COVID-19 variant: Why fear of growth setback has spooked investors

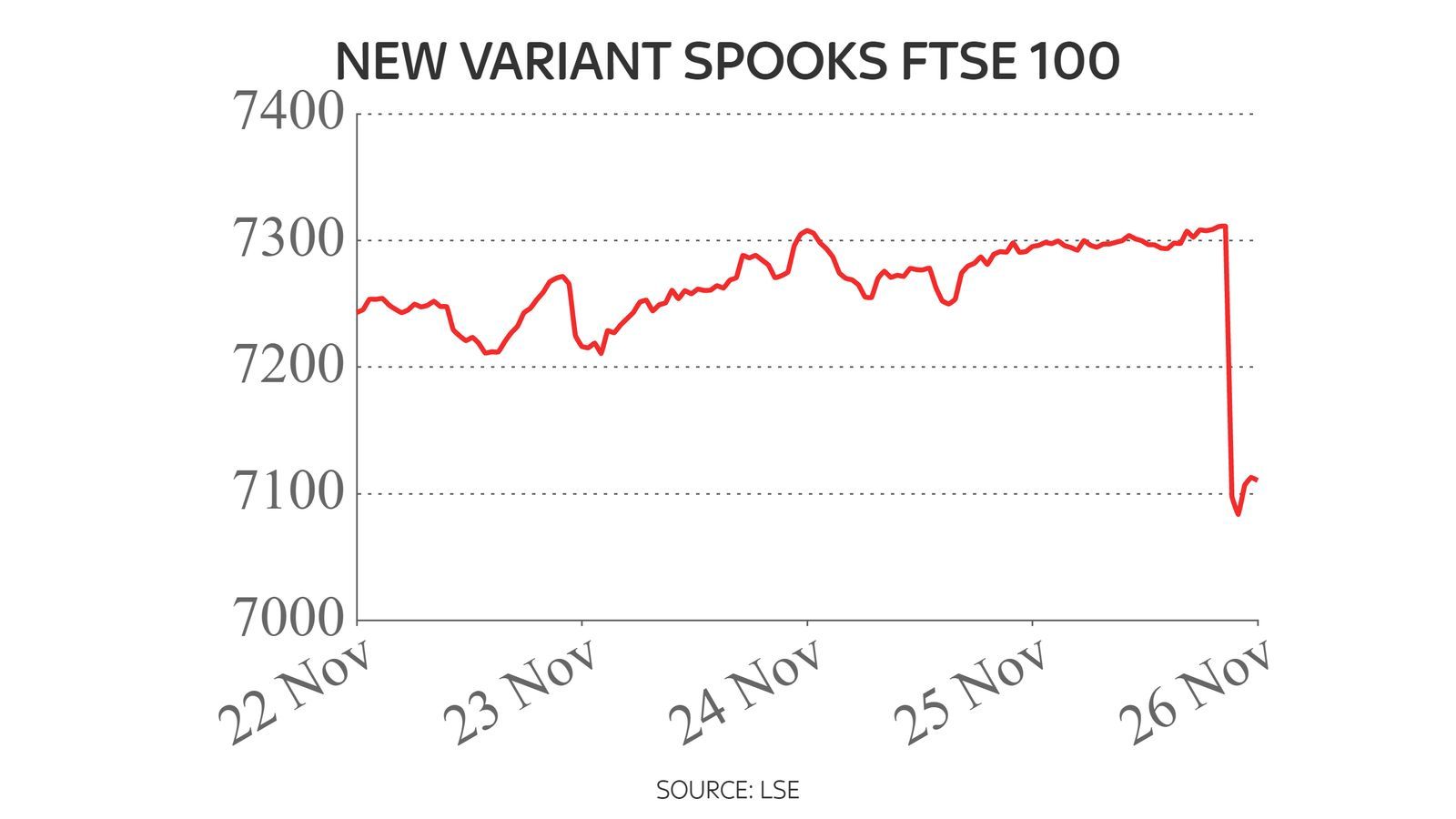

News of a potentially fast-spreading new coronavirus variant has already triggered a violent reaction on markets and in a number of different asset classes.

While much attention has naturally alighted on equity markets, with big falls in the FTSE-100 and continental European indices such as the DAX in Germany and the CAC-40 in France, probably the most significant move has been in the oil price.

At one point this morning, the price of a barrel of Brent crude fell to $77.28 - a level it has not seen since 24 September.

And, while a new coronavirus variant is undoubtedly unwelcome news, the fall in the price of oil may be one piece of good news emerging from the situation.

