The universal credit claimants effectively paying top tax rates

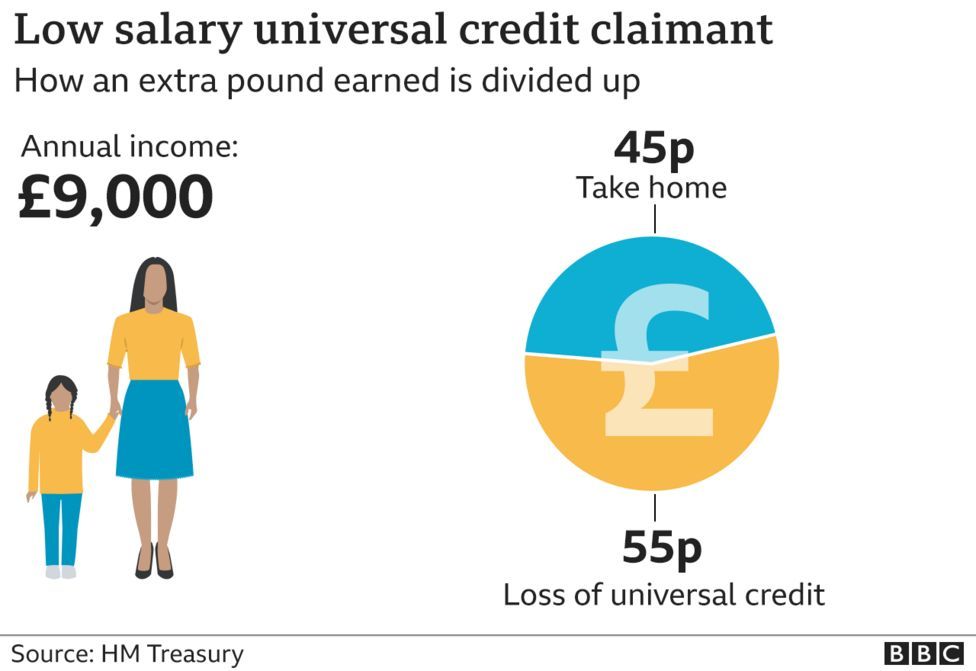

About 40% of claimants are working. And the taper rate, as it is known, has been cut from 63p to 55p - for each £1 earned.

But this can still leave claimants effectively paying very high rates of tax.

In fact, they can end up taking home a smaller proportion of an extra £1 earned than someone earning £150,000 a year.

Here, are five examples of workers paying very high effective tax rates.

Before the chancellor cut the taper rate, a universal credit claimant earning £9,000 a year from a part-time job would be taking home 37p of an extra £1 earned.

Now, that rises to 45p - but that is still the equivalent of a pretty high tax rate.

