Revealed: Queen lobbied for change in law to hide her private wealth

The Queen successfully lobbied the government to change a draft law in order to conceal her “embarrassing” private wealth from the public, according to documents discovered by the Guardian.

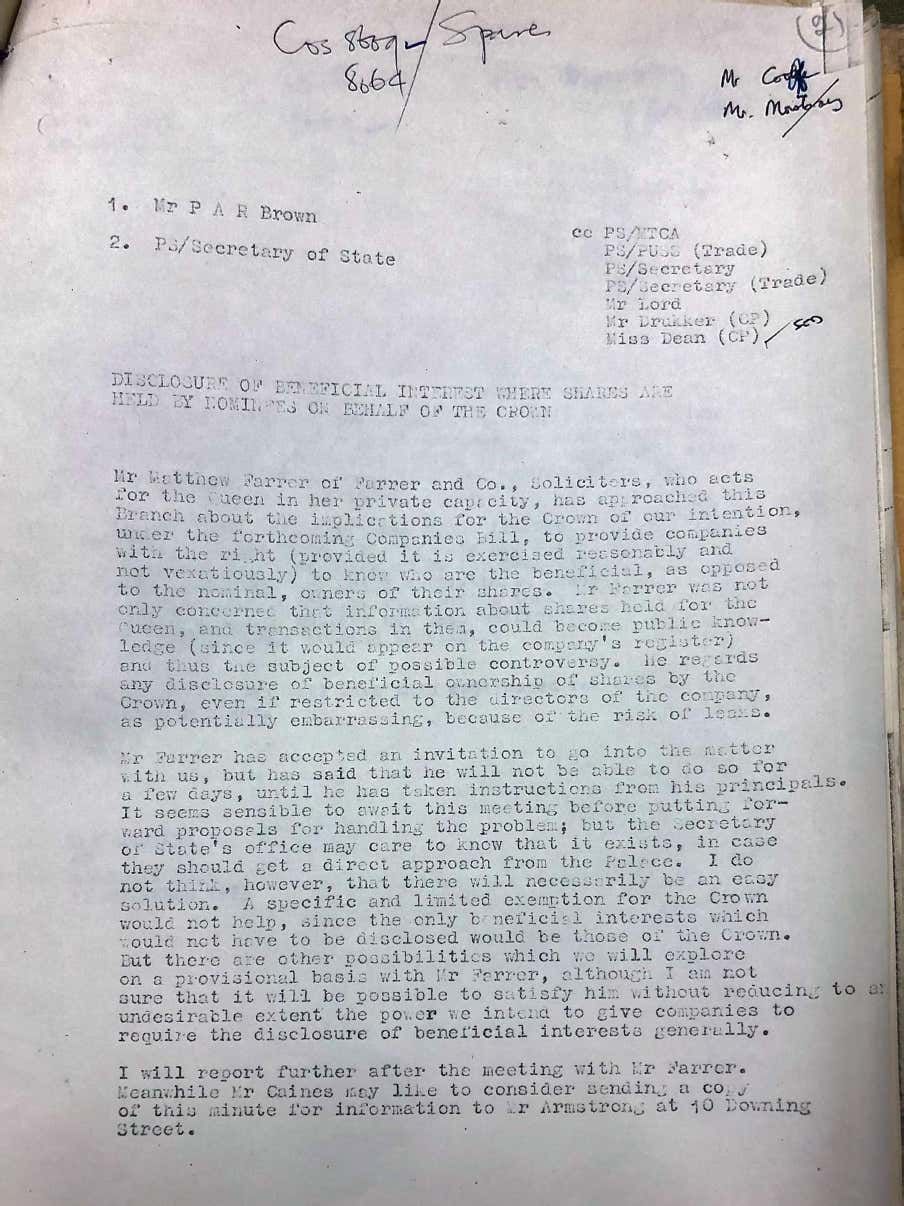

A series of government memos unearthed in the National Archives reveal that Elizabeth Windsor’s private lawyer put pressure on ministers to alter proposed legislation to prevent her shareholdings from being disclosed to the public.

