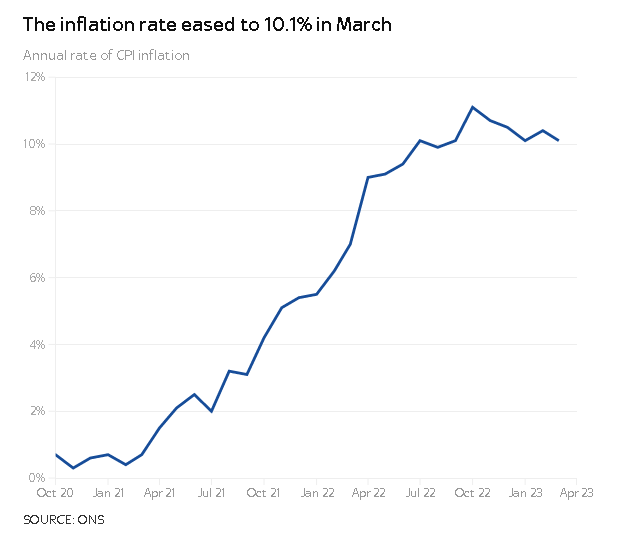

Inflation eases but still remains above 10% as food costs at 45-year high

The rate of inflation has eased slightly but still remains above 10%, according to official figures showing food and drink costs at a 45-year high.

The Office for National Statistics (ONS) said the consumer prices index (CPI) measure slowed to 10.1% in March from 10.4% the previous month.

Economists had largely expected a figure of 9.8%.

The data represents a slight improvement in the energy-driven cost of living crisis as fuel prices fell back to levels seen a year ago when Russia's war in Ukraine prompted a spike in oil costs.

However, upwards pressure remained from household gas and electricity and food, including essentials such as bread, milk and eggs.

Food and non-alcoholic drink inflation was measured at 19.1% by the ONS - the highest level since August 1977.

High commodity and production costs are mostly to blame.

Other factors behind the spike were highlighted in February's inflation data when the salad shortage struck supermarkets.

A crumb of comfort is that prices for goods such as tomatoes and cucumbers are tipped to fall sharply as the UK growing season gathers pace.

ONS chief economist Grant Fitzner said of the easing in overall inflation in March: "The main drivers of the decline were motor fuel prices and heating oil costs, both of which fell after sharp rises at the same time last year.

"Clothing, furniture and household goods prices increased, but more slowly than a year ago.

"However, these were partially offset by the cost of food, which is still climbing steeply, with bread and cereal price inflation at a record high.

"The overall costs facing business have been largely stable since last summer, although prices remain high."

The latest figures were released against a backdrop of hopes that a deceleration in inflation would allow the Bank of England to pause its action to battle inflation through interest rate rises.

It has raised Bank rates at 11 consecutive meetings since December 2021 in a bid to keep a lid on price pressures in the economy.

While policymakers can do nothing about things like energy - the main driver of the inflation crisis - the Bank can look to take demand out of the economy by raising borrowing costs.

It will have been encouraged by the easing in the headline rate of inflation.

But a separate measure closely watched by the Bank that strips out volatile price elements, known as core inflation, remained static at 6.2%.

Employment data released on Tuesday also showed that wages continued to creep upwards, albeit at levels well below CPI.

The Bank has previously expressed worries that wage rises seeking to combat the hit to household budgets from inflation, which have come into sharp focus during the winter strikes across the economy, risk stoking inflation ahead.

Financial market data suggested the chance of a 0.25 percentage point rise in Bank Rate at the next meeting, due next month, had risen from 80% to 95%.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, commented: "'The heat has been turned down on the bubbling cauldron of prices, but inflation is still scalding and interest rates look set to be pushed up again to try and cool it down rapidly.

"Instead of retreating below double digits, CPI is staying stubbornly high, causing more pain for companies and consumers."

Chancellor Jeremy Hunt said: "These figures reaffirm exactly why we must continue with our efforts to drive down inflation so we can ease pressure on families and businesses.

"We are on track to do this - with the OBR (Office for Budget Responsibility) forecasting we will halve inflation this year - and we'll continue supporting people with cost-of-living support worth an average of £3,300 per household over this year and last, funded through windfall taxes on energy profits."

Labour shadow chancellor, Rachel Reeves, said: "The question for families remains as real as ever - when will they feel better off under this Conservative government?

"And, why when the cost of living continues to bite, is the government refusing to freeze council tax this year, paid for by a proper windfall tax on oil and gas giants?"