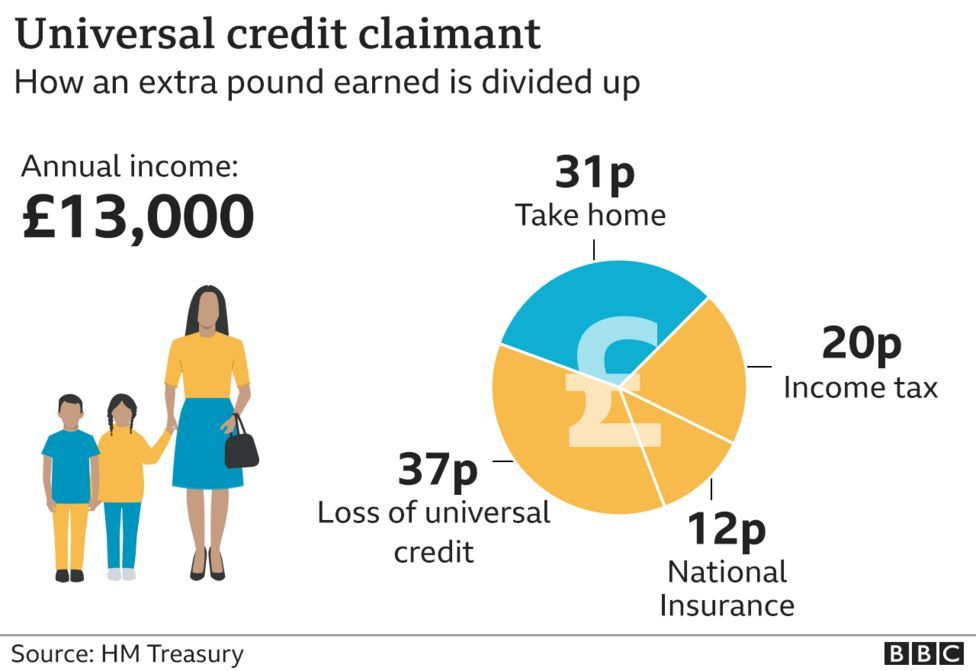

Now consider an employee, for example a parent, earning enough to pay income tax - so at least £12,570 a year - but still entitled to universal credit.

Even with the lower taper rate, they are still taking home only 31p of an extra £1 earned.

The taper rate is applied after income tax and National Insurance have been paid, which is why, in this example, it is taking 37p of an extra £1 earned and not 55p.

Income tax rates and bands are slightly different in Scotland. There is a 19% starter rate for income tax between earnings of £12,570 and £14,667. But in this case, that would still leave our worker taking home 31p of an extra £1 earned.

Child benefit is paid to families to help with the costs of raising children.

It is £21.15 a week for the first child and £14 a week for each additional child.

But the benefit is withdrawn gradually for those earning between £50,000 and £60,000.

Consider someone with three children, earning £50,500 a year.

The loss of child benefit means for an extra £1 earned, they take home 32p.

The higher rate of income tax in Scotland is 41%, so our worker with three children, earning £50,500, would keep 31p of an extra £1 earned.

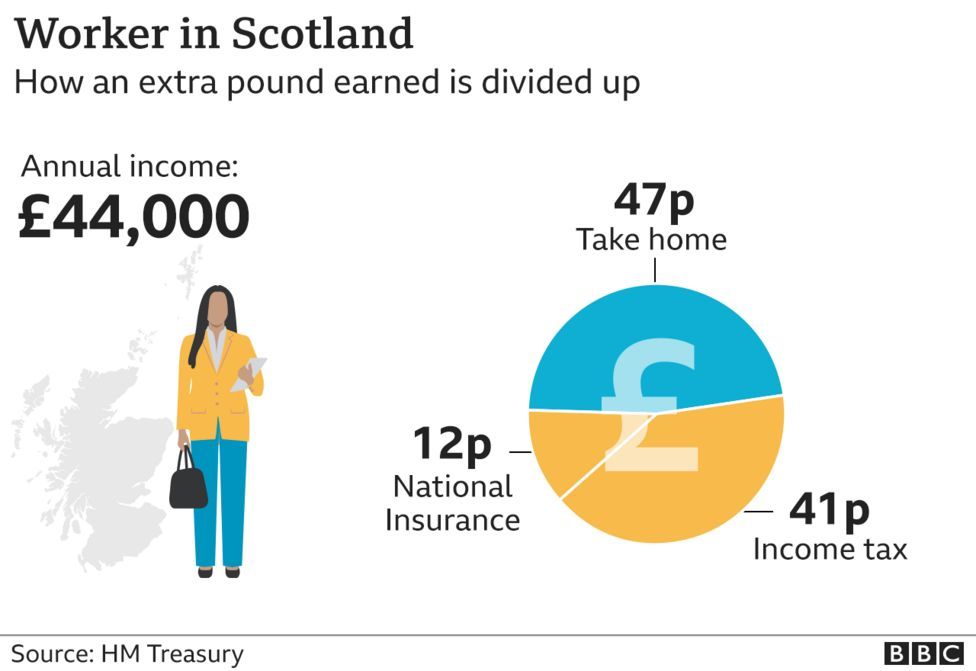

In Scotland, people start paying the 41% higher rate of income tax when they are earning £43,663 a year.

In the rest of the UK, they start paying a 40% higher rate at £50,271 a year.

