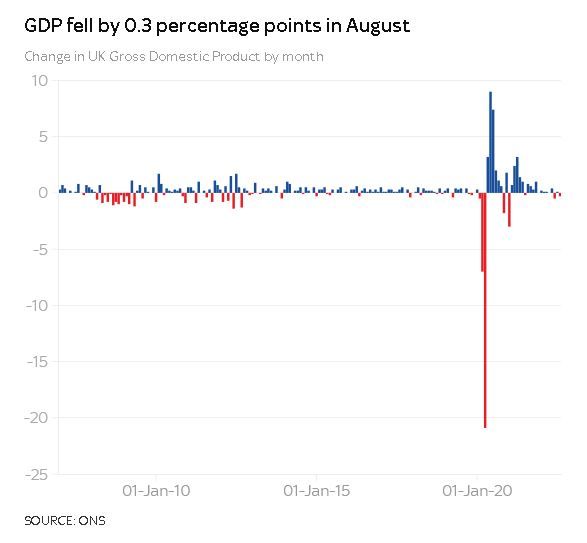

Economy shrinks unexpectedly in August by 0.3%, Office for National Statistics figures show

The economy unexpectedly shrank in August, contracting by 0.3% on the previous month.

The growth in July has also been revised downwards, from the previously recorded 0.2% to 0.1%.

The Office for National Statistics released its latest reading on the UK's performance as the government frets over the prospect of recession ahead, given the toll placed on demand by the cost of living crisis.

The result for August is worse than expected, as no growth rather than shrinking was anticipated.

It is likely that the contraction will result in a sharper period of slowdown in September.

"August's negative out-turn should be followed by a more marked drop in September's output as the extra bank holiday for the Queen's funeral will have added to the downwards pressure on activity," Suren Thiru, economics director of the Institute of Chartered Accountants in England and Wales, said.

Commentators now suspect the UK is nearing a recession.

"UK economy teetering on the edge of recession," Yael Selfin, chief economist at KPMG UK, said.

"The ongoing squeeze on household finances continues to weigh on growth, and likely to have caused the UK economy to enter a technical recession from the third quarter of this year."

Mr Thiru added: "The government has needlessly risked a longer recession with any boost from the energy package likely to be dwarfed by a sustained squeeze on UK output from persistently high inflation, punishing interest rate rises and acute financial market turbulence."

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: "August's drop in GDP likely marks the start of a downward trend that will continue deep into next year."

The ONS figures were dismissed as estimates by Jacob Rees-Mogg, the business secretary, who told Sky News that "figures that are released immediately are very often revised".

Action by the Bank of England to tame inflation, through successive interest rate increases, is adding to the cost burden for borrowers.

The Bank's tightening has placed its mandate to control inflation at odds with the agenda of the new Truss administration, which has set a target for annual economic growth of 2.5%.

The mini-budget last month, which contained energy bill help for households and businesses along with a series of tax cuts, prompted turmoil on financial markets.

The resulting crisis of credibility forced down the value of the pound and raised government borrowing costs to such an extent that the Bank had to intervene.

The International Monetary Fund warned on Tuesday that the government should ensure its tax and spending plans are in line with the Bank of England's inflation-fighting remit.

In other words, the priority should be tackling inflation rather than adding to the price problem through tax giveaways to achieve economic growth.

The IMF welcomed the prospect of an earlier-than-expected debt plan from Kwasi Kwarteng, the chancellor.

That will now be delivered to MPs on 31 October and contain independent analysis from the Office for Budget Responsibility.

Responding to this morning's announcement, Mr Kwarteng said the UK was facing global challenges that his government's growth plan will address.

"Countries around the world are facing challenges right now, particularly as a result of high energy prices driven by Putin's barbaric action in Ukraine," he said.

"That is why this government acted quickly to put in place a comprehensive plan to protect families and businesses from soaring energy bills this winter.

"Our Growth Plan will address the challenges that we face with ambitious supply-side reforms and tax cuts, which will grow our economy, create more well-paid skilled jobs and in turn raise living standards for everyone."