Tory leadership: Do rivals tax pledges add up?

Under current government plans, the total tax burden is set to reach its highest level since the 1940s, according to official forecasts.

The Tory leadership candidates are promising to reduce it but haven't specified whether they would pay for any shortfall in government finances with extra borrowing or cuts to public spending, instead emphasising that they would spur growth and thus increase government revenues.

Lord Lawson - a former Conservative chancellor - has warned: "There is a danger that this leadership election is going to descend into a Dutch auction of tax cuts which are not necessarily affordable."

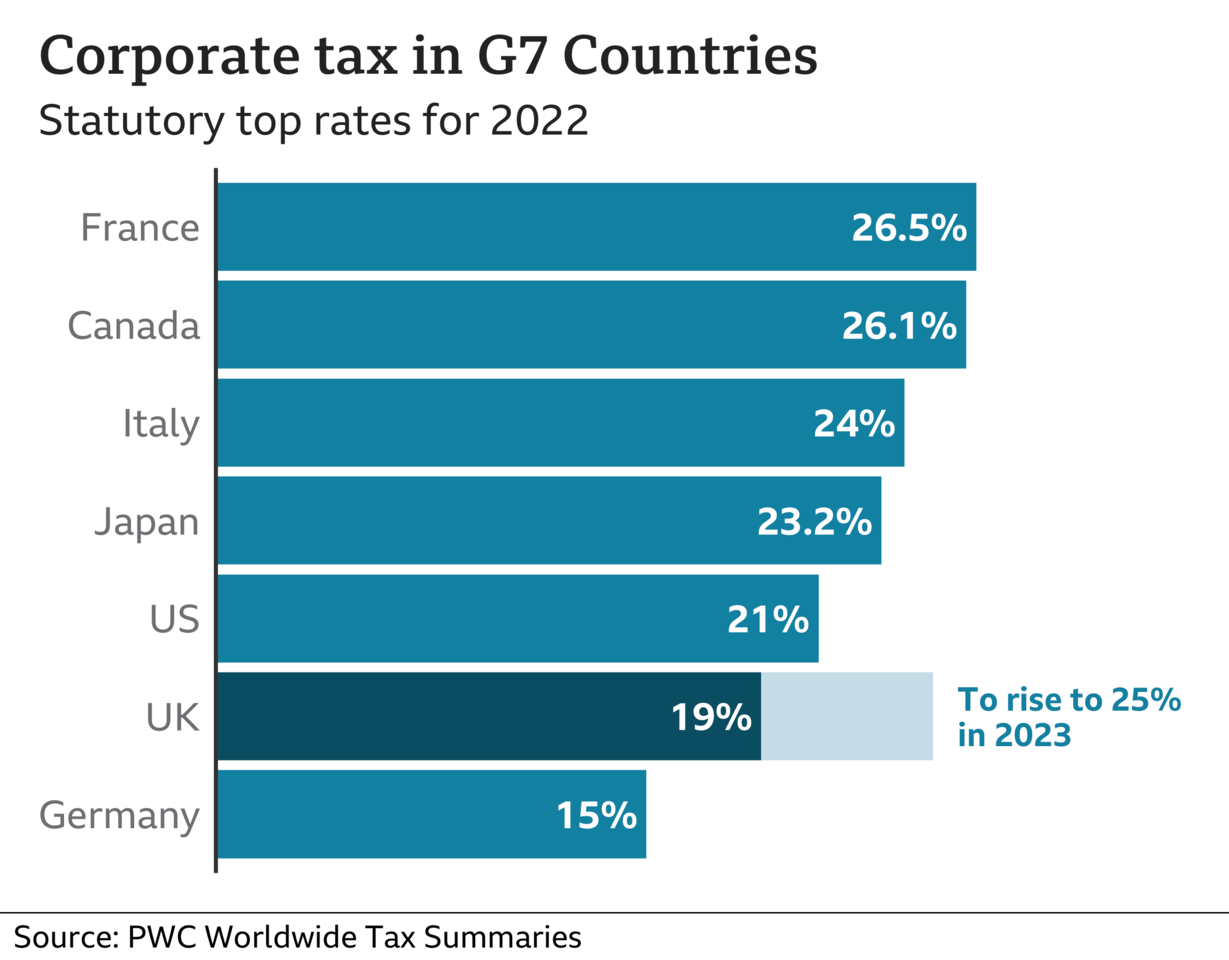

Corporation tax

This is a direct tax on the annual profits of businesses - essentially, a form of income tax for companies.

