Layoffs 2023: Tech companies lead job cuts amid economic uncertainty

Layoffs are mounting as concerns of a weakening economy grow.

The tech industry has undeniably taken the biggest hit as companies try to feverishly cut costs after hiring too rapidly during the COVID-19 pandemic

However, job cuts have affected several industries – from media to Wall Street to the crypto world – in recent months. Recently, the growing list has included companies such as FedEx, Hasbro and Newell Brands, parent of Sharpie and Yankee Candle, proving that the slowdown is spilling outside the tech sector.

Despite the growing layoffs, the government offered up some optimistic news in regard to job growth in January. Employers added 517,000 jobs last month, the Labor Department said in its monthly payroll report released Friday. This topped the 185,000 jobs forecast by Refinitiv economists and marked the best month for job creation since July.

The unemployment rate, meanwhile, dropped to 3.4%, the lowest level since 1969.

Here are the major companies that laid off workers in recent weeks:

3M

Multinational conglomerate 3M announced on Tuesday that it will cut 2,500 global manufacturing roles after fourth-quarter profits plummeted due to a slowing economy.

"In a year impacted by inflation, global conflicts, and economic softening, our team took actions to position 3M for future success," CEO Mike Roman said.

Still, the company expects "macroeconomic challenges to persist in 2023."

Alphabet

Google parent company Alphabet Inc. announced that it plans to cut 12,000 jobs to weather the current economy.

Google CEO Sundar Pichai

Google CEO Sundar Pichai

CEO Sundar Pichai said the cuts affect teams globally, including recruiting and some corporate functions as well as some engineering and products teams.

Affected employees in the U.S. were notified by email, Pichai said in a blog post.

Pichai said he takes full responsibility for the decisions that led the company to this point.

"Over the past two years we’ve seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today," he said.

Amazon

Amazon said in early January that it would lay off more than 18,000 employees in what will be its largest workforce reduction to date. The company started cutting jobs on Jan. 18.

An Amazon Prime delivery van leaves a warehouse in Dedham, Massachusetts, on Oct. 1, 2020.

An Amazon Prime delivery van leaves a warehouse in Dedham, Massachusetts, on Oct. 1, 2020.

The layoffs mostly impact the company’s Amazon Stores division — which encompasses its e-commerce business as well as the company’s brick-and-mortar stores — and its PXT organizations, which handle human resources and other functions.

CEO Andy Jassy first warned employees in November that layoffs were on the horizon given the uncertain economy and the fact that the company rapidly hired over the course of the pandemic.

Dell

Dell announced on Feb. 6 that it plans to cut 6,650 jobs, or 5% of its global workforce, due to a drop in demand for its personal computers, according to a Securities Exchange Commission filing.

Dell's co-Chief Operating Officer Jeff Clarke said in a memo to employees that the company was facing market conditions that "continue to erode with an uncertain future."

Prior to the cuts, the company instituted cost-cutting initiatives such as pausing hiring and limiting travel, but said those are no longer sufficient.

Dow

Dow Inc. announced plans on Thursday to cut 2,000 jobs worldwide as part of a corporate restructuring plan to secure $1 billion in cost savings in 2023.

"We are taking these actions to further optimize our cost structure and prioritize business operations toward our most competitive, cost-advantaged and growth-oriented markets, while also navigating macro uncertainties and challenging energy markets, particularly in Europe," Dow CEO Jim Fitterling said.

FedEx

FedEx told employees in a memo on Feb. 1 that it is reducing its officer and director team by more than 10% and consolidating some teams and functions.

CEO Raj Subramaniam told employees that the cuts were necessary to "become a more efficient, agile organization."

"It is my responsibility to look critically at the business and determine where we can be stronger by better aligning the size of our network with customer demand," Subramaniam said. "While we have already taken many actions to that end, it was necessary to also look closely at the size of our leadership team and functions that could be consolidated."

Hasbro

Hasbro Inc. announced on Thursday that the company will cut 15% of its global workforce this year as part of an effort to substantially reduce costs and increase growth and profitability.

Hasbro CEO Chris Cocks said in a statement that the company's consumer products business "underperformed in the fourth quarter against the backdrop of a challenging holiday consumer environment."

The cuts, along with ongoing systems and supply chain investments, are slated to help the company save between $250 million and $300 million annually by the end of 2025, Hasbro said.

IBM

IBM announced large-scale layoffs on Wednesday.

CFO James Kavanaugh told Bloomberg the company plans to cut roughly 3,900 employees, about 1.5% of its workforce. The layoffs will mainly come from those still with the company after it spun off Kyndryl Holdings in 2021 and Watson Health in 2022.

