note. “The markets were supported by ... highly accommodative fiscal and monetary policies.”

Strong corporate earnings also boosted U.S. stocks, Haverland said. The estimated year-over-year earnings growth rate for 2021 is 45.1%, according to FactSet. That would mark the highest annual earnings growth rate for the index since FactSet began tracking the metric in 2008.

“The economic and earnings rebound that started in 2020 carried over into 2021, lifting equity markets to record highs. While returns in 2020 were driven by price-to-earnings multiple expansion, returns in 2021 were driven by earnings growth,” Haverland said.

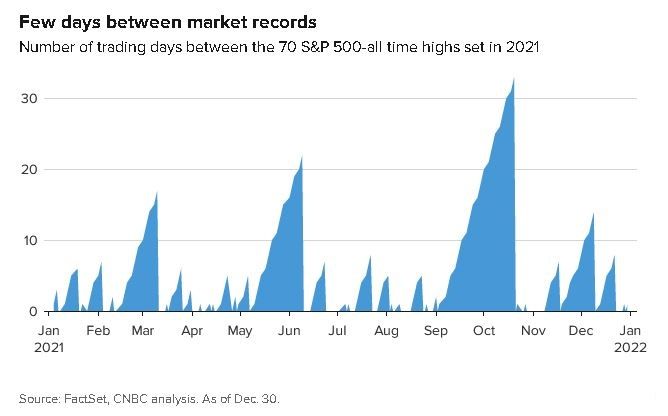

The S&P 500 notched 70 record closes this year, the second-highest annual tally behind 1995′s 77 closing highs.

The record closes occurred frequently. The S&P 500 has posted at least one new record close every month since November 2020. The longest span without a new high in 2021 was 33 trading days between record closes on Sept. 2 and Oct. 21.

Energy and real estate were the best-performing sectors in the S&P 500 this year, surging more than 40% each. Tech and financials also rose more than 30%.

Devon Energy was the top-performing stock on the S&P 500 this year with a 178.6% gain. Marathon Oil and Moderna were next in line, returning more than 140% in 2021. Ford was also among the S&P 500′s best performers this year, surging 136.3% for its biggest annual gain since 2009.

Home Depot and Microsoft led the Dow’s gains, rising more than 50% each this year. Names like Alphabet, Apple, Meta Platforms and Tesla were the top gainers on the Nasdaq Composite for the year.

The stellar year for stocks came even as the Covid pandemic rages on, with variants like delta and, more recently, omicron leading to case outbreaks throughout the year. The U.S. has now recorded more than 53 million Covid cases and more than 820,000 deaths, according to CDC data as of Thursday.

To be sure, developments like the rollout of the Covid vaccine have shifted public health protocols, giving way to some positive sentiment in the market.

But many investors and strategists expect tougher conditions next year as the Fed tapers off its pandemic-era easy monetary policy and addresses persistent inflation.

“It’s going to be tougher, I think, in the second half of 2022. Still, I think you’re going to have enough market for stocks next year,” Wharton finance professor and long-time market bull Jeremy Siegel said Friday on CNBC’s “Squawk Box.”