More than 1.4 million households face higher fixed rate mortgage bills this year

More than 1.4 million fixed rate mortgage customers are facing the prospect of significant hikes to their monthly payments when their deals end this year, according to official figures.

The Office for National Statistics (ONS) said 57% of those coming up for renewal in 2023 were fixed at interest rates below 2%.

It added that deals set to mature next year will be from two-year fixed rate loans made in 2022 and five-year fixed rate deals made in 2019, when "mortgage rates were generally higher than 2%".

Its report on housing costs, using Bank of England data on transactions, showed that 353,000 fixed rate mortgages were due for renewal during the first three months of 2023.

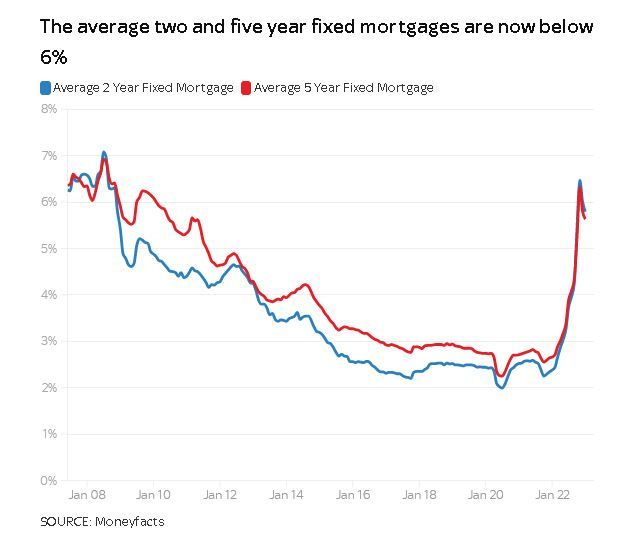

It comes at a time when the cost of a fixed term home loan continues to recover from the peaks seen - way above 6% - last autumn when the market suffered a shock at the hands of the-then government.

Households on tracker and standard variable deals have endured rising bills for over a year - reflecting the surge in the cost of borrowing imposed by the Bank through interest rate rises to curb inflation.

The energy-led spike in the cost of living has added to a variety of bills - squeezing consumer spending power and leaving the country on the brink of recession, according to economists.

Fixed rate mortgage costs, however, were subjected to something of an own goal as they rose sharply in the wake of the Liz Truss government's uncosted mini-budget which spooked financial markets.

The mayhem prompted the cost of fixed term mortgage deals to rise as lenders pulled products temporarily to ensure they reflected higher funding costs.

The Bank of England warned last month that homeowners were facing an annual increase of £3,000 to mortgage bills - exacerbating the cost of living crisis.

It is widely expected that policymakers in Threadneedle Street will raise Bank rate further - from its current level of 3.5% - in the first half of 2023 in a bid to maintain pressure on inflation.

Analysis from the Resolution Foundation think tank, released separately on Monday, suggested families had only experienced half the lost income they are expected to endure so far because of rising costs.

Myron Jobson, senior personal finance analyst at interactive investor, said: "Housing costs are going through the roof and are set to become even more expensive for many Britons in the coming months.

"Housing is the biggest expense for most households, so even a modest percentage increase in these costs could translate to a significant amount in pounds and pence terms.

"The climb in interest rates over the past year has marked the end of the golden era of cheap mortgages.

"Home loans have hit levels not seen since the financial crisis and the spectre of further hikes in the base rate is set to pile more misery on mortgage holders and wannabe homeowners alike at time when household budgets are reeling from the cost-of-living squeeze on finances."

A spokesperson for loan trade association UK Finance said: "Lenders stand ready to help customers who might be struggling with their mortgage payments, with a range of tailored support available.

"Anyone who is concerned about their finances should contact their lender as soon as possible to discuss the options available to help."