Northern English cities faced ‘avalanche’ of debt during Covid – study

Britain’s contrasting economic fortunes during Covid are highlighted by a study that shows the £150bn of savings accrued over the pandemic are overwhelmingly concentrated in the affluent south of England, while large parts of the north and the Midlands faced an “avalanche” of personal debt.

Affluent people in richer southern England neighbourhoods were typically able to save £12 for every £1 saved by people in poorer neighbourhoods in mostly northern cities and towns, who spent proportionately more of their income on essentials such as food and energy, said the Centre for Cities thinktank.

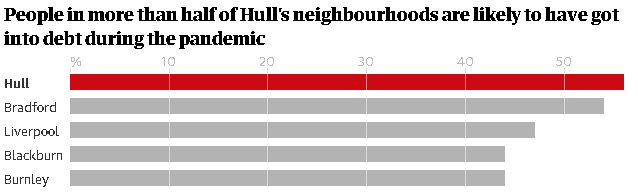

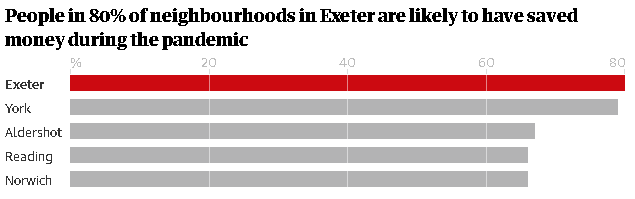

Cities such as Exeter, York and Aldershot were the biggest financial beneficiaries of lockdown, with residents in at least three-quarters of neighbourhoods likely to have boosted savings. This contrasted with Hull, Bradford and Blackburn, where people in around half of neighbourhoods were likely to have racked up debts.

The Centre for Cities warned of a “north-south” economic divide opening up more widely when the government’s Covid support package is phased out in the autumn, with some parts of the country potentially benefiting from the “champagne bottle effect” of Covid savings and others facing increased levels of problem debt.

It called on the government to unveil a package of support for people facing financial hardship as a result of Covid-19, including a specialist debt relief scheme for people who have run up pandemic-related problem debt, and retention of the £20 uplift to universal credit.

“The pandemic has left this country more divided than ever. While people in mostly prosperous southern cities and towns have accumulated £150bn of savings, many less affluent people in the north and Midlands will face an avalanche of debt as government support ends later this year,” said Centre for Cities’ chief executive, Andrew Carter.

“The pandemic has left this country more divided than ever. While people in mostly prosperous southern cities and towns have accumulated £150bn of savings, many less affluent people in the north and Midlands will face an avalanche of debt as government support ends later this year,” said Centre for Cities’ chief executive, Andrew Carter.

He added: “The government is withdrawing financial support far too quickly for people in places that have been hit hard by the pandemic. Not only will this set its levelling up agenda back significantly, it also risks levelling down many previously affluent parts of southern England such as Crawley.

Spending on non-essential services such as travel, restaurants and entertainment in Great Britain dipped dramatically during the lockdowns of the past 16 months as a result of work from home guidance and restrictions on shop opening, enabling the accumulation nationally of a £150bn savings cash pile.

Spending on non-essential services such as travel, restaurants and entertainment in Great Britain dipped dramatically during the lockdowns of the past 16 months as a result of work from home guidance and restrictions on shop opening, enabling the accumulation nationally of a £150bn savings cash pile.

But this “dividend” is unevenly distributed, said the study. While residents in places such as Oxford, Cambridge and Reading were able to spend, on average, 15% less than pre-pandemic, those living in places such as Hull, Sunderland, Dundee and Middlesbrough saw spending (and savings) levels barely changed.

The study says people living in poorer neighbourhoods faced a double whammy – not only were they less likely to be able to cut spending over lockdown but were more likely to have lost income as a result of moving on to universal credit or furlough – heightening the risk that they accumulate debt.

In Liverpool, for example, where there are high concentrations of deprivation, nearly half of neighbourhoods, were likely to have run up higher debts as a result of the pandemic, while less than a third of neighbourhoods were estimated to have been in a position to save.

By contrast, in mainly affluent Milton Keynes in Buckinghamshire, around 40% of neighbourhoods were estimated to have been saving during the pandemic while fewer than a fifth of neighbourhoods are likely to have seen a rise in debt.

The risk was that town and cities in deprived areas would lose out because there they had fewer savings to inject into the local economy, the study said: “Fewer jobs will therefore be created in these places as a result of the bounce back, further exacerbating their pre-existing and pandemic debt challenges.”

Pockets of the south-east whose fortunes were tightly bound to those of the international travel industry were also struggling, notably – Crawley, Luton and Slough – where both rich and poor neighbourhoods had seen their financial situation deteriorate over the past year.

Centre for Cities called for an extension of the coronavirus job retention scheme in sectors such as the aviation industry that will continue to be affected by the pandemic in the autumn.