Cardiff flat owner gets tax bills for 11,000 Chinese firms

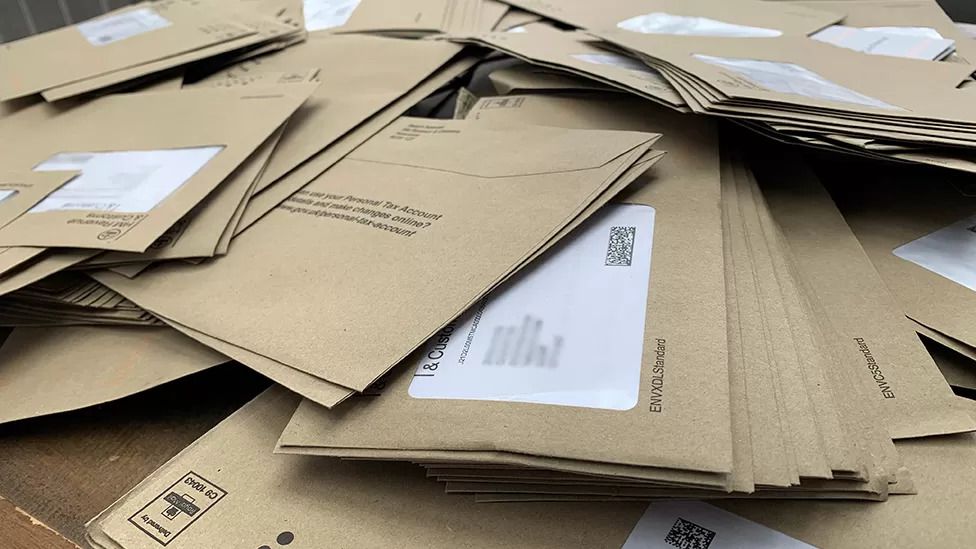

Over next six months he got tax bills for 11,000 Chinese companies after they fraudulently used his Cardiff address to register for VAT.

"It's been horrendous," said Mr Davies, who got letters from HM Revenue & Customs (HMRC) demanding tax amounting to £500,000.

HMRC admitted the situation did not raise alarm bells at the tax office.

"You'd think there'd be a systems with the technology today that would have picked it up immediately," Mr Davies said.

He told the police and HMRC but the brown letters just kept coming.

When letters from debt collection agencies started to arrive, he got even more worried that bailiffs may come "charging the door down" and feared that the amount of money involved meant his property could be taken.

Dylan Davies "couldn't believe" the number of brown envelopes coming each week

Dylan Davies "couldn't believe" the number of brown envelopes coming each week

He said HRMC only started to take notice when he took his concerns to BBC Wales consumer programme X-Ray.

The head of HMRC admitted the problem in a letter to the Commons public accounts committee.

Permanent secretary Jim Harra said: "2,356 of the businesses have a tax debt and we have acted to prevent any further contact with this address in relation to these debts."

Mr Harra said investigations had "so far have found no evidence of fraud or fraudulent intent" and 70% of the businesses registered to Mr Davies's address operated in online marketplaces.

The law changed in Jan 2021, meaning online marketplaces such as Amazon or eBay must collect VAT from overseas traders and pay it to HMRC.

But if a company has a UK address for VAT, which it does not have to provide proof of, it is responsible for the payment.

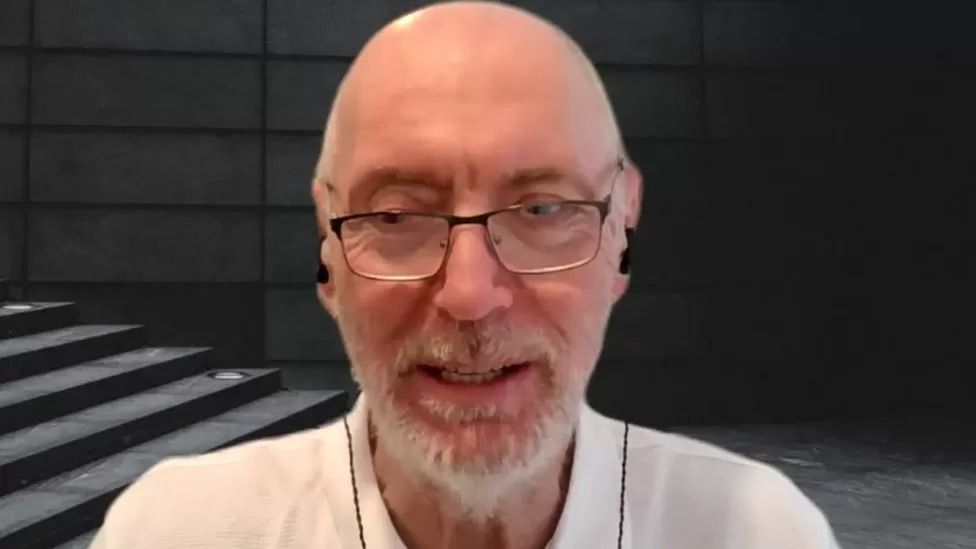

Financial crime consultant Graham Barrow said he suspected fraudulent activity from the overseas companies.

"It looks to all intents and purposes like VAT fraud," he said.

"There's no other reason why you'd register for VAT at a complete stranger's address, particularly for 11,000 companies to do that."

He believes the firms are collecting VAT from their buyers, but not paying it to HMRC.

The bills coming to Mr Davies's flat were probably tax fraud, says financial crime consultant Graham Barrow

The bills coming to Mr Davies's flat were probably tax fraud, says financial crime consultant Graham Barrow

Mr Barrow said it "beggared belief" that HMRC did not notice the number of companies being registered for VAT at Mr Davies's flat.

He said the consequences for an individual could be severe, through no fault of their own.

"You could find that there are large numbers of county court judgements being registered to your address," he said.

Mr Davies said HMRC needed to "tighten up completely", claiming it was easier to "register a company for VAT than it is to go and get a bus pass".

HMRC said: "We are reviewing our operational processes for managing high volume address changes, including understanding any vulnerabilities in our systems associated with this behaviour."