Global tax reforms that could raise billions edge closer as G7 on brink of agreement

The biggest reforms to the global taxation system in a century are edging closer to reality, with the group of seven leading industrial economies now on the brink of agreeing to a global minimum corporate tax rate, insiders have told Sky News.

The unprecedented plans could mean the UK raises billions of pounds in taxes from tech giants and other big companies which have previously shifted profits around the world to avoid them.

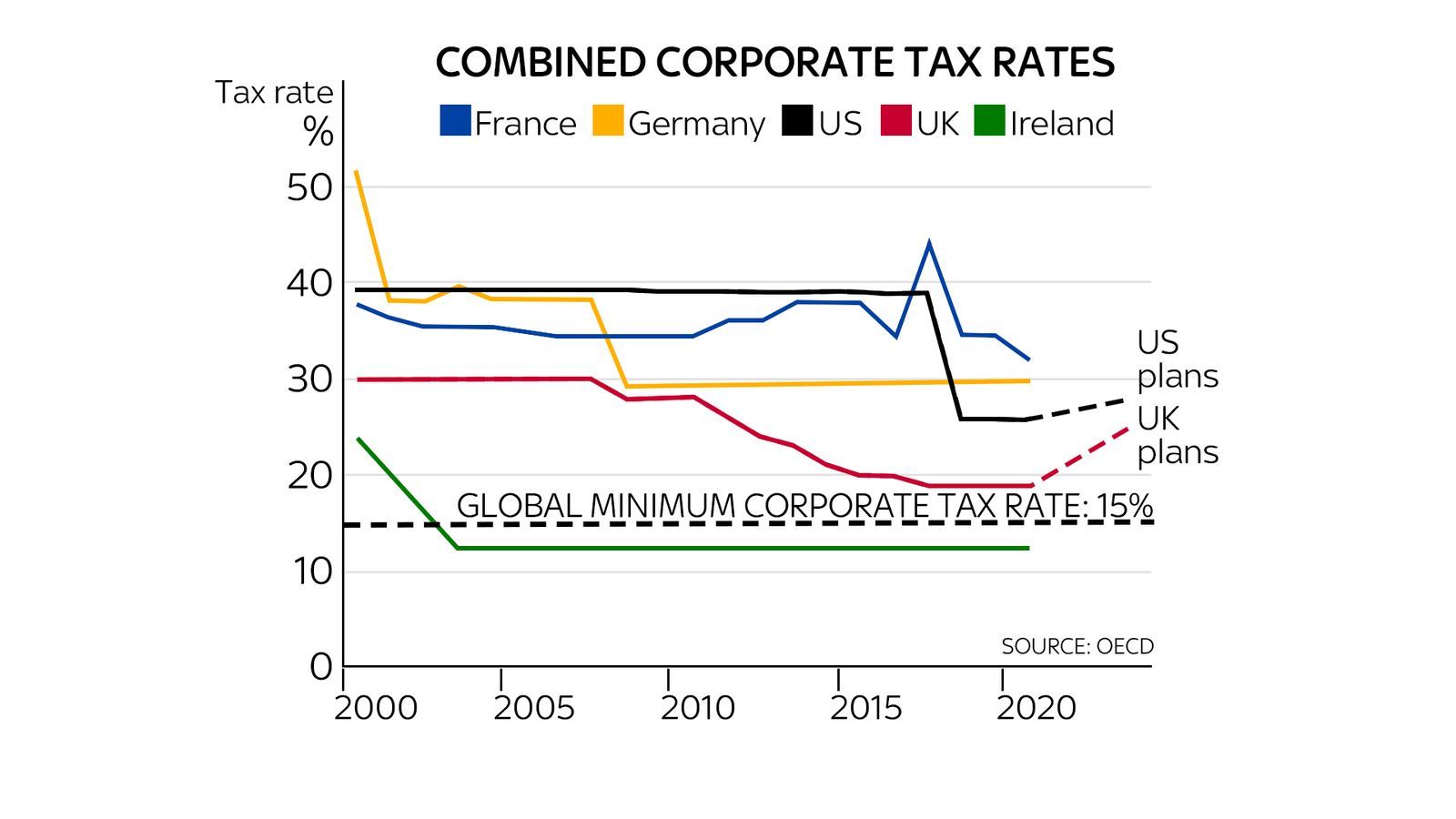

G7 finance ministers are expected to agree to keep their business tax rates above a certain level - likely to be 15% - at next week's meeting in London, according to insiders close to the discussions.

