UK banks face savings glut on road to pandemic recovery

Full-year earnings reported by HSBC, Barclays, Lloyds and NatWest last month revealed the extent to which lenders’ finances have been upended by the crisis.

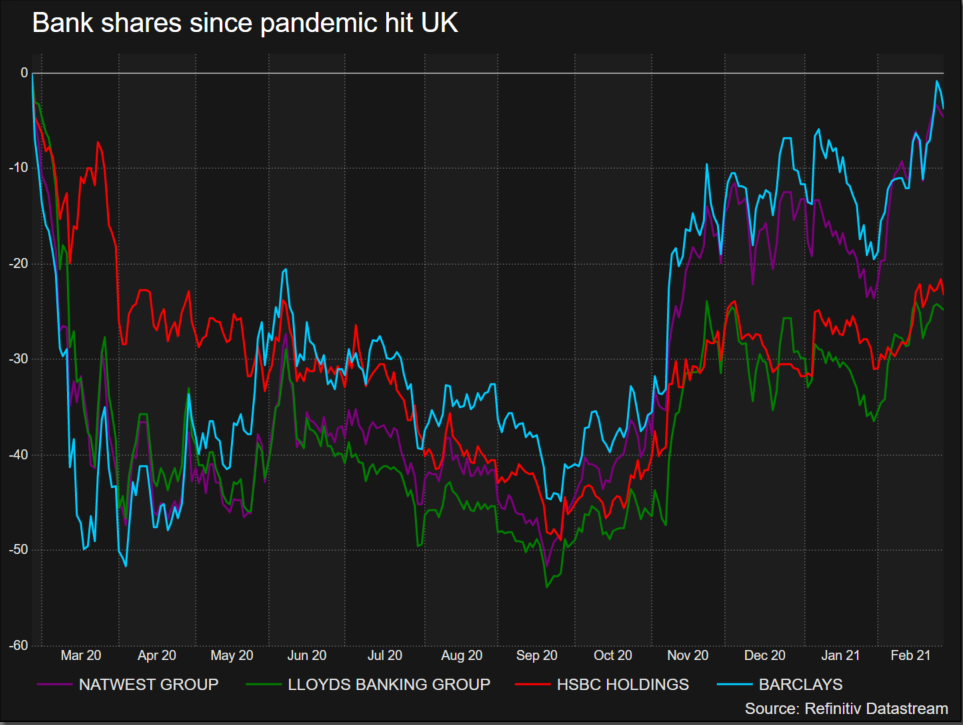

The banks now face a glut in savings, a Reuters analysis of the banks’ results show, as domestic customers of the four lenders deposited 221 billion pounds of extra cash.

By contrast, despite banks doling out billions of pounds of state-guaranteed finance to companies since the pandemic hit, their net lending growth in the UK overall was 53.4 billion pounds - a quarter of the growth in deposits.

The more limited lending growth can be explained by a fall in appetite for some lending, particularly consumer credit, where separate Bank of England data has shown Britons paid back 13.8 billion pounds in the last year.

More deposits help shore up bank finances, but are not necessarily good news for lenders when central bank interest rates are near zero, making it hard to lend profitably.

That explains the heavy focus on wealth management in banks’ strategy updates last month, as they race to earn more from fees to compensate for low lending margins.

Banks have said they expect a customer spending splurge as Britain comes out of its latest lockdown in the coming months, which may go some way to eating into the deposits pile.

Graphic: UK deposits grew much faster than lending in 2020

The bulk of UK bank profits are made on the difference between the interest gained on lending and paid out on deposits.

The crunch in consumer credit therefore severely dented lender income, compounded by the fact the Bank of England cut benchmark rates to an all-time low of 0.1%.

