Food prices will remain stubbornly high for a while but there is good news on inflation ahead

The government has made it its primary aim to halve inflation by the end of the year but things aren't quite going to plan.

Britain has shot up the leader board and now has western Europe's highest rate of consumer price inflation.

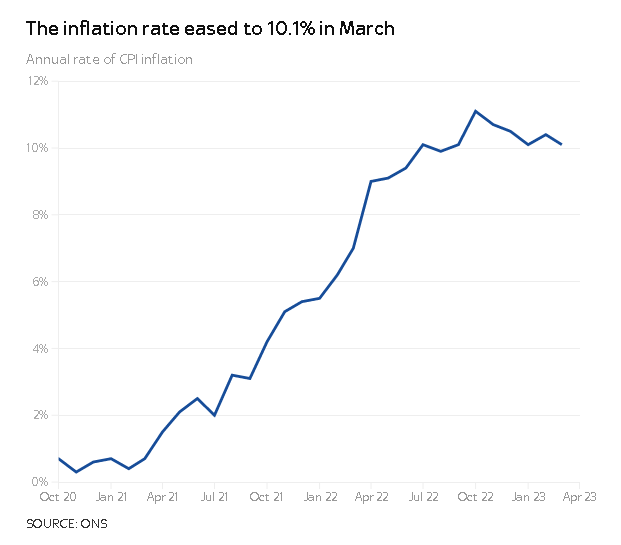

Economists were expecting the headline rate to fall from 10.4% to 9.8% in March but it only came down to 10.1%.

This may not seem hugely significant, but it has massively raised the prospect that the Bank of England will have to raise Bank rate again to help bring inflation down to target.

That doesn't come without pain. Higher interest rates increase the cost of borrowing, which inflicts a burden on those paying off their mortgages.

For renters, it raises the risk that landlords will pass on higher mortgage costs in the form of higher rents.

By raising interest rates the Bank is trying to dampen demand in the economy, which it hopes will help bring prices back down.

It is focusing on something called "core inflation".

This strips out volatile components like food and energy, which can swing wildly from month to month, and gives economists a better view of domestically generated inflationary pressure.

This remained stubbornly high at 6.2% in March. Economists thought it would come down.

Just last week it was still unclear whether the Bank would raise the interest rate from its current level of 4.25%.

However, the odds were raised on Tuesday, when official figures showed that wages were still rising robustly.

This is something policymakers pay close attention to because higher wages may force businesses to put up prices to cover their costs.

Wednesday's inflation figures have ratcheted up the odds once more. Financial markets believe there is now a 97% chance that the Bank will raise rates by a quarter of one percentage point to 4.5% in May. That is up from 82% yesterday.

Samuel Tombs, economist at Pantheon Macroeconomics, said: "The fall in CPI inflation in March likely is too modest for the MPC (monetary policy committee) to hold back from raising Bank rate one final time next month."

However, Inflation should start to fall more substantially now.

The headline rate should drop to 8% in April as energy prices continue to fall.

Wholesale gas prices have been falling consistently and are now lower than they were in February last year, before the war in Ukraine started.

According to the Institute for Fiscal Studies, this suggests that the average households' annual energy bill will drop to about £2,000 in July, from £2,500 at present, reducing energy's contribution to the headline rate to zero.

After hitting a new record of 19.1% in March, food price inflation should also start to slow.

Shipping, transport and packaging costs have been falling, which has filtered into slowing food producer output prices.

This means the rate of price growth for goods leaving warehouses and factories has been slowing. While price growth may slow, it will take longer for prices to come down from their current level.

James Smith, research director at the Resolution Foundation, said: "Headline inflation should fall sharply next month as the effect of last April's energy price spike falls out of the data.

"But the acceleration of food price inflation to nearly 20% is a major cause for concern, particularly for low-income families who spend a far greater share of their income on food than richer households."