Higher earners in Scotland to pay more income tax

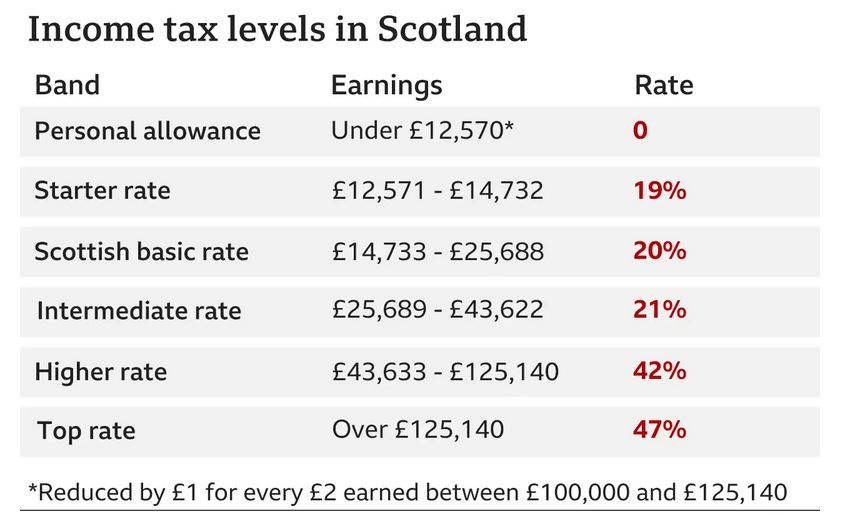

Deputy First Minister John Swinney said the higher rate of tax will increase from 41p to 42p in the pound in April, and the top rate from 46p to 47p.

The tax threshold for the top rate will also be lowered from £150,000 to £125,140.

This change has already been announced for other parts of the UK by Chancellor Jeremy Hunt.

Mr Swinney described the increase as an "extra penny to enable spending on patient care in our National Health Service".

And he said he was asking people to "pay their fair share" so they could "help to create the fairer society in which we all want to live".

But the Scottish Conservatives said making higher and middle earners in Scotland pay more more tax than their counterparts elsewhere in the UK risked undermining the country's potential for economic growth.

Scottish Labour said the extra money would be used to "fix some of the damage done by 15 years of SNP cuts and failure" and predicted that people will not accept rising tax bills "if all they see is further decline in services".

Mr Swinney had been due to deliver his budget statement at 14:30 - but Presiding Officer Alison Johnstone suspended the session for 30 minutes so she could investigate how details of the tax rises had been revealed by the BBC two hours earlier.

Ms Johnstone later allowed Mr Swinney to speak after receiving "categoric assurance" from him and First Minister Nicola Sturgeon that the information had not been shared by the government.

Income tax rates in Scotland, as well as several other taxes, are set by the Scottish government rather than at Westminster.

About 500,000 people in Scotland are in the higher rate bracket while a further 33,000 pay the top rate of income tax, according to the government.

The threshold for the 41p higher rate will remain frozen at £43,663 in Scotland - lower than the £50,271 elsewhere in the UK.

And there will be no changes to the rate paid by lower earners, with First Minister Nicola Sturgeon previously saying this would be counterproductive in a cost of living crisis.

The changes mean that everyone earning more than that threshold will pay more income tax than they did last year, and more than people earning the same salary elsewhere in the UK.

* Scots earning less than £27,850 will pay a maximum of £21.62 less tax than someone in the rest of the UK next year

* Someone earning £50,000 in Scotland will pay an extra £63.38 in tax compared with this year, and £1,552 more per year than someone on the same salary elsewhere in the UK

* Anyone earning £150,000 in Scotland will pay an additional £2,432.08 compared to this year, which will be £3,857 more than someone earning the same salary elsewhere in the UK

The increases are a significant departure from the SNP's manifesto aim not to alter income tax rates for the duration of this parliament.

Mr Swinney said that the changes will raise a total of £553m next year when taken alongside changes to other taxes including Land and Buildings Transaction Tax (LBTT) - the Scottish equivalent of stamp duty.

The second homes tax part of LBTT will rise from 4% to 6%.

The deputy first minister also confirmed an extra £550m for local government next year. Local authorities had been asking for much more, but will be given full flexibility to set their own council tax rates.

Mr Swinney said councils should "consider carefully the cost pressures facing the public" when deciding the rate they will charge people.

The Scottish Child Payment will remain at the increased level of £25 per child per week, with all other social security benefits under the control of the Scottish government being increased by the rate of inflation in September of 10.1%.

The chancellor had already confirmed that benefits and pensions paid by the UK government would also rise by that figure.

Spending on health and social care in Scotland will increase by £1bn, Mr Swinney said.

And funding of £20m that had been set aside for a referendum on Scottish independence will instead be used to help people at risk of fuel poverty.

The Supreme Court recently ruled that the Scottish government does not have the power to hold a vote without the formal consent of Westminster.

Meanwhile, the basic rate of business rates, which is also called the poundage, will be frozen at 49.8p. The intermediate property rate, at 51.1p, will be charged on properties with a rateable value of between £51,001 and £100,000. The threshold for the higher property rate will increase from £95,000 to £100,000.

Mr Swinney said the budget was being announced against the backdrop of the "most turbulent economic and financial context most people can remember".

He added: "War is taking place in Europe, leading to the suffering and displacement of millions of Ukrainians. As a result of the conflict, energy and fuel prices are surging. Inflation is now corroding our economy having reached a 40-year high.

"If these challenges - faced by countries around the globe - were not enough, the UK has added to the turmoil by a disastrous approach to Brexit which has damaged labour supply through the loss of free movement of people and undermined frictionless trade with our nearest markets.

"All of these difficulties have been compounded by the utterly catastrophic decisions of the UK government in the September mini-budget, which have driven increases in interest rates and saddled the country with much higher debt, undermining the public finances for generations to come."

Scottish Conservative finance spokesman Liz Smith said Mr Swinney should "stop blaming the UK government for every single predicament".

And she said she was concerned about the tax differential between Scotland and the rest of the UK, which she fears could make Scotland a less attractive place to work, live and invest.

Scottish Labour finance spokesman Daniel Johnson said: "The fact is that this money is going to have to be used to fix some of the damage done by 15 years of SNP cuts and failure.

"It is down to John Swinney to show how this money will be used to support our public services, and not to swell the ranks of spin doctors, quangos and apparatchiks."

John Swinney explains why he is asking higher earners to pay more in tax

The presiding officer suspended parliament to investigate how details of the tax rises were given to the BBC in advance of the budget statement