Following the Queen’s intervention, the government inserted a clause into the law granting itself the power to exempt companies used by “heads of state” from new transparency measures.

The arrangement, which was concocted in the 1970s, was used in effect to create a state-backed shell corporation which is understood to have placed a veil of secrecy over the Queen’s private shareholdings and investments until at least 2011.

The true scale of her wealth has never been disclosed, though it has been estimated to run into the hundreds of millions of pounds.

The scale of Queen Elizabeth’s wealth has never been disclosed but she

feared a 1973 bill would allow the public to scrutinise her finances.

The scale of Queen Elizabeth’s wealth has never been disclosed but she

feared a 1973 bill would allow the public to scrutinise her finances.

Evidence of the monarch’s lobbying of ministers was uncovered by a Guardian investigation into the royal family’s use of an arcane parliamentary procedure, known as Queen’s consent, to secretly influence the formation of British laws.

Unlike the better-known procedure of royal assent, a formality that marks the moment when a bill becomes law, Queen’s consent must be sought before legislation can be approved by parliament.

It requires ministers to alert the Queen when legislation might affect either the royal prerogative or the private interests of the crown.

The website of the royal family describes it as “a long established convention” and constitutional scholars have tended to regard consent as an opaque but harmless example of the pageantry that surrounds the monarchy.

But documents unearthed in the National Archives, which the Guardian is publishing this week, suggest that the consent process, which gives the Queen and her lawyers advance sight of bills coming into parliament, has enabled her to secretly lobby for legislative changes.

Thomas Adams, a specialist in constitutional law at Oxford University who reviewed the new documents, said they revealed “the kind of influence over legislation that lobbyists would only dream of”. The mere existence of the consent procedure, he said, appeared to have given the monarch “substantial influence” over draft laws that could affect her.

‘Disclosure would be embarrassing’

The papers reveal that in November 1973 the Queen feared that a proposed bill to bring transparency to company shareholdings could enable the public to scrutinise her finances. As a result she dispatched her private lawyer to press the government to make changes.

Matthew Farrer, then a partner at the prestigious law firm Farrer & Co, visited civil servants at the then Department of Trade and Industry to discuss the proposed transparency measures in the companies bill, which had been drafted by Edward Heath’s government.

The bill sought to prevent investors from secretly building up significant stakes in listed companies by acquiring their shares through front companies or nominees. It would therefore include a clause granting directors the right to demand that any nominees owning their company’s shares reveal, when asked, the identities of their clients.

Three crucial pages of correspondence between civil servants at the trade department reveal how, at that meeting, Farrer relayed the Queen’s objection that the law would reveal her private investments in listed companies, as well as their value. He proposed that the monarch be exempted.

“I have spoken to Mr Farrer,” a civil servant called CM Drukker wrote on 9 November. “As I had recalled he – or rather, I think, his clients – are quite as concerned over the risk of disclosure to directors of a company as to shareholders and the general public.

The Queen with the

then prime minister, Edward Heath, in 1973, the year Heath’s government

put forward the transparency proposals.

The Queen with the

then prime minister, Edward Heath, in 1973, the year Heath’s government

put forward the transparency proposals.

“He justifies this not only because of the risk of inadvertent or indiscreet leaking to other people,” Drukker continued, “but more basically because disclosure to any person would be embarrassing.”

After being informed that exempting only the crown from the legislation would mean it was obvious any shareholdings so anonymised were the Queen’s property, Farrer, the correspondence states, “took fright somewhat, emphasised that the problem was taken very seriously and suggested – somewhat tentatively – that we had put them into this quandary and must therefore find a way out.”

Drukker continued: “He did not like any suggestions that holdings were not these days so embarrassing, given the wide knowledge of, for example, landed property held. Nor did he see that the problem might be resolved by any avoidance of holdings in particular companies. It was the knowledge per se that was objectionable.”

After being informed by Farrer “that he must now seek instruction” from his client, Drukker advised a colleague: “I think we must now do what you suggested we should eventually do – warn ministers.”

Three days later, another civil servant, CW Roberts, summarised the problem in a second memo.