But National Insurance rates are the same throughout the UK, which means a worker in Scotland earning between £43,663 and £50,271 would be paying both the higher rate of income tax and the 12% higher rate of National Insurance at the same time, meaning they take home only 47p of an extra £1 earned.

In the rest of the UK, employees earning that much would be paying only 20% income tax, so would take home 68p of an extra £1 earned - 21p more than their Scottish counterparts.

People do not have to start paying income tax until they are earning more than £12,570 a year.

This is called the personal allowance.

But the personal allowance is withdrawn at a rate of £1 of allowance for every extra £2 earned above £100,000.

So those earning more than £100,000 a year start paying tax on part of their earnings they did not previously have to pay tax on.

And this means someone earning between £100,000 and £125,140 a year would take home 38p of an extra £1 earned. In Scotland, it would be 37p.

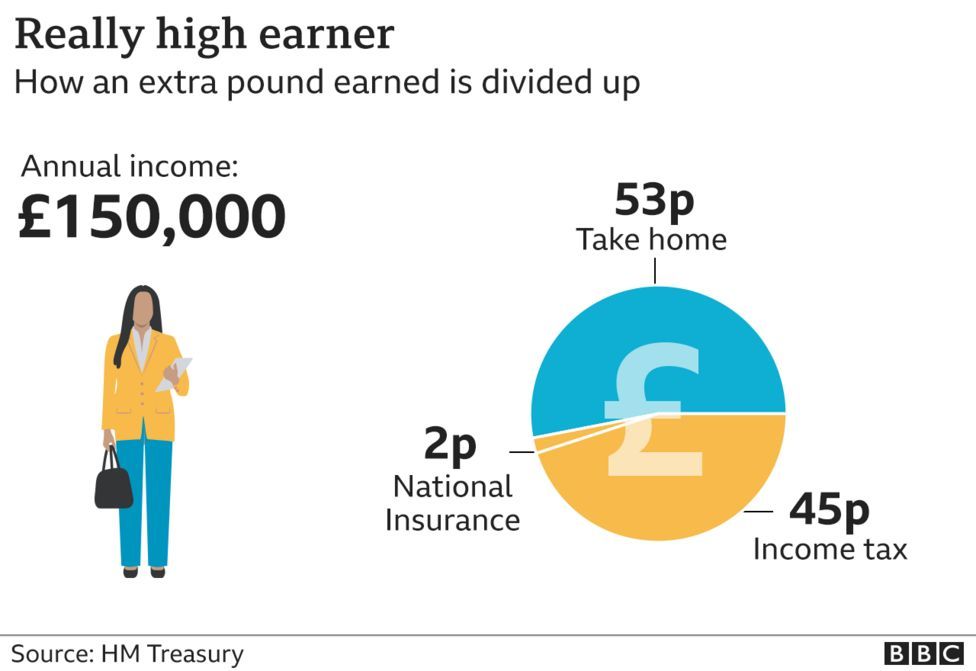

All of these people are taking home less of an extra £1 earned than somebody earning more than £150,000 and paying what is supposedly the top rate of tax.

That person would take home 53p of an extra £1 earned.

Bear in mind all of these figures are the current rates - National Insurance rates will be rising in April.

We asked the Treasury why some workers pay much higher rates of tax than people earning considerably more but have not received a reply.

Cliff edges

In all the examples above, somebody earning an extra £1 still gets to keep some of this extra money - but there are situations in which earning an extra £1 could actually make someone worse off overall. These are known as cliff edges.

For example, if you earn less than £50,270 and your husband, wife or civil partner earns less than £12,570, they can use marriage allowance to transfer £1,260 of their income tax personal allowance to you.

That would mean you no longer needed to pay income tax on £1,260 of your earnings, saving you £252 a year.

But if you earned an extra £1, putting you on £50,271, you would no longer be eligible for marriage allowance, leaving you almost £252 a year worse off.

In Scotland, the cliff edge would be at £43,662 a year.

Cliff edges also occur with other schemes, including the personal savings allowance and tax-free childcare.