SCOTT GALLOWAY: Removing Jack Dorsey as CEO should be the first step in Twitter's path to redemption

Every day, 187 million people open Twitter for news, entertainment, and a social connection. It is the real-time global communications network that sci-fi novelists envisioned. It is also a catalyst for conspiracy theories, a forum for hate speech, and a surprisingly lousy business.

In this week's issue of New York Magazine (February 1, 2021), I make the case that Twitter's toxicity and subpar financial results are one and the same problem, amenable to one and the same solution. Fixing Twitter starts at the top — replacing an absentee CEO — and from there, changing the company's business model. The potential rewards are worth it, both economically and socially.

The capitalist case

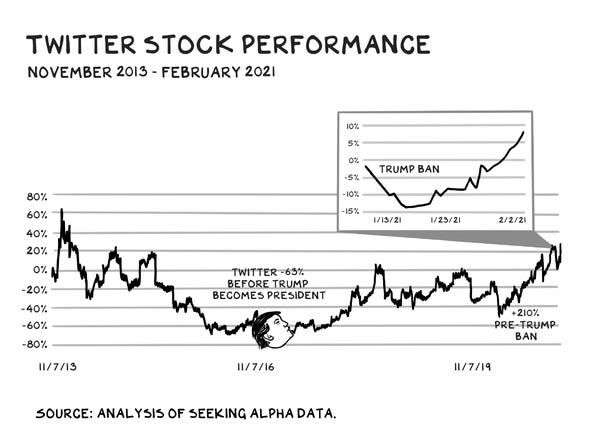

Since its IPO in 2013, Twitter has underperformed the market, growing its share price at just 2% per year. For years, I've advocated for a change in Twitter's business model for both the good of the commonwealth and benefit to shareholders (Disclosure: shareholder). The need for this change is greater than ever.

Donald Trump's election — and his prolific use of the platform — smeared Vaseline over the lens of this chronic under-performance. The traffic and engagement that Trump brought to the platform (26,000 tweets and 1,000 tags per minute) helped to reverse the 63% downward slide in Twitter's stock price since its public offering. Tellingly, when Twitter banned Trump's account, the stock immediately fell, shaving $5 billion off the company's market cap, before slowly regaining ground.

This one-term "fix" came at great cost: The platform has become what political philosopher Hannah Arendt described as a "temporary alliance between the elite and the mob." Arendt was talking about the rise of totalitarianism, but she could have been talking about the attack on the Capitol on January 6. All of this — Twitter's weak financial performance and its toxic content — is the result of a broken business model.

What should Twitter do? Own the space it occupies

Twitter has let toxic content run amok because doing so is in its interest: The company depends on the engagement it generates. Its advertising-driven model prioritizes time on the platform at all costs, and produces an algorithm that amplifies enragement and polarization. Anyone who has been on Twitter will recognize the compulsion to refresh the page just one more time and get that dopamine hit, hate-reading enemies and enjoying the glorious dunks on everyone else. The algorithm knows it, too: It learns from our every tap and dials up the doom.

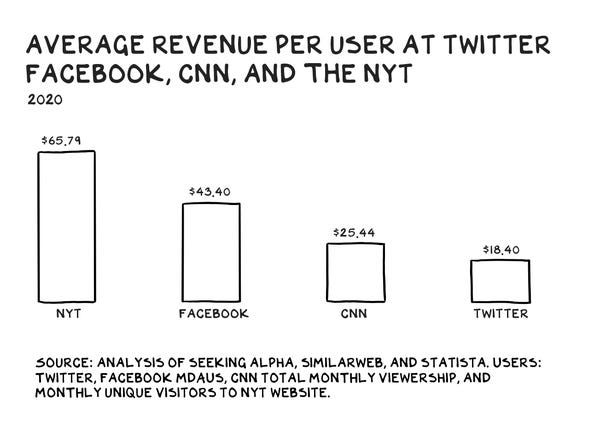

Even if an ad-based model did not produce this kind of digital exhaust, it would still be destined to fail by Twitter's insufficient scale. While the company's reach is large compared to that of traditional media, it is dwarfed by that of Google and Facebook, which dominate digital advertising. Choking on the dust of a duopoly is a difficult position from which to build a business.

