Revealed: first-time homes have grown less affordable under the Tories

First-time buyers have seen the gap between their wages and house prices grow in the vast majority of councils in England and Wales, casting doubt on Boris Johnson’s promise to “turn generation rent into generation buy”.

Just over a year ago, the prime minister said he wanted to give people “the fundamental life-affirming power of home ownership” and “spread that opportunity to every part of the country”.

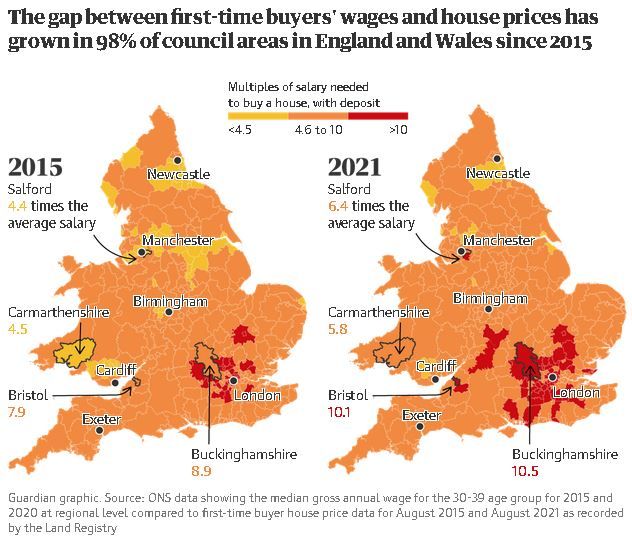

Guardian analysis of prices paid by first-time buyers, however, shows that the affordability gap has grown in 98% of England’s local authorities since 2015, and in every part of Wales.

The traditional benchmark for mortgage affordability is that the amount required from a lender – the property price minus a 10% deposit – should not exceed 4.5 times the buyer’s wage or the combined wage of a couple.

But that target is unachievable for single first-time buyers – who are typically aged 32 – in 95% of local authorities in England, based on the median earnings for people in their 30s.

Single first-time buyers in Wales would not be able to afford a home in 86% of local authorities in the country. Although couples fare better, they would struggle to stay within 4.5 times their wage in almost a third (31%) of council areas in England.

The analysis looked at what has happened to affordability in the six years since the Conservatives won a majority government. The party’s 2015 manifesto said “everyone who works hard should be able to own a home of their own” and outlined schemes for cut-price starter homes and a help-to-buy Isa.

In the run-up to the 2019 election, the party said: “For the UK to unleash its potential, young people need the security of knowing that home ownership is within their reach.”

Since then the help-to-buy loan scheme has been extended, and this year a scheme to guarantee 95% mortgages was introduced. But the analysis shows homes have become less affordable over that period.

“Home ownership is now almost completely out of reach for most people on average or low incomes – with house prices continuing to soar, most people can’t scrape together a sky-high deposit to buy and so are stuck paying extortionate private rents,” Polly Neate, the chief executive of Shelter, said.

“The government has ploughed money into a series of expensive home ownership schemes that most people can never hope to benefit from, as they still require a sizeable deposit when most renters don’t have any savings.”

House prices increased by the largest proportion in Salford, in the north-west of England, where the average house price for a first-time buyer increased by 58% over the six-year period.

This is despite the fact that Salford is within the top 20 most deprived local authorities in England in terms of deprivation.

In 2015, a single first-time buyer would have needed 4.4 times an individual’s wage to afford a typical mortgage, within the affordability criteria generally sought by lenders.

Today, a buyer on the median wage for a person in their 30s in the region would require 6.4 times the average salary.

In Bristol, while a property was affordable for couples seeking to get on the property ladder in 2015, the increase in prices has not kept pace with wages, rising from four times their joint wage in 2015 to 5.1 times their combined salary in 2021.

Two-thirds of London boroughs remain outside the reach of couples seeking to buy their first property in the capital.

In Wales, the biggest proportional increase in house prices between 2015 and 2021 was in Blaenau Gwent, where prices rose by 52.7% across that period, but the area remains affordable for a buyer in their 30s earning the local median wage.

Conversely, while prices haven’t risen as fast, the gap between a first-time buyer’s wage and the average property price was within the 4.5 times limit in 2015 but has since risen to beyond 5.5 times the average salary in Caerphilly, Torfaen and Carmarthenshire.

The analysis is based on Office for National Statistics data showing the median gross annual wage for the 30-39 age group for 2015 and 2020 at regional level compared with house price data for August 2015 and August 2021 as recorded by the Land Registry.

Dan Wilson Craw, the deputy director of the campaign group Generation Rent, said: “It is already a struggle to save the deposit to buy your first home, and as prices have shot up home ownership has become even harder … The government has intervened to encourage banks to lend at higher loan-to-value ratios, so buyers don’t need as much in savings. But ultimately if you’re borrowing that much, your monthly repayments will be huge.”

“Ultimately, the only sustainable way the government can help people buy a home is to throw everything they have at reducing rents. That means building more homes where people want to live, and more council homes.”

A government spokesperson said: “Our economy is on track to reach pre-pandemic levels around the turn of the year and wages are rising in real terms.

“We know how important it is for people to own their own home, which is why we have supported over 700,000 households into ownership through shared ownership and help to buy since 2010, and our new First Homes scheme will provide homes at a discount of at least 30% for local first-time buyers.

“We’re also investing over £12bn in affordable homes over the next five years –the largest investment in affordable housing in a decade, alongside increasing skills funding and the national living wage.”