“Mr Farrer was not only concerned that information about shares held for the Queen, and transactions in them, could become public knowledge (since it would appear on the company’s register) and thus the subject of possible controversy,” Roberts wrote.

“He regards any disclosure of beneficial ownership of shares by the crown, even if restricted to the directors of the company, as potentially embarrassing, because of the risk of leaks.”

He continued: “Mr Farrer has accepted an invitation to go into the matter with us, but has said that he will not be able to do so for a few days, until he has taken instructions from his principals.”

Secrecy clause

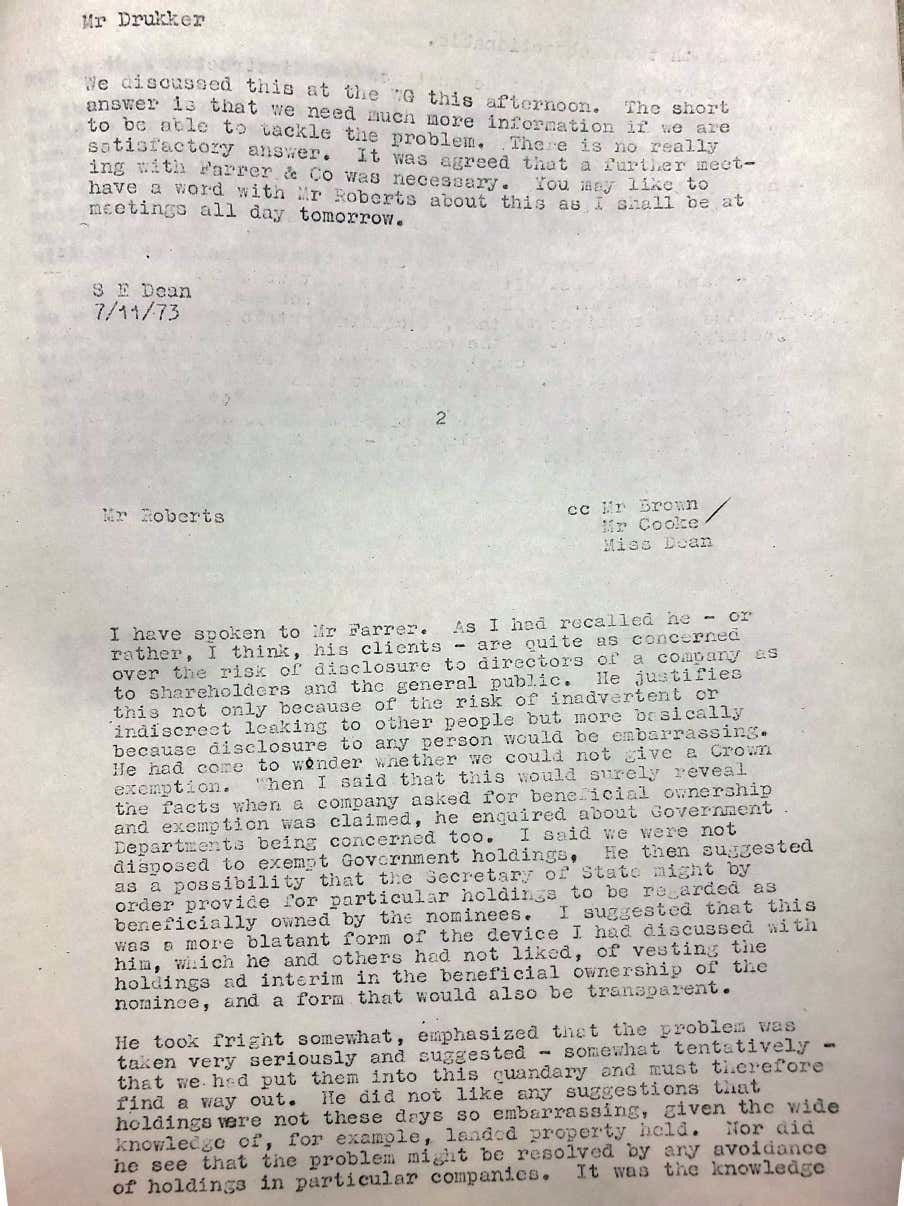

By the following month the Heath government had developed an ingenious proposal through which the Queen’s dilemma might be resolved.

