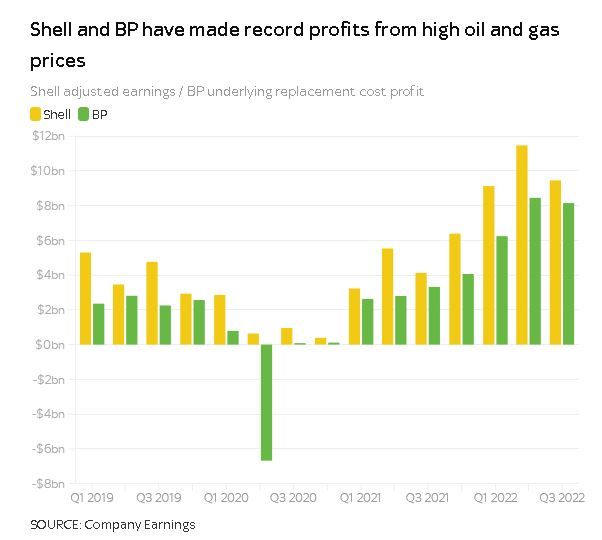

BP quarterly profits come in at £7.1bn after gas prices surge - as calls for 'bigger' windfall tax demands made

BP has credited strong natural gas trading for strong quarterly profits of £7.1bn, which have fanned the flames around demands for stiffer windfall taxes.

The oil and gas giant revealed third quarter profits of $8.2bn compared to $3.3bn in the same period a year earlier - boosted by high prices resulting from the impact of Russia's war in Ukraine.

The sum was only slightly down on the 14-year-high profit of $8.5bn achieved between April to June, but much higher than the $6bn expected by analysts.

It credited an "exceptional gas marketing and trading result" on the back of higher prices caused by the fallout from Russia's war in Ukraine.

BP said that they offset weaker refining margins and "average" oil trading.

The company posted its latest numbers just days after UK-listed rival Shell, which declared the company was ready to face higher taxes on its earnings and had been working constructively with the UK's Treasury on the issue.

Outgoing CEO Ben van Beurden admitted then it was a "societal reality" that governments will intervene while "a lot of people, particularly the most vulnerable" are struggling with the cost of living.

BP said in its results statement that it expected to pay $2.5bn in taxes this year to the UK Treasury for its North Sea operations.

Within that sum is an Energy Profits Levy contribution of almost $800m.

The windfall tax was imposed in May.

Shell had said it expected to escape a payment in the current quarter because it met the criteria under the levy's rules to avoid payments due its spending on new oil and gas projects.

The government is under pressure to expand the levy in the autumn statement later this month, given a big black hole in the public finances.

Ed Miliband, Labour's shadow climate change and net zero secretary, said: "Today's profits at BP are damning evidence of the failure of the government to levy a proper windfall tax.

"Rishi Sunak should be hanging his head in shame that he has left billions of windfall profits in the pockets of oil and gas companies, while the British people face a cost of living crisis.

"Even if he U-turns on a windfall tax now, the oil and gas companies have taken billions from the cash machine that is the British people's energy bills - and Rishi Sunak has let it happen."

'Case for bigger, bolder windfall tax is now overwhelming'

Friends of the Earth energy campaigner, Sana Yusuf, said of BP's financial performance: "The case for a bigger, bolder windfall tax is now overwhelming.

"This must address the ridiculous loophole that undermines the levy by enabling companies to pay the bare minimum if they invest in more planet-warming gas and oil projects."

Across the Atlantic, Joe Biden piled further pressure on big oil on Monday.

The US president, whose Democrat party is facing the prospect of a mid-term elections backlash because of surging inflation, accused firms of "war profiteering" and threatened windfall taxes unless they raised domestic production to bring down fuel prices.

Like its other rivals, BP on Tuesday revealed further rewards for shareholders.

The company hiked its dividend by 10% in the quarter and said it would buy back $2.5bn worth of shares, taking the total this year to $8.5bn.

Dr George Dibb, head of the Centre for Economic Justice at the IPPR think-tank, said the buybacks were a potential target for the chancellor.

"The US have recently levied a tax on share buybacks and the UK should follow suit.

"A 25% windfall tax on the share buybacks of BP and Shell would raise up to £4.8bn per year for the treasury, taxes which could be spent on supporting households across the UK."

BP shares - up by more than 45% in the year to date - rose by almost 1% in early deals on the FTSE 100.

Chief executive Bernard Looney told investors: "This quarter's results reflect us continuing to perform while transforming.

"We remain focused on helping to solve the energy trilemma - secure, affordable and lower carbon energy.

"We are providing the oil and gas the world needs today - while at the same time investing to accelerate the energy transition."