The tax rate is currently 19% but from next April - under a decision by former Chancellor Rishi Sunak - it is due to increase to 25%.

Who wants to change it?

The newly appointed Chancellor Nadhim Zahawi has promised to scrap next year's corporation tax rise.

Jeremy Hunt - former foreign secretary - has gone further, suggesting he would reduce corporation tax to 15% in the autumn budget, due in October.

Liz Truss has said she wants to "keep corporation tax competitive".

Economic analysis

The economic think tank, the Institute for Fiscal Studies (IFS), has been crunching the numbers. IFS economist Stuart Adam calculates that:

* cancelling the rise from 19% to 25% would cost £17bn a year

* reducing the rate to 15% would cost another £14bn a year

The IFS says though that this potential £31bn annual cost doesn't allow for whether the corporation tax cut could lead to increased investment in the UK, which could make the final bill "substantially lower - though not enough for the tax cut to pay for itself".

Income tax

The basic rate of income tax is currently 20p in the pound and is paid on earnings between £12,571 to £50,270.

This rises to 40p in the pound for earnings above £50,270 and 45p in the pound for earnings over £150,000.

Former Chancellor Rishi Sunak announced a reduction in the basic rate to 19p but not until 2024-25.

Who wants to change it?

Nadhim Zahawi wants to bring the income tax cut forward by one year, making it 19p in 2023.

He would then reduce it to 18p in 2024.

"That will give households back £900 a year on average," he claims.

Economic analysis

According to IFS economist Stuart Adam, bringing the income tax cut forward to 2023-24 would cost a "one-off" £6bn.

It's thought reducing it further would cost another £6bn.

National Insurance

National Insurance (NI) is a tax on earnings and self-employed profits - paid by all workers, until they reach the state pension age.

Since April, they have been paying more in NI - an extra 1.25p in the pound. The rise - announced by Mr Sunak - was to fund health and social care.

To try to ease the impact of the changes, Mr Sunak raised the threshold - at which people start paying NI - to £12,570. But some of his leadership rivals say this isn't enough.

Who wants to change it?

Ms Truss and Tom Tugendhat - chairman of the foreign affairs committee - want to scrap April's NI rise.

Economic analysis

Reversing the NI rise would cost about £13bn a year, according to the IFS's Stuart Adam.

Carl Emmerson, deputy director of the IFS, said cuts to personal taxes such as NI "certainly won't be paying for themselves". He said while such tax cuts would put "more money in people's pockets", they risked contributing to inflation.

