UK industry could face shutdowns as wholesale gas price hits record high

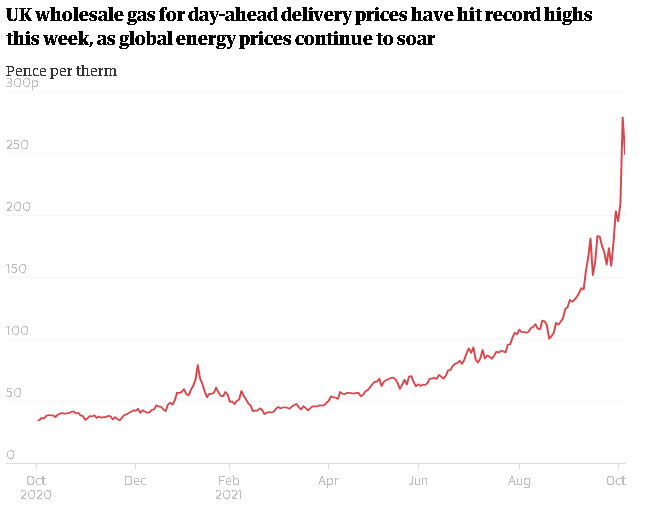

Wholesale gas prices hit new all-time highs on Wednesday, prompting warnings that factories could be forced to shut down over winter or switch to more polluting fuels just as the UK hosts the Cop26 climate conference next month.

The crisis has already forced a wave of collapses among energy suppliers that has led to warnings of “desperate choices” for households likely to face higher bills as a result.

As power-hungry sectors such as steel, glass and chemicals fight their own battle with soaring gas and electricity costs, they warned of further shocks to both industry and consumers, including higher prices of goods and factories being forced to temporarily close.

Growing concern about the domino effect of high energy prices came as the cost of gas for delivery the next day reached 350p per therm on Wednesday, while gas for delivery in November reached 407p, both new records. Prices fell back later, after Russia’s president, Vladimir Putin, indicated that the country, the largest supplier of gas into Europe, was prepared to help ease the crisis.

But leading figures from energy-intensive industries said serious ramifications were already on the cards unless the government heeded their call for measures to reduce energy costs.

Trade body UK Steel said it was now “uneconomic” to make steel at certain times in the UK, with British firms facing double the electricity prices paid by rivals in Germany, France and the Netherlands. British Steel, based in Scunthorpe, has begun adding surcharges of up to £30 a tonne to its products to recoup higher energy costs, increasing costs for customers in the construction and automotive sectors.

David Bailey, a professor of business economics at Birmingham Business School, said consumers could end up feeling the pinch if steel remained expensive. “They’ll pass it on to consumers ultimately, so it could increase the price of cars,” he said.

Network

Rail, which owns Britain’s 20,000 miles of railway and buys about 97% of

its track from British Steel, said it had yet to see an increase in

prices.

Network

Rail, which owns Britain’s 20,000 miles of railway and buys about 97% of

its track from British Steel, said it had yet to see an increase in

prices.

With just weeks to go until the UK hosts the Cop26 global climate conference, leaders in the glass and minerals industries said high gas prices could ultimately lead to increased pollution.

Richard Stansfield, the chief executive of the lime manufacturer Singleton Birch, said the increased cost of production was being passed on to consumers, including water companies and firms that use the mineral to turn waste into energy.

“We could get into a ridiculous situation where it’s cheaper to put waste into landfill than to put it into waste-to-energy plants,” he said. “There are all sorts of knock-on effects.”

Paul Pearcy, the federation coordinator at the trade body British Glass, said companies that make windows could be forced to revert to powering their furnaces with polluting fuels that had been abandoned.

“Some of our members still have heavy fuel oil on site, having moved over to gas,” he said. “Some of them are seriously considering moving back to that because of the price of gas.

“As prices go the way they are, it becomes more and more financially attractive but with Cop26 around the corner, it’s not a great advert.”

Glass companies and steelmakers run their furnaces continuously, making it extremely difficult, time-consuming and costly to shut down.

Jon Flitney, of the British Ceramic Confederation, said the same was true of its members’ kilns, meaning any decision to scale back operation would “not be taken lightly”.

However, he said that if prices remain high, “the balance between income and operating costs may shift”.

The glass, steel and minerals industries are all members of the Energy Intensive Users Group trade body, which warned of shutdowns in essential industries without help from the government and the energy regulator, Ofgem.

Richard Leese, the chairman of the group, said: “We have already seen the impact of the truly astronomical increases in energy costs on production in the fertiliser and steel sectors.

“Nobody wants to see a repeat in other industries this winter given that UK energy-intensive industries produce so many essential domestic and industrial products and are intrinsically linked with many supply chains.”

The group has called for exemptions for energy-intensive industries from measures designed to help fund renewable energy and penalise carbon emissions.

Any slowdown in work schedules could place a further drag on the economy, adding to concern in sectors such as construction, where shortages of materials and staff drove growth expectations to an eight-month low, according to survey figures released on Wednesday.

Spiking gas prices have already taken their toll on British business, forcing fertiliser plants to shut down and capsizing 12 energy suppliers. A 13th, Omni Energy, warned its customers on Wednesday that it could cease trading in November.

The energy adviser Cornwall Insights said it expected the effect to drive up household energy bills into 2023, by driving the government-imposed cap on energy prices higher.

It expects the energy price cap, currently set at £1,277 for an average dual fuel customer paying by direct debit, to reach £1,659 for summer 2022 and £1,663 for next winter.

The business department said: “We are determined to secure a competitive future for our energy-intensive industries and in recent years have provided them with extensive support, including more than £2bn to help with the costs of energy and to protect jobs.

“Our exposure to volatile global gas prices underscores the importance of our plan to build a strong, home-grown renewable energy sector to further reduce our reliance on fossil fuels.”