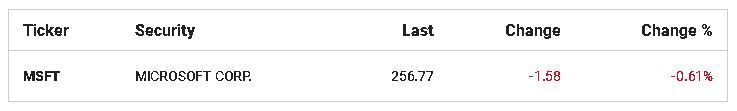

Microsoft

Microsoft announced on Jan. 18 that it's cutting 10,000 positions.

Microsoft logo in Los Angeles on Nov. 7, 2017.

Microsoft logo in Los Angeles on Nov. 7, 2017.

The move, which will take place at the end of the third quarter, is "in response to macroeconomic conditions and changing customer priorities," according to a filing with the Securities and Exchange Commission (SEC).

Newell Brands

Newell Brands announced on Monday that it will eliminate 13% of its office positions as part of a restructuring and savings initiative called "Project Phoenix."

The company's portfolio of well-known brands includes Rubbermaid, FoodSaver, Calphalon, Sistema, Sharpie, Paper Mate, Dymo, Expo, Elmer's and Yankee Candle.

"We expect to unlock significant savings from the restructuring initiatives, which should help partially offset the impact of macroeconomic pressures on the business, while making us a more nimble and agile organization," CEO Ravi Saligram said in a statement.

Okta

CEO Todd McKinnon told employees in Feb. 2 notice that the company was reducing its global workforce by 5%, which equates to about 300 employees.

McKinnon apologized to employees saying that a workforce reduction was "the last thing" he wanted to do.

"We entered fiscal 2023 with a growth plan based on the demand we experienced in the prior year," McKinnon said.

As a result, McKinnon said that the company overhired "for the macroeconomic reality we’re in today."

PayPal

PayPal CEO Dan Schulman told employees in a Jan 31. letter that the company will cut its global workforce by 7%, or approximately 2,000 full-time employees. The cuts will impact some organizations more than others, he added.

"Over the past year, we made significant progress in strengthening and reshaping our company to address the challenging macro-economic environment while continuing to invest to meet our customers’ needs," Schulman said.

Although the company has made "substantial progress" in right-sizing its cost structure and focusing its resources on its core strategic priorities, Schulman said more work needs to be done to better adapt to the current economic environment.

Rivian Automotive

The electric vehicle maker is cutting 6% of its workforce in order to lower costs.

In an email to employees, seen by FOX Business, CEO R.J. Scaringe said that the company is trying to focus its resources on ramping up production and reaching profitability amid the uncertain economic environment.

SAP

The software company said on Thursday that it is eliminating about 3,000 jobs, which amounts to about 2.5% of its workforce.

"This was a difficult decision, and we are deeply aware of the personal impact of these changes," the German company said in a statement. "We will provide colleagues the care and support they need during this challenging time."

SAP's full-year profits fell 68% last year compared with 2021.

Spotify

Spotify announced on Monday that it is planning to cut 6% of its global workforce in order to rein in costs.

CEO Daniel Ek said its operating expenses outpaced its revenue growth in 2022, which he acknowledged would have been impossible to sustain.

"Like many other leaders, I hoped to sustain the strong tailwinds from the pandemic and believed that our broad global business and lower risk to the impact of a slowdown in ads would insulate us," Ek said, adding that "in hindsight, I was too ambitious in investing ahead of our revenue growth."

Wayfair

Wayfair is also cutting its global workforce again.

The discount home retailer plans to shed 10% of its global workforce — or 1,750 jobs — as outlined in a Jan. 20 filing with the SEC. The move is part of ongoing plans to thin out management and become more agile in the current environment.

"In hindsight, similar to our technology peers, we scaled our spend too quickly over the last few years," CEO Niraj Shah said.

The Wayfair Inc. website on a laptop computer in St. Thomas, Virgin Islands, on Feb. 18, 2021.

The Wayfair Inc. website on a laptop computer in St. Thomas, Virgin Islands, on Feb. 18, 2021.

The company already axed 5% of its global workforce in August.

WeWork

WeWork announced on Jan. 19 that it is cutting its global workforce.

In order to continue to streamline operations and optimize its portfolio, the company said it is cutting 300 positions.

Workday

Workday announced in a Securities and Exchange Commission filing on Jan. 31 that it's cutting 3% of its global workforce.

The majority of the roles being cut are within its Product & Technology organization, according to co-CEOs Aneel Bhusri and Carl Eschenbach.

"As we navigate this uncertain environment, it’s important we help ensure Workday is set up for continued growth for many years to come," Bhusri and Eschenbach said in a joint statement. "This includes continuing to invest in the strategic areas of our business so we can capitalize on the opportunity in front of us; aligning our resources against business priorities; optimizing in certain areas so we can operate more efficiently; and prioritizing to meet customer and market demands."