Topshop owner Arcadia on brink of collapse

Sir Philip had been in talks with potential lenders about borrowing £30m to help the business through Christmas.

However, these talks have failed and administrators could be appointed on Monday, putting 13,000 jobs at risk.

Arcadia said it was working on "contingency options".

Is this because of the pandemic?

Arcadia admitted that the coronavirus had had "a material impact on trading across our businesses".

"As a result, the Arcadia boards have been working on a number of contingency options to secure the future of the group's brands," it said.

"The brands continue to trade and our stores will be opening again in England and the Republic of Ireland as soon as the government Covid-19 restrictions are lifted next week."

However, even before the pandemic, Arcadia's best-known names - like Topshop - were struggling against nimbler online-only fashion retailers like Asos, Boohoo and Pretty Little Thing.

And rival High Street chains like Zara have invested heavily in their digital business while Topshop has been slow to catch up.

In its most recent accounts for the year to 1 September 2018, Arcadia reported a £93.4m pre-tax loss compared with a £164.6m profit in the previous 12 months.

It also said sales fell 4.5% to £1.8bn.

The 'King of the High Street's' biggest challenge

Sir Philip Green - once known as the "King of the High Street" - is facing his biggest challenge yet.

With his Arcadia retail empire teetering on the brink of collapse, it is the latest saga in a colourful career that once saw him branded as the "unacceptable face of capitalism".

The retail tycoon's life story to date is rich in character and anecdote, from his failed attempts to take over M&S, to a lavish lifestyle that has attracted accusations of tax avoidance.

But questions now swirl over the fate of his empire.

Richard Lim, chief executive at Retail Economics, said that while all clothing shops had been adversely affected by the pandemic, Arcadia's "demise has been accelerated because of an online proposition that falls way behind that of their competitors".

"Years of underinvestment in the digital channel has severely restricted their ability to trade successfully through this hugely difficult period," he said.

What happens next?

"Arcadia would be the biggest British corporate collapse of the pandemic if it does enter voluntary liquidation," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

"It would hollow out huge swathes of the High Street, if its huge footprint of stores were forced to close."

If administrators are called in, the shops will continue to trade as buyers for the company - or more likely its well-known brands - are lined up for sale.

Arcadia currently has about 500 shops.

There is some speculation that Boohoo could emerge as a buyer for some of the brand. This year it bought the online businesses of Oasis and Warehouse, adding to Karen Millen and Coast, which it acquired in 2019.

What about the rest of the High Street?

Non-essential retailers in England have been forced to close for four weeks until 2 December to contain the spread of Covid-19. This followed a longer lockdown earlier in the year.

It has meant that other retailers with ties to Arcadia - such as department store chain Debenhams - are also struggling.

Debenhams sells a number of Sir Philip's brands through concessions at its department stores.

However, Debenhams is in administration and is currently in talks to find a buyer.

As with many High Street chains that had to go into lockdown, Arcadia placed many of the group's 13,000 workers on furlough.

It began the year with 15,000 workers. But in the summer, it axed 500 roles at its head office, while natural attrition meant employees have left for other, busier businesses.

While it would be the casualty of the pandemic if it collapsed, Arcadia is not alone.

On Friday, menswear retailer Moss Bros launched a restructuring of its business after it said trading had been "severely impacted" by Covid-19. It hired auditors to prepare for the company voluntary arrangement earlier this year.

Earlier this month, fashion chains Peacocks and Jaeger were placed into administration after owner Edinburgh Woollen Mill Group failed to find a buyer.

And other retailers have been cutting jobs, including 3,500 at grocer Sainsbury's and 1,500 roles at John Lewis Partnership.

What now for Sir Philip Green?

Sir Philip is unlikely to buy back any of his brands if it does go into administration, which was first reported by Sky News.

Arcadia underwent restructuring last year when it agreed to shut 50 shops.

As part of that deal, the company secured a rent cut with its landlords on property, as well as an agreement with the Pension Protection Fund to put money into the company's pension schemes.

Sir Philip and his wife Lady Cristina Green are worth £930m, according to the Sunday Times Rich List.

Much of their wealth is derived from a £1.2bn dividend payment Sir Philip took from Arcadia in 2005, two years after buying the business.

It was paid tax-free as his wife, Lady Green, is resident in Monaco, and she is the ultimate owner of the company.

In recent years, Sir Philip faced controversy for selling off BHS, the former department store chain, for £1 to high-profile businessman Dominic Chappell.

The following year, BHS went bust with the loss of 11,000 jobs and a pension deficit of £571m.

Sir Philip reached a deal with the Pensions Regulator to inject £363m into that scheme.

The buyer of BHS, Mr Chappell, was recently sentenced to six years in prison after being found guilty of tax evasion.

What about Arcadia's pension scheme?

John Ralfe, an independent pension expert who advised the work and pensions select committee on BHS pensions in 2016, told the BBC that Sir Philip Green seemed to "have learnt his lesson".

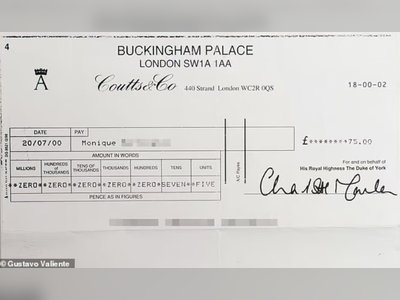

In a deal with the Pensions Regulator in 2019, Lady Tina Green, Arcadia's biggest shareholder, agreed to pump £100m into its two pension schemes over three years.

The wider group also said it would inject £75m, although it paused payments in March for six months due to difficulties stemming from the pandemic.

Mr Ralfe believes that the pension deficit could be as much as £350m for insurers to take on once the value of things like its physical shops had been accounted for.

The Pension Regulator and the Pension Protection Fund (PPF) are understood to be being kept closely informed about plans for the group.

A spokesperson for the PPF said that although it was unable to comment on trading companies, members of the schemes "can be assured of our ongoing protection."