Rishi Sunak: What will the new PM mean for my money?

Inside ordinary homes across the UK, more attention may have been directed at the rising cost of groceries. Over the past year, vegetable oil went up in price by 65%, pasta by 60% and chips by 39%.

Almost half of adults who pay energy bills and 30% paying rent or mortgages say they are struggling to afford these bills, according to the Office for National Statistics.

Of course, our personal finances cannot be disentangled from what is happening in Westminster.

And the arrival of a new prime minister - Rishi Sunak - will have an impact on our money.

Prices are still climbing

Mr Sunak immediately made reference to the "profound economic crisis" faced by the UK. That belief is centred on the soaring cost of living, and a gap in the UK's public finances.

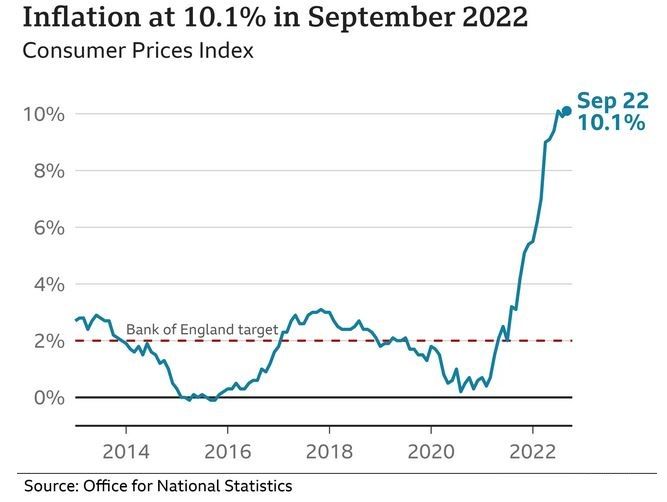

Prices are rising at their highest rate for 40 years - driven primarily by energy and food. Those two necessities are pushing up that inflation rate, which forecasters say is yet to peak.

Remember, even when the inflation rate starts to come down, it is not that prices are actually falling but that the rate of price rises is slowing.

So, people who receive benefits, such as universal credit or the state pension, will want to know whether their payments will go up in line with inflation in April.

Mr Sunak, in his previous role of chancellor, promised that benefits would match prices rises but - according to Sarah Coles, analyst at Hargreaves Lansdown - "there are no guarantees at this stage".

In his opening speech in Downing Street, Mr Sunak gave little away, saying there are "difficult decisions to come" but that they will be tackled with "compassion".

He also said he would deliver on the 2019 Conservative manifesto, which explicitly says the pensions triple-lock would remain in place. That would see the state pension rise in line with inflation in April.

The state pension for people retiring now is currently worth £185.15 a week. If it goes up in line with prices, it will be £203.85 a week from April. If it rises in line with earnings, it will be £195.35 a week.

The basic state pension, for those who reached state pension age before April 2016, is currently £141.85 a week. This would go up to £156.20 if it rises in line with prices, and £149.65 if it rises in line with average earnings. This is topped up with Pension Credit for some low-income pensioners.

"Pensioners need clarity from the new prime minister over what the state pension is likely to rise by next year, so they have the certainty to plan ahead of a difficult winter," says Tom Selby, head of retirement policy at investment firm AJ Bell.

Families will also watch closely to see what the new administration decides to do regarding the long-standing issue of social care, and the impact that has on people's finances later in life.

Support with energy bills

The impact of some of the policies implemented by Mr Sunak as chancellor some time ago are being seen now on household energy bills.

The universal discount of £400 is cutting this winter's domestic bills, and more cost-of-living payments will be made to those on low-incomes receiving benefits in November, and to nearly all pensioners in the next couple of months.

A government policy introduced by Liz Truss which caps the cost of each unit of gas and electricity, and means the typical household's annual domestic energy bill will be £2,500, will be in place this winter.

A decision is needed, if not immediately, on what happens after that.

As it stands, energy bills are likely to rise sharply from April. When chancellor, and during the summer's leadership contest, Mr Sunak focussed on the idea of financial support with bills for the most vulnerable. Those on middle-incomes, worried about the cost of gas and electricity, will hope that support is relatively broad.

Mortgage costs bite

Mortgages have been getting more expensive throughout the year, as the Bank of England increased the benchmark interest rate. After the mini-budget, there was a further surge, with borrowers now paying about 6.5% on a new, typical two- or five-year fixed-rate home loan.

Mr Sunak's arrival at 10 Downing Street comes as the cost of government borrowing has eased, and therefore the cost to lenders to finance mortgage deals has also fallen.

Of course, we will never know how high mortgage rates would have risen without the mini-budget. The expectation in the industry now is that the picture is likely to improve for mortgage borrowers from the current situation, but slowly.

"Rate decreases by lenders are always a gradual thing," says Chris Sykes, of mortgage broker Private Finance.

That will feed through to landlords too, and what they charge their tenants.

Renters may finally get some certainty too on whether no-fault evictions will be banned - another manifesto commitment which at times has looked under threat.

Taxing decisions to be made

When challenging for the leadership against Ms Truss, Mr Sunak pledged to cut the basic rate of income tax from the current 20% down to 19% in April 2024, and then to 16% by the end of the next Parliament.

That ambition seems a very long way off now.

More relevant than tax cuts now is whether there will be any tax rises to repair the public finances. Remember, that manifesto of 2019 ruled out any increase to National Insurance, income tax and VAT.

One rumour that has been swirling is that the threshold at which people pay different rates of income tax may be frozen for longer. That means, even if workers receive a below-inflation pay rise, they could still be drawn into paying income tax at a higher rate.

That remains speculation, among a host of questions that the new prime minister and his chancellor will soon have to answer.