Tax rate U-turn lifts pound but markets still fret over government credibility

The pound and government bond yields have recovered some poise in the wake of the government's U-turn on abolishing the top rate of income tax.

Kwasi Kwarteng revealed early on Monday morning that the decision to axe the 45p rate - part of his growth plan revealed last month - would now not happen in April as he had announced just 10 days ago.

The measures were badly received by the financial markets as they were seen as placing too much strain on the public finances, with the tax cuts set to cost £45bn alone.

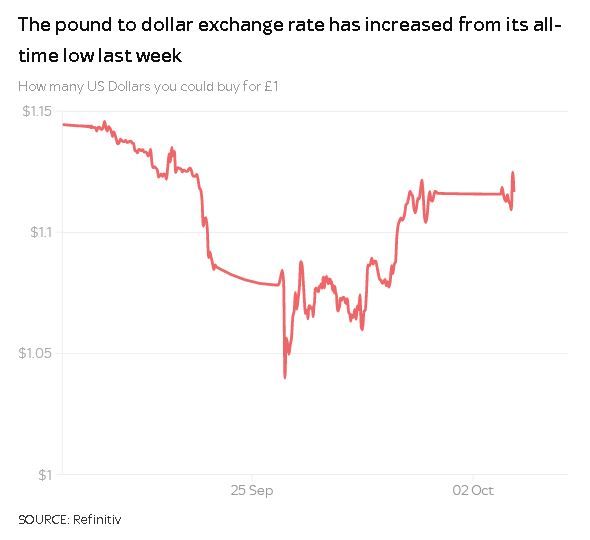

The crisis of confidence saw sterling hit record lows against the dollar a week ago while the Bank of England later had to intervene to restore market functionality for pension funds when long-dated government bond yields surged.

The yield - the effective interest rate demanded by investors to buy UK government debt - on the 30-year bond had nudged to levels not seen since 2002 before the Bank said it would buy bonds to support the market.

In a statement on Monday afternoon the Bank reaffirmed its commitment to buying up to £5 billion of long-dated gilts at each of its daily auctions. Gilt prices fell sharply in the wake of the announcement, and 30-year yields jumped more than 30 basis points after the announcement.

Monday morning's government climbdown had seen the yield, briefly, climb back to where it was ahead of the mini-budget.

The same could be said for the pound.

'The market was panicking'

But market commentators cautioned that it was likely some respite only.

AJ Bell's investment director, Russ Mould, noted that sterling had jumped from $1.1088 to $1.1264 in less than two hours on Monday morning.

"The U-turn is important for two reasons", he wrote.

"First, the market was panicking about the cost of the tax cuts and how that would push up government debt and in turn raise the prospect of reduced public spending and benefit cuts.

"Removing one of the key components of this seemingly flawed plan provided some relief, and you saw that in how the pound rallied and 10-year gilt rates briefly fell below 4%."

'UK faces challenging times'

"The other factor to consider is that Kwarteng has effectively admitted to a massive policy error only weeks into his tenure as chancellor," Mr Mould continued.

"If Liz Truss is to establish any credibility as prime minister, can she afford to have anyone on her team who has effectively scored an own goal in the opening game?

"The fact that both the pound fell back, and gilt rates started to move higher after the news had been digested, is the market's way of saying there are still plenty of problems with the government's finances, state of the consumer and business, and economic outlook.

"With or without the 45% tax cut, the country still faces challenging times with individuals and companies finding life a lot harder."

Mr Mould noted that the FTSE 100 fell 1% to 6,827 - dragged down by miners, financial services and consumer goods firms.

"Many of these earn in dollars and so a stronger pound - even if just a temporary move - is bad for them", he explained.

The FTSE 100's declines were in line with those on the continent where investors were also reacting to the latest evidence of recession ahead.

Closely-watched surveys of purchasing managers in the manufacturing sector all pointed to slowdowns - largely due to surging inflation.

In the case of the UK, a third consecutive monthly decline in activity was noted with rates of inflation in input costs and selling prices both picking up linked, in part, to the weaker pound.

By market close in London the FTSE 100 had closed up 0.2%, nearly 15 points, ending the day at 6,909.