“With the help of the Bank of England, my department have evolved the following solutions, which will appear in the bill,” wrote the Conservative trade secretary, Geoffrey Howe, to a fellow minister.

Howe proposed that the government would insert a new clause into the bill granting the government the power to exempt certain companies from the requirement to declare the identities of their shareholders.

Officially, the change would be for the benefit of a variety of wealthy investors. “Such a class could be generally defined to cover, say, heads of state, governments, central monetary authorities, investment boards and international bodies formed by governments,” Howe continued.

In practice, however, the Queen was plainly the intended beneficiary of the arrangement. The government intended to create a shell company through which a range of these investors could hold shares. It meant that any curious member of the public would be unable to pinpoint which of the shares owned by the company were held on behalf of the monarch.

“My department have discussed this solution with the legal advisers to the Queen,” Howe noted. “While they cannot of course commit themselves to using the suggested new facility, they accept that it is a perfectly reasonable solution to the problem which they face, and that they could not ask us to do more. I am therefore arranging that the necessary provisions should appear in the bill.”

Geoffrey Howe, September 1973.

Geoffrey Howe, September 1973.

It would be three years before the bill and its secrecy clause would come into law. In February 1974 Heath called a general election, resulting in all legislation that was going through parliament being thrown out.

However, the proposal was resuscitated by the subsequent Labour government under Harold Wilson and became law in 1976, with much of the original bill simply copied into the second edition.

The exemption was almost immediately granted to a newly formed company called Bank of England Nominees Limited, operated by senior individuals at the Bank of England, which has previously been identified as a possible vehicle through which the Queen held shares.

Shares believed to be owned by the Queen were transferred to the company in April 1977, according to a 1989 book by the journalist Andrew Morton.

The exemption is believed to have helped conceal the Queen’s private fortune until at least 2011, when the government disclosed that Bank of England Nominees was no longer covered by it.

Four years ago, the company was closed down. Precisely what happened to the shares it held on behalf of others is not clear. As a dormant company, it never filed public accounts itemising its activities.

‘A possible landmine’

The use of Queen’s consent is normally recorded in Hansard, the official record of parliamentary debates, before a bill’s third reading. However, no notification of consent for the 1976 bill appears in the record, possibly because it was only sought for the 1973 version that never made it to third reading.

Howe, who died in 2015, appears to have disclosed the role of Queen’s consent – which is invoked when ministers believe a draft law might affect the royal prerogative or the private interests of the crown – during a parliamentary debate in 1975 in a previously unnoticed speech.

“In relation to that draft legislation, as to any other, the advisers of the Queen, as they do as a matter of routine, examined the bill to see whether it contained, inadvertently or otherwise, any curtailment of the royal prerogative,” Howe said.

Howe had been prompted to speak in the parliamentary debate during a row caused by the leak of high-level Whitehall papers to the Morning Star newspaper. The leak revealed the government’s intention to exempt the Windsor wealth from the companies bill.

It was a major scoop for the communist newspaper, but the leaked papers did not establish whether the Queen had lobbied the government to help conceal her wealth.

At the time, the Financial Times remarked that “a possible landmine for the Conservatives would be if Buckingham Palace in 1973 had taken the initiative in suggesting that disclosure of the Queen’s shareholdings should be excluded from the bill”.

The newly discovered papers reveal exactly that. “At the very least, it seems clear that representations on the part of the crown were material in altering the shape of the legislation,” Adams said.

When contacted by the Guardian, Buckingham Palace did not answer any questions about the Queen’s lobbying to alter the companies bill, or whether she had used the consent procedure to put pressure on the government.

In a statement, a spokesperson for the Queen said: “Queen’s consent is a parliamentary process, with the role of sovereign purely formal. Consent is always granted by the monarch where requested by government.

“Whether Queen’s consent is required is decided by parliament, independently from the royal household, in matters that would affect crown interests, including personal property and personal interests of the monarch,” she said.

“If consent is required, draft legislation is, by convention, put to the sovereign to grant solely on advice of ministers and as a matter of public record.”