‘It’s just the beginning’: Covid push to digital boosts big tech profits

Big tech is on a roll. In every minute of the first three months of 2021, Apple, Google owner Alphabet, Amazon, Facebook and Microsoft sold products and services worth about $2.5m (£1.8m) combined. Profits before tax for the period came in at $88bn – more than $1bn of profit for every working day.

After a year of shifting to online work and leisure across the global economy, financial results published this week by most of US tech’s biggest names were bound to be strong. But even more bullish analysts on Wall Street were surprised by how fast they raked in money in the quarter, auguring even greater profits in the years ahead.

Apple astonished investors with strong growth across its business, from iPhone buyers snapping up new models capable of using faster 5G mobile networks to the usually quieter business selling wearables such as headphones and watches.

Online advertising is booming. Facebook said demand is so high that the average price it charges for ads rose by 30% year on year – albeit compared with the start of pandemic. Alphabet revenues rose by a third year on year thanks to Google’s advertising business.

Alphabet was also helped by fast growth in cloud services, offering companies access to data centres – a business helped by the pandemic shift to working from home. Amazon’s cloud business added $1bn in profits compared with the previous year, even while profits from its core online retail business soared.

The Microsoft chief executive, Satya Nadella, said the shift to digital technology was “accelerating” as its profits jumped 31% year on year. “It’s just the beginning,” he added.

The strong results were not limited to technology’s biggest names: analysts also point to strong performances from smaller tech companies such as chip designer AMD or social networks Snap and Pinterest.

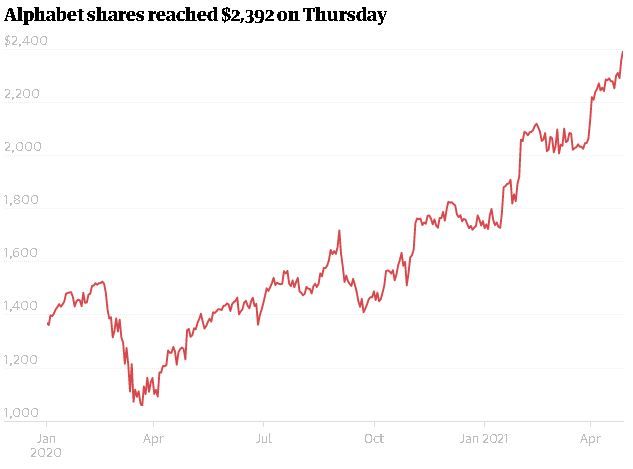

Share price gains left the big tech companies at all-time highs (barring Apple, which has the consolation of being the most valuable company in history). The gains reflected widespread investor agreement with Nadella’s thesis that the pandemic push to digital will benefit big tech.

The companies’ dominance is unprecedented in modern times. Daniel Ives, an analyst at Wedbush Securities, hailed record numbers for Apple, but argued that shares could gain another third to reach a $3tn valuation within 12 months. (Apple only reached the unprecedented $1tn mark in 2018, and $2tn in August.)

The scale of their balance sheets means they can rival countries on some metrics. Between them Alphabet, Apple and Microsoft spent $50bn on research and development in their 2018 financial years. That was equivalent to R&D spending by the whole UK economy in that year of £37.1bn, according to the most recent Office for National Statistics data.

Yet there appears to be only so much research and development that one organisation can do. One extraordinary aspect of the last week was the scale of share buybacks. Apple’s $90bn return to shareholders alone would be enough to individually buy almost all of the FTSE 100’s supposed behemoths.

Alphabet has scaled back some of its spending on famous “moonshot” programmes – such as the “Loon” effort to beam internet via high-altitude balloons – but even so it is ploughing money into technology that aims to push the boundaries of what computers can do. At the same time, it still judged that it had $50bn lying around to buy back shares.

There is more to come, argued David Donovan, a consultant at Publicis Sapient. His work upgrading technology at financial companies has convinced him that other sectors still have far to go in embracing digital technology, putting the economy “on the cusp of a major transformational period”.

Google owner Alphabet has cut back some of its spending on famous ‘moonshot’ programmes.

Google owner Alphabet has cut back some of its spending on famous ‘moonshot’ programmes.

Donovan added that the shift to recurring revenue models by companies like Amazon and Apple will add another moat to keep rivals out. More than 200 million Amazon customers pay for the privilege of buying products via its Prime service. Apple’s services business made revenues of $16.9bn in the first quarter, with more growth expected.

It might not all go smoothly. Martin Garner, the chief operating officer at CCS Insight, a market analysis firm, highlighted the groundswell of regulatory pressure, such as the European commission’s warning on Friday that Apple Music has broken EU competition law.

Big tech companies face another significant challenge: each other. There is large crossover in business models, whether it be advertising, cloud services or nascent targets such as in-car services. Apple’s battle with Facebook over privacy controls is the most striking cases of an open arm wrestle.

However, Alex DeGroote, an independent analyst, said that even at slower pre-pandemic growth rates there are such massive barriers to entry that it is difficult to see any way they will be dislodged. During last year’s market panic and the subsequent recovery tech stock gains have been nearly ever-present, suggesting a permanent shift is happening.

“The investment case has gone from defensive to growth in a year,” said de Groote. “The digital revolution is here to stay, and these businesses are embedded in our lives.”

Comments