US Treasury Secretary Janet Yellen will attend the meeting in London

US Treasury Secretary Janet Yellen will attend the meeting in London

The radical shake-up is being pushed by US President Joe Biden, who has vowed to confront long-standing corporate tax avoidance by multinational corporations, which routinely shift their profits to low-tax countries in an effort to reduce their payments to governments.

He has pushed for the minimum corporate tax rate, though some countries are resisting.

Ireland's finance minister, Paschal Donohoe, told Sky News that he stands firm by the country's 12.5% tax rate and has "significant concerns" about Mr Biden's plans.

The UK's corporation tax rate is currently 19%, but is set to rise to 25% by 2023.

The G7 - which comprises the US, Japan, Germany, the UK, France, Italy and Canada - is now likely to agree a shared position at the London summit next Friday and Saturday.

"We think an agreement between the G7 to get a common position on this is possible at next week's ministerial," a G7 insider told Sky News, though they added that it was unlikely to come in tomorrow's virtual summit of ministers and central bank governors.

Agreement depends in part on the US committing to other global tax reforms, including an overhaul of how the taxes are calculated and apportioned between countries.

This represents a significant shift, as last week insiders were briefing that an agreement looked unlikely.

The chancellor, Rishi Sunak, had originally intended for the meetings to focus primarily on climate change rather than tax reform.

However, insiders say discussions on the tax will now play a significant part in the London meeting.

A Treasury spokesman said the UK was pushing for a deal at the London meeting, which US Treasury Secretary Janet Yellen will attend in her first foreign visit since being appointed.

But the spokesman said it was dependent on the US committing to the other proposals on international tax put forward by the OECD - the international government organisation leading the work on reform.

"Reaching an international agreement on how large digital companies are taxed has been a priority for the chancellor since he took office," he said.

"Our consistent position has been that it matters where tax is paid and any agreement must ensure digital businesses pay tax in the UK that reflects their economic activities.

Combined corporate tax rates

Combined corporate tax rates

"That is what our taxpayers would expect and is the right thing for our public services.

"We welcome the US's renewed commitment to tackling the issue and agree that minimum taxes might help to ensure businesses pay tax - as long as they are part of that package approach."

The UK currently raises around £400m from a digital services tax on the tech giants - something that has long frustrated the US.

However, insiders believe that the combined global minimum tax and reforms on calculating taxes owed would potentially raise billions for the UK, with the minimum tax dwarfing those other parts.

Should a deal be sealed, the UK would ditch its digital services tax.

Alex Cobham of the Tax Justice Network, which argued in favour of international business tax reform, said: "The G7 ultimately dictates the OECD negotiations, so the suggestion that agreement is close on a global minimum corporate tax rate is significant.

"Such is the low rate of tax actually paid by major multinationals at present that even imposing an effective rate of just 15% would potentially raise some $275bn in additional, annual revenues worldwide - arguably the biggest change in international tax rules in a century.

"The UK alone stands to receive up to $15bn of that - crucial funds to support public services and the pandemic recovery, and more than twenty times what the government hoped to raise from its digital services tax.

"But it is crucial that undertaxed profits are allocated to countries according to where multinationals' real economic activity takes place - otherwise the headquarters countries, starting with the US, will take a completely disproportionate share of the revenues.

"The UK should also push for a minimum effective rate of 25%, as the Independent Commission for the Reform of International Corporate Taxation has recommended."