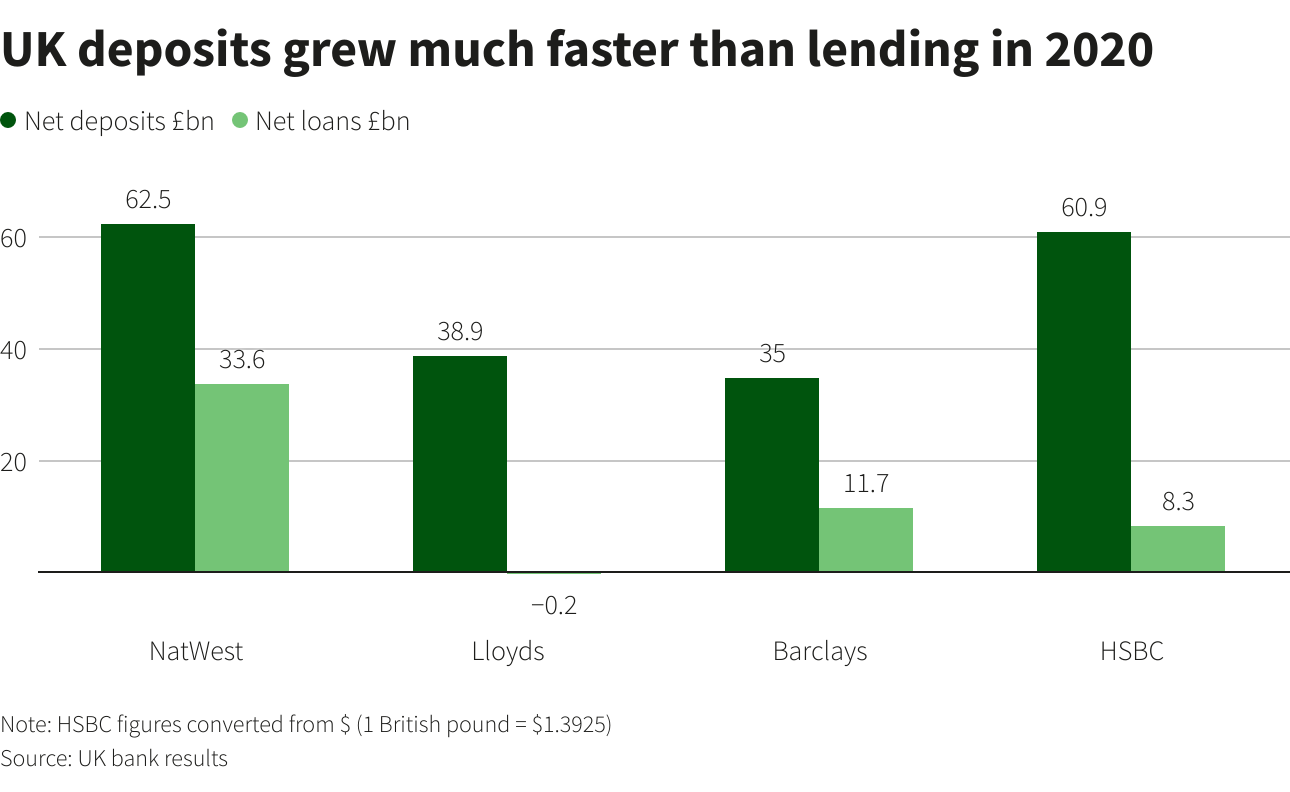

This double whammy can be seen in sharp drops in income at the two domestically-focused banks - NatWest and Lloyds - where income fell 24% and 16% respectively last year.

The fall was a more modest 10% at HSBC, which benefited from a more international footprint and exposure to markets in Asia that proved more resilient over the year.

Barclays bucked the trend entirely, with income overall edging up 1% thanks to a stellar year for its investment bank in pandemic-driven volatile markets that offset woes in retail.

Graphic: Bank income crunched, Barclays lifted by trading arm

The big unknown for the banks remains how severe a hit the crisis will deal to their loan books, once government stimulus packages to support consumers and businesses are phased out.

