Treasury could raise £16bn a year if shares and property were taxed like salaries

The government could raise an extra £16bn a year if the low tax rates on profits from shares and property were increased and brought back into line with taxes on salaries.

Exclusive analysis of data on the 540,000 wealthiest individuals in the UK – the top 1% – shows how decades of low taxes on capital gains, a type of income mainly available to the wealthiest in society, is creating a new breed of “super-gainers”.

The findings will boost calls for reforms which spread the tax burden more fairly. The chancellor, Rishi Sunak, was criticised by members of his own party last month after increasing national insurance rates to raise billions for health and social care while leaving the earnings of the wealthiest largely untouched.

Under the current system, income – which covers earnings such as salaries – is taxed at a maximum rate of 45%. Capital gains – the profit made when an asset such as shares or property is sold for more than it cost to acquire – is taxed at much lower rates. Gains from shares attract a maximum rate of 20%, while the maximum for property is 28%.

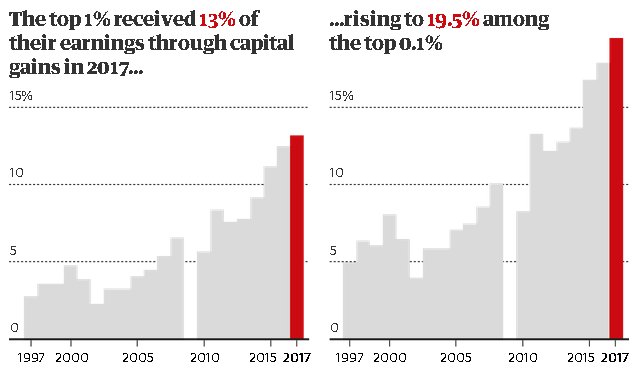

The Guardian’s analysis has found that since the late 1990s, the proportion of earnings that are declared as capital gains by the top 1% has ballooned: just 3% of their income came through gains in 1997, doubling to 5.4% in 2010. By the 2017/18 tax year it had reached 13.3%.

Among the extremely rich – the 50,000 people who make up the 0.1% – the amount declared in capital gains grew by 213% between 2007 and 2017. By contrast, this group’s salaries have not grown as fast. Their median income grew by 22% between 2007 and 2017.

The analysis was carried out for the Guardian by Arun Advani, the assistant professor of economics at the University of Warwick’s CAGE Research Centre and a research fellow specialising in tax at the Institute for Fiscal Studies.

“We’ve seen that by reducing capital gains tax rates, the primary thing it has done is encourage people to take income as capital gains, reducing tax take without providing any wider benefits. It is hard to explain why people who are more able to restructure their income in this way should pay less than those who can’t,” Advani said.

Much of the information about the capital gains of the wealthiest 1% of taxpayers is not available in any public dataset. The analysis was only possible because Advani and his fellow researchers were given access to a secure room at HMRC, where they were able to view anonymised tax returns for the super-rich.

Gains from shares attract a maximum tax rate of 20%.

Gains from shares attract a maximum tax rate of 20%.

In a paper published last year, based on their HMRC research, they found this type of income was very concentrated at the top, with the 5,000 highest earners receiving 54% of all capital gains.

Because gains are so lightly taxed, the wealthiest pay a far lower share of their earnings to the tax authorities than most workers. The top 0.001% – 400 people with earnings of between £9m and £11m – were paying an effective tax rate of just 21%, Advani found. This was slightly less than someone on median earnings of £30,000, whose effective rate was 21.4%.

Using the latest data on capital gains, as recorded by HMRC, Advani estimates that if gains were taxed at the same rates as salaries, an extra £13.8bn could have been collected the in 2016-17, rising to £15.9bn in 2019-20.

The idea of alignment is not new. The former Conservative chancellor Nigel Lawson introduced parity between capital gains and income taxes in 1988, but this was unpicked a decade later by his Labour successor, Gordon Brown.

“The chancellor doesn’t just decide how much money to raise, he also has to choose how to do it fairly. So far he has raised taxes on those who work to earn a living, in order to protect those who live off income from wealth,” Advani said.

Support for reform is growing. Labour has indicated it would increase taxes on earnings made from owning shares and investment properties, although the party has yet to set out detailed plans.

Adam Corlett, the principal economist at the Resolution Foundation, said there were “glaring holes” around capital gains which needed to be addressed.

“Thanks to the glaring holes in the capital gains tax system, it’s quite possible for the wealthiest to pay a tax rate of only 10%, or even zero, while low income workers pay much higher rates. That should change,” he said.

The argument against such tax reform is that it might, in turn discourage investment.

Helen Miller, the deputy director and head of tax at the Institute for Fiscal Studies, said there were “good reasons to reform capital gains tax” but added it required a “two-pronged approach” to avoid the risk of discouraging investment.

“[The government] should reform the definition of what is taxed, including by removing some reliefs and adding others, which would allow it to raise rates while minimising distortions to saving and investment incentives,” she said.