For a start, because oil prices move in close correlation to the price of other energy sources such as natural gas, a big decline will relieve inflationary pressures.

News of a fresh coronavirus variant has triggered a violent reaction on markets, including the FTSE 100

News of a fresh coronavirus variant has triggered a violent reaction on markets, including the FTSE 100

These, as was shown by this week's co-ordinated release of crude reserves by the US, China and others, have been exercising governments in a number of countries.

It has also been exercising policy makers. The Bank of England has been dropping ever heavier hints of a looming increase in interest rates and, while it surprised the markets by not raising its main policy rate this month, at least one rise was being priced by the end of February next year.

But a sustained decline in the price of oil - and the threat to growth posed by the new variant - will relieve pressure on the Bank of England to act quickly and especially at a time when a number of members of the Bank's Monetary Policy Committee are still extremely wary of the possible impact of even a modest increase in Bank Rate.

That is also the calculation markets have been making this morning about the US. Yields on US Treasuries (US government IOUs) have fallen this morning - the yield falls as the price rises - as investors started to reconsider the likely timing of the next rise in US interest rates.

The odds against an early rate hike from the US Federal Reserve had been shortening since, on Monday, President Joe Biden reappointed Jay Powell as chairman of the Fed rather than going for the more dovish Lael Brainard.

Those bets have now started to unwind as some investors calculate the spread of a new coronavirus variant could push back the timing of the Fed's first hike.

A bigger concern, when it comes to the potential impact of another COVID variant, will be Europe. The main European economies have not rebounded from the pandemic as rapidly as the United States, as borne out on Thursday by confirmation of weaker-than-expected GDP growth in the third quarter of this year in Germany, the continent's biggest economy.

Those concerns also apply to the UK, whose economy is further away from recapturing its pre-pandemic levels than any other country in the G7, other than Japan.

What is particularly striking about market reaction to this new variant is that it has been far more violent than the response, earlier this week, to new COVID lockdowns in Austria, Slovakia and other parts of continental Europe. On that occasion, investors calculated that spending prevented from taking place due to lockdowns would be merely deferred, not postponed altogether.

Markets around the world were down on Friday as news of a worrying new variant spooked investors

Markets around the world were down on Friday as news of a worrying new variant spooked investors

With the new variant, as so little information is currently available about the speed with which it can be transmitted and the impact it will have on sufferers, the same assumption cannot be made.

That explains the punishment meted out this morning to aviation stocks, such as International Airlines Group (IAG) and Lufthansa and tourism-related stocks, such as TUI, Intercontinental Hotels and Whitbread, the owner of the Premier Inn chain.

But it cannot be stressed how unknowable the situation is.

As Neil Shearing, group chief economist at the consultancy Capital Economics, put it in a note to clients this morning: "It goes without saying that it's still too early to say exactly how big a threat the new B.1.1.529 strain poses to the global economy."

Mr Shearing said there were three key points to make, though, the first of which is that - as Delta showed - it is very hard to stop the spread of virulent new variants. Secondly, it is the restrictions imposed in response to the virus, rather than the virus itself, that causes the bulk of the economic damage.

Thirdly, he said, the global economic backdrop is different than in previous waves, with supply chains already stretched, while labour shortages are widespread.

He added: "All of this will complicate the policy response. At the margin, the threat of a new, more serious, variant of the virus may be a reason for central banks to postpone plans to raise interest rates until the picture becomes clearer.

"The key dates are 15 December, when the Fed meets, and 16 December, when several central banks, including the Bank of England and European Central Bank, meet.

"But unless a new wave causes widespread and significant damage to economic activity, it may not prevent some central banks from lifting interest rates next year."

Much will depend on what information comes from the World Health Organisation in coming days and how governments respond.

As Jim Reid, head of global fundamental credit strategy at Deutsche Bank, noted today: "At this stage very little is known. Mutations are often less severe so we shouldn't jump to conclusions but there is clearly a lot of concern about this one.

Also South Africa is one of the world leaders in sequencing so we are more likely to see this sort of news originate from there than many countries.

"Suffice to say at this stage no one in markets will have any idea which way this will go."

Exactly. At the moment, travel bans have only been imposed to and from six southern African countries. It may well be that, if the new variant has already taken hold elsewhere, there may be little point in imposing new travel restrictions.

But this is not a situation many investors either expected or wanted to return to. They have seen this story before. And they do not wish to be caught out in the way they were during earlier waves of the pandemic.