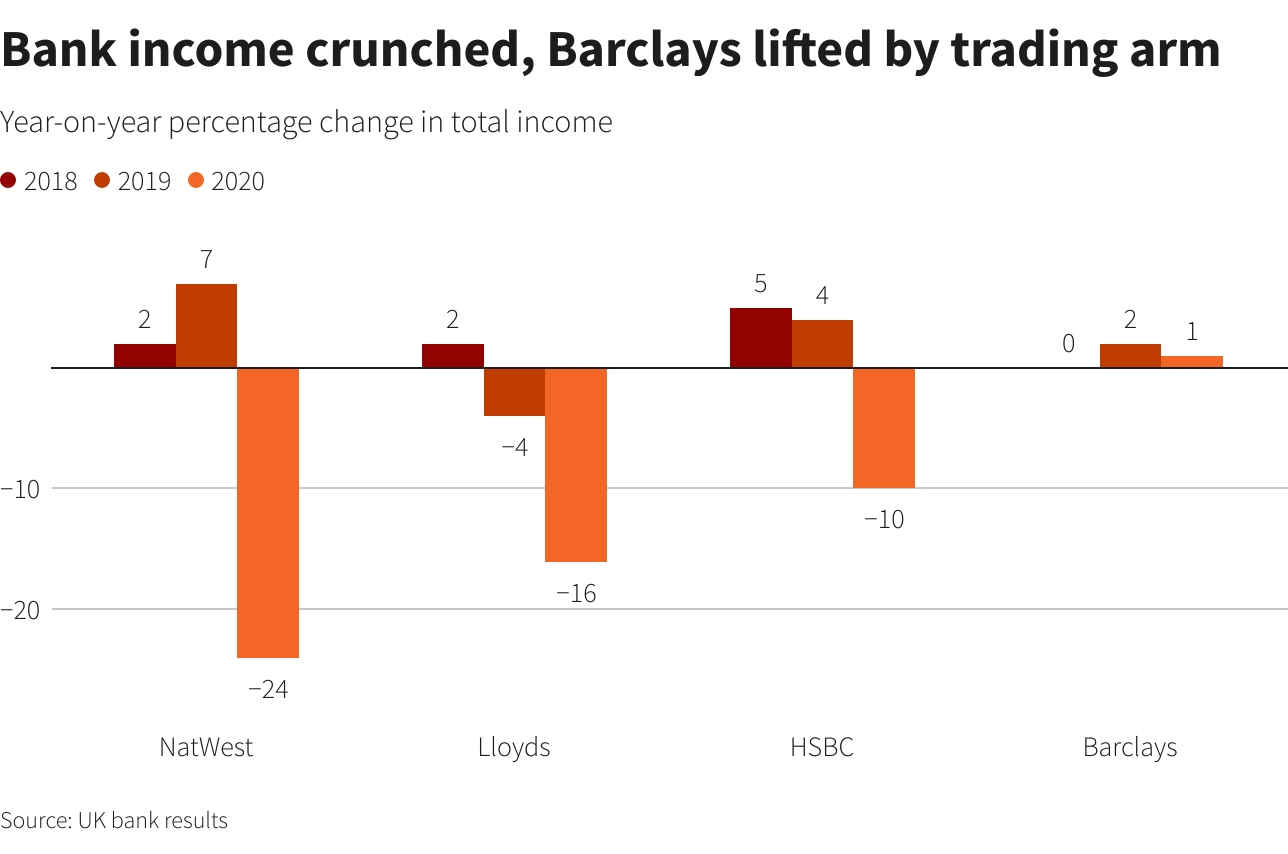

The four banks have set aside nearly 19 billion pounds worth of provisions between them for loans expected to go bad due to the crisis.

These provisions were largely front-loaded in 2020, with the bulk taken in the first half of the year - as lenders are required to book ahead of time under forward-looking accounting rules known as IFRS9.

Despite the torrid economic backdrop, the provisions in the last two quarters were back to pre-crisis levels at at least some of the banks - a reflection of the impact of ongoing government stimulus.

Britain’s Finance Minister Rishi Sunak is expected to extend support again on Wednesday when he lays out his annual budget plan that is expected to pile more borrowing on top of almost 300 billion pounds of COVID-19 spending and tax cuts.

Banks know there is a great deal of delayed pain to come and it is unclear whether their provisioning to date is sufficient.

Graphic: Bad loan provisions were frontloaded in 2020

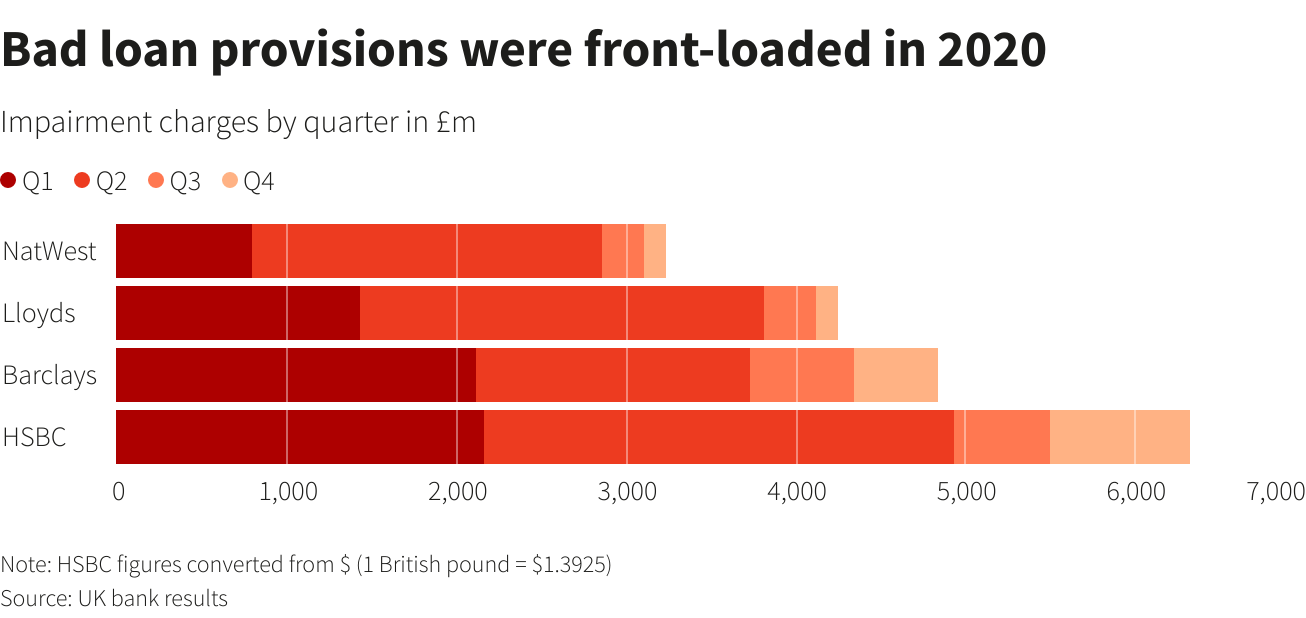

Solving this conundrum will be key to jump-starting British banks’ share prices, which have languished in recent years over fears about Brexit and near-constant restructuring that has crimped profits.

Optimism over vaccine rollouts has seen the lenders’ shares climb back towards pre-pandemic levels since the autumn, but that still leaves them near 12-year lows.

Graphic: Bank shares since pandemic hit UK