How coronavirus has dented Gulf spending on luxury London homes

French buyers have bumped Arab homebuyers from the top of prime central London’s international buyer rankings.

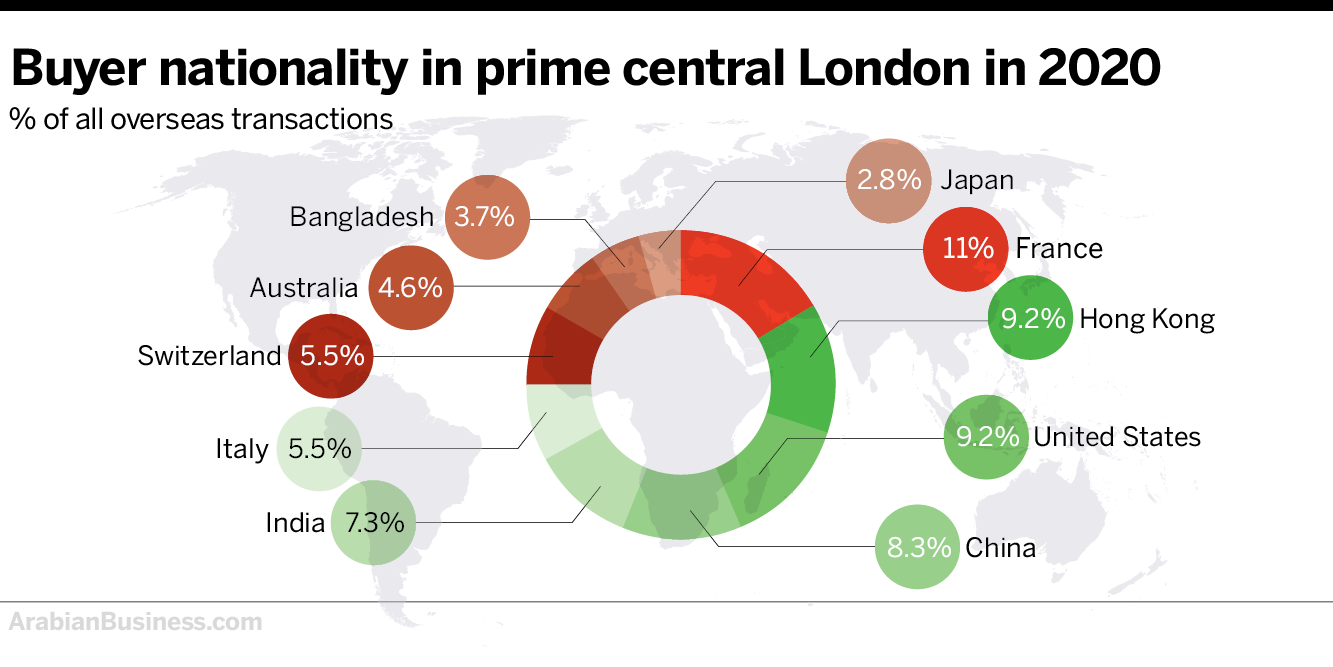

Purchasers from France made up the largest group of buyers in prime central London (PCL) during the first nine months of 2020, according to global property consultancy Knight Frank.

They accounted for 11 percent of all transactions involving overseas buyers, said the firm.

Gulf buyers did not even appear in the top 10 rankings for the months of January to September, Tom Bill, head of UK residential research at Knight Frank, confirmed to Arabian Business.

However, the property firm’s data for 2019 showed that Gulf buyers bought the most overseas PCL properties over the full year with UAE buyers (3.4 percent) and Kuwaitis (3.4 percent) prominent.

This data contrasts with January to September 2020 figures which show that just 2.8 percent of PCL buyers hailed from Saudi Arabia, and one percent from Kuwait and the UAE respectively.

“This type of buyer profile has never happened before,” said Bill.

“Given the unique circumstances and strict international travel restrictions on Gulf buyers, while the demand from that region is high, the actual transactions are lower as they can’t view the properties,” he said.

Tom Bill, head of UK residential research at Knight Frank

European property rush

According to Bill, despite the background noise of Brexit, there is ‘smart money’ in Europe targeting London.

He said: “The combination of a weak pound, a looming stamp duty hike and less competition from buyers who need to catch a long-haul flight has created a buying opportunity.”

Analysis of Knight Frank’s purchaser data highlights that Chinese buyers have dominated in recent years and accounted for 15 percent of overseas transactions in PCL between January and September 2019, while over the same period, French buyers represented just two percent.

UK buyers represent a larger proportion of overall sales in PCL in 2020, which are down by around a third in the first nine months of this year. They accounted for 59 percent of deals over the period compared to 47 percent last year.

Gulf travel ban barrier

Bill said that PCL properties would see more transactional activity from Gulf buyers once travel restrictions were lifted.

“The demand is there but there is a logistical barrier,” he said. “I don’t see this pattern being replicated next year; it’s only these unique circumstances that seen that profile change. I’d expect business as usual when travel returns as normal,” he said.

Hassan Basma, associate director, Middle East Desk at the London office for property firm Savills, said that virtual viewings could be used to stimulate transactional deal from Gulf buyers.

“I sold my first property to a Bahrain buyer this morning over Facetime. The place was worth $3.5 million,” he said.

Basma said while Gulf buyers traditionally prefer to buy properties face-to-face, the lure of the currency discount could nudge more investors to view PCL stock through virtual means.

“It’s definitely a logistical barrier. I predict more activity from Gulf buyers from now until the end of the year. There will likely be an increase in virtual tours

as Gulf buyers look to buy property before the international stamp duty into place comes early next year.”

Ultra luxury homes selling well

The streets of London’s most exclusive postcodes may have been much quieter than normal this year but their housing markets have been surprisingly active as buyers look to take advantage of the value in the market.

Transactions of homes with a £5m-plus price tag were 12 percent higher in the first three quarters of 2020 than in the same period in 2019, as this market segment recorded its strongest third quarter for five years.

“The international travel restrictions have meant less competition and more opportunity for those on the ground this summer,” said Frances Clacy, Savills research analyst.

“But the strength of the market this year to date perhaps indicates that activity is beginning to be brought forward to beat the stamp duty surcharge for non-resident buyers which is due to come into effect on April 1, 2021.

Savills anticipates that prime central London price growth for the 2020-2024 forecast period will total 17.5 percent.

Five things we learned:

1. Purchasers from France made up the largest group of buyers in prime central London (PCL) during the first nine months of 2020

2. Gulf buyers did not appear in the top ten rankings for UK PCL properties January to September 2020

3. Increased Gulf interest in PCL investment is yet to materialise into transactions

4. PCL properties will see more transactional activity from Gulf buyers once travel restrictions are lifted

5. Savills anticipates that PCL price growth for the 2020-2024 forecast period will total 17.5 percent