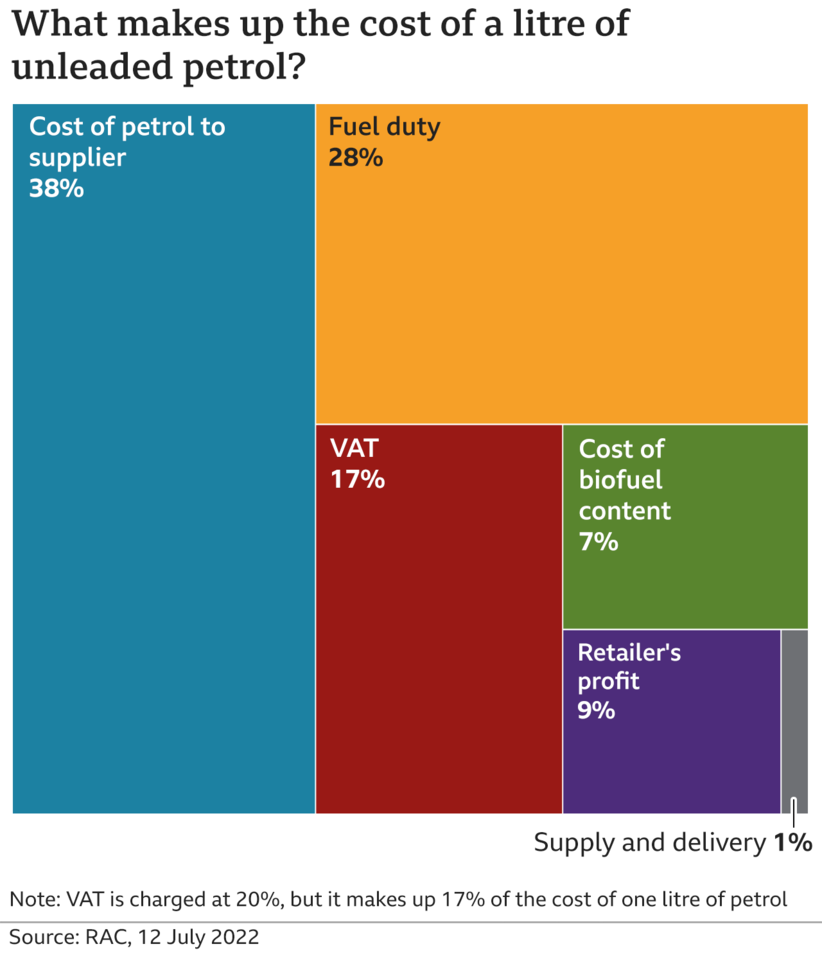

Fuel duty

This is a tax - along with VAT - included in the price of petrol, diesel and other types of fuel.

The price of fuel has increased dramatically in the UK - following the war in Ukraine - adding to the cost of living pressures.

UK fuel duty is currently 52.95 pence per litre for petrol and diesel. In the 2022 Spring Statement, the government announced a temporary cut to fuel duty of five pence per litre.

Who wants to change it?

Mr Tugendhat has pledged to cut fuel duty by 10 pence per litre.

Trade Minister Penny Mordaunt has said she would cut VAT on fuel in half, from 20% to 10%.

Trade minister Penny Mordaunt has been MP for Portsmouth North since 2010.

Trade minister Penny Mordaunt has been MP for Portsmouth North since 2010.

Economic analysis

Fuel duty brings in a lot of money for the government - an estimated £26.2bn in revenue in 2022-23, according to the Office for Budget Responsibility (OBR).

The government said that April's five pence per litre cut would cost £2.4bn - so any further reductions would be in the billions.

Caroline Mullen and Greg Marsden, transport researchers from Leeds University, argue that cutting fuel duty would only benefit the wealthiest in society.

"In 2019, the highest income group in the UK drove an average of 4,893 miles per year, more than three times that of the lowest income group.

"If it is the least well off that the fuel duty cut is aimed at protecting, then the tax system or benefit adjustments would surely be more targeted and effective," they said.

VAT on energy bills

VAT is payable on goods and services. The standard rate is 20% but VAT on domestic energy bills is currently 5%.

When the UK was a member of the EU, this could not be reduced further. During the 2016 EU referendum campaign, Boris Johnson and Michael Gove said that "when we Vote Leave, we will be able to scrap this unfair and damaging tax". But this has not happened.

Who's proposing what?

Suella Braverman has called for VAT on energy bills to be cut further.

Economic analysis

Getting rid of the 5% tax would cost the government about £1.7bn a year, according to HMRC estimates.

What about the other candidates?

Rishi Sunak - the former chancellor - has launched his leadership bid, saying: "Once we have gripped inflation, I will get the tax burden down. It is a question of 'when', not 'if'."

He hasn't come out with detailed tax cuts yet but says he wants "radical reforms" to the way businesses are taxed.

Kemi Badenoch says "I'm committed to reduce corporate and personal taxes" but hasn't given any more details.