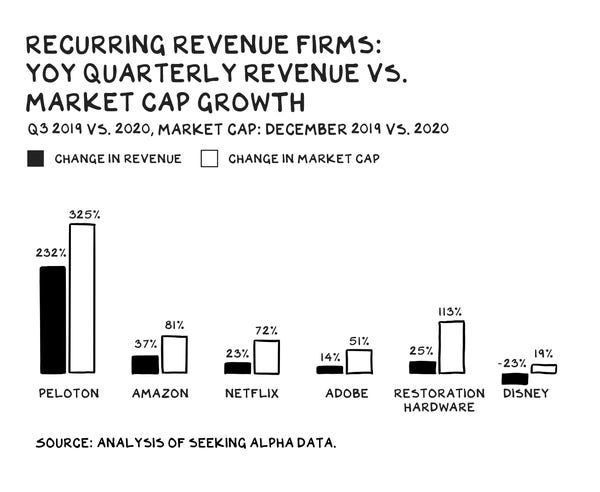

Twitter needs to move from an ad model to a subscription model, with subscription fees for accounts of a certain size. The platform would still be free for the majority of users, but accounts over 200,000 followers (or even 50,000 followers) should pay for the audience that Twitter provides them with. This would lead to better financial results because recurring revenue is reliable, profitable, and earns a higher multiple than transaction revenue.

A subscription model would also orient Twitter around its users (rather than its advertisers) and incentivize the company to improve its product. For example, it could provide creators with tools to capitalize on their influence, something an annual development budget of roughly 800 million has thus far failed to accomplish. As a result, other platforms have moved in, such as Substack and Clubhouse.

A payment system is another obvious innovation for Twitter. Recently, Clubhouse announced it would be adding payment processing, and TikTok said it had formed a partnership with Shopify that will eventually allow merchants to sell products directly through the app. Why hasn't Twitter done this? For one thing, its CEO also happens to be the CEO of a payments company, Square, where roughly 90% of Jack Dorsey's wealth resides. This fact highlights not only a distraction, but also a conflict of interest.

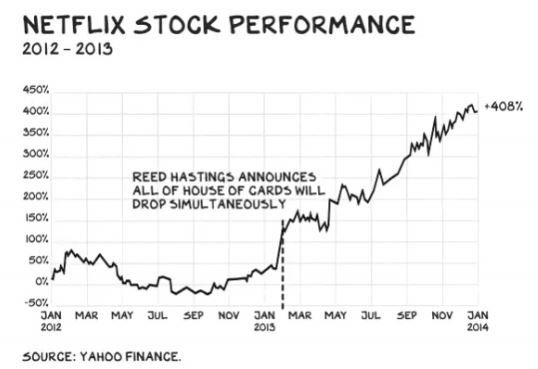

As it builds a business around its users, Twitter should acquire or create its own content. Both Spotify and Netflix's stocks accelerated once they began investing in their own programming. Twitter is already a destination for news and entertainment content, and if it added its own vertical — high-quality political journalism, for example — it could establish itself as the first truly hybrid social platform, blending user-generated and exclusive material. The company has dipped its toe into these waters before: It aired NFL games in 2016 and pursued a broader array of partnerships with Disney in a 2018 deal. Unfortunately, as investors have come to expect from Twitter, these forays have gone nowhere.

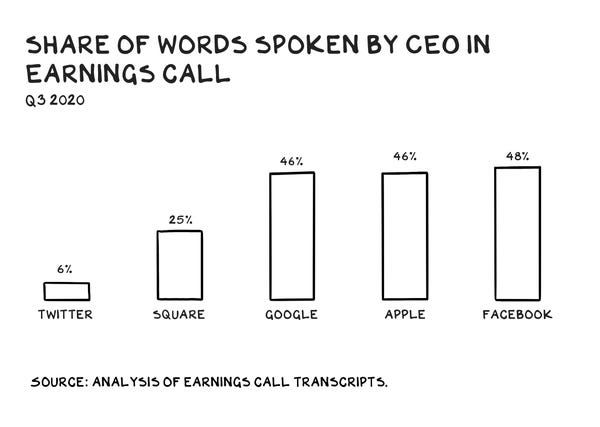

The transition to a new model should not be done under Dorsey's watch. He has repeatedly demonstrated his lack of engagement with Twitter — on the company's most recent earnings call, he spoke just 6% of the words in the meeting. According to the New York Times, Dorsey oversaw Twitter's response to the Capitol insurrection from a private island in French Polynesia frequented by celebrities escaping the paparazzi. Well, isn't that nice? I wonder if he splits his time between two archipelagos as well as two companies?

Mr. Dorsey's insistence on managing (or not) Twitter from far-flung retreats should alone make the case for his removal as CEO. I can't believe I even have to say this: We should remove a part-time CEO.

Twitter's management, enabled by legacy board members, has demonstrated an alarming disregard for the commonwealth, weak strategic thinking, and an inability to create a fraction of the shareholder value that is possible for the platform. Twitter's financial weakness gives it a chance for redemption. It's time.

For the full version of my argument for overhauling Twitter, see my article in New York Magazine and watch the latest episode of the Prof G Show.