Flush With Cash, Saudi Prince Snubs Biden And Sends A Message

President Joe Biden sounded deeply frustrated. Inflation was heading toward a 30-year high and Americans, rich and poor, could see the price of gasoline going up almost daily. Politically, oil was toxic for the White House.

"The idea that Russia and Saudi Arabia and other major producers are not going to pump more oil so people can have gasoline to get to and from work, for example, is not right," Biden said in late October.

First in private and later more publicly, American envoys had spent weeks trying to convince the Saudis to pump more crude -- and quickly, according to officials on both sides. The diplomatic pressure was ultimately directed at a 36-year-old man who has the capacity to change the price of oil -- and the fortune of politicians in consuming nations -- on a whim: Saudi Crown Prince Mohammed bin Salman.

But the kingdom's day-to-day ruler didn't budge despite the overtures from American diplomats. Prince Mohammed was more worried about oil's supply and demand fundamentals than the political needs of Washington. But if Biden wanted cheaper gasoline, the prince had his own wish list, including something he hasn't yet got from the current White House -- access.

Since taking office, Biden has only spoken with King Salman, Prince Mohammed's father, and refused to deal directly with the crown prince, who's still seen as a pariah in the U.S. after the killing of Washington Post columnist Jamal Khashoggi in 2018.

"There's a lot of Middle Eastern folks who want to talk to me," Biden said in October, without directly naming Prince Mohammed. "I'm not sure I'm going to talk to them."

Ultimately, Biden didn't get the extra oil he wanted, forcing him to respond on Tuesday by tapping the country's strategic petroleum reserve -- a decision that risks a further escalation from the Saudi-led OPEC+ cartel.

For Prince Mohammed, sitting atop what's sometimes described as the central bank of oil, soaring crude prices are giving him the confidence to demand the attention of Biden, and everyone else. The influx of cash also helps his plan to make the kingdom a global investment powerhouse through the $450 billion Public Investment Fund, the sovereign wealth fund which he also chairs and wants to grow to $1 trillion by 2025.

In early 2020, Saudi Arabia was staring into the abyss. The pandemic led to a crash in oil prices forcing it to hike taxes and boost its borrowing. Now, just over a year later, oil prices and Saudi crude production are booming, helping restore the kingdom's finances with a wave of petrodollars, replenishing state coffers, and boosting the prince's standing at home.

"Saudi Arabia is in a strong position," said Jason Bordoff, dean of the Columbia Climate School and a former senior White House energy official under President Barack Obama. "Oil demand is going up, not down; U.S. shale is not what used to be, and for the foreseeable future the world is going to need more Saudi oil."

In interviews with former and current western and Arab government officials, diplomats, consultants, bankers and oil executives, a picture emerges: Riyadh is coming out of the Covid crisis stronger, both politically and economically. The officials agreed to speak only under condition of anonymity to discuss private interchanges.

The Saudi resurgence is linked to the world's thirst for fossil fuels. Despite the fight against climate change, the world economy is as addicted to oil as it was before the pandemic. Global consumption is now back to about 100 million barrels a day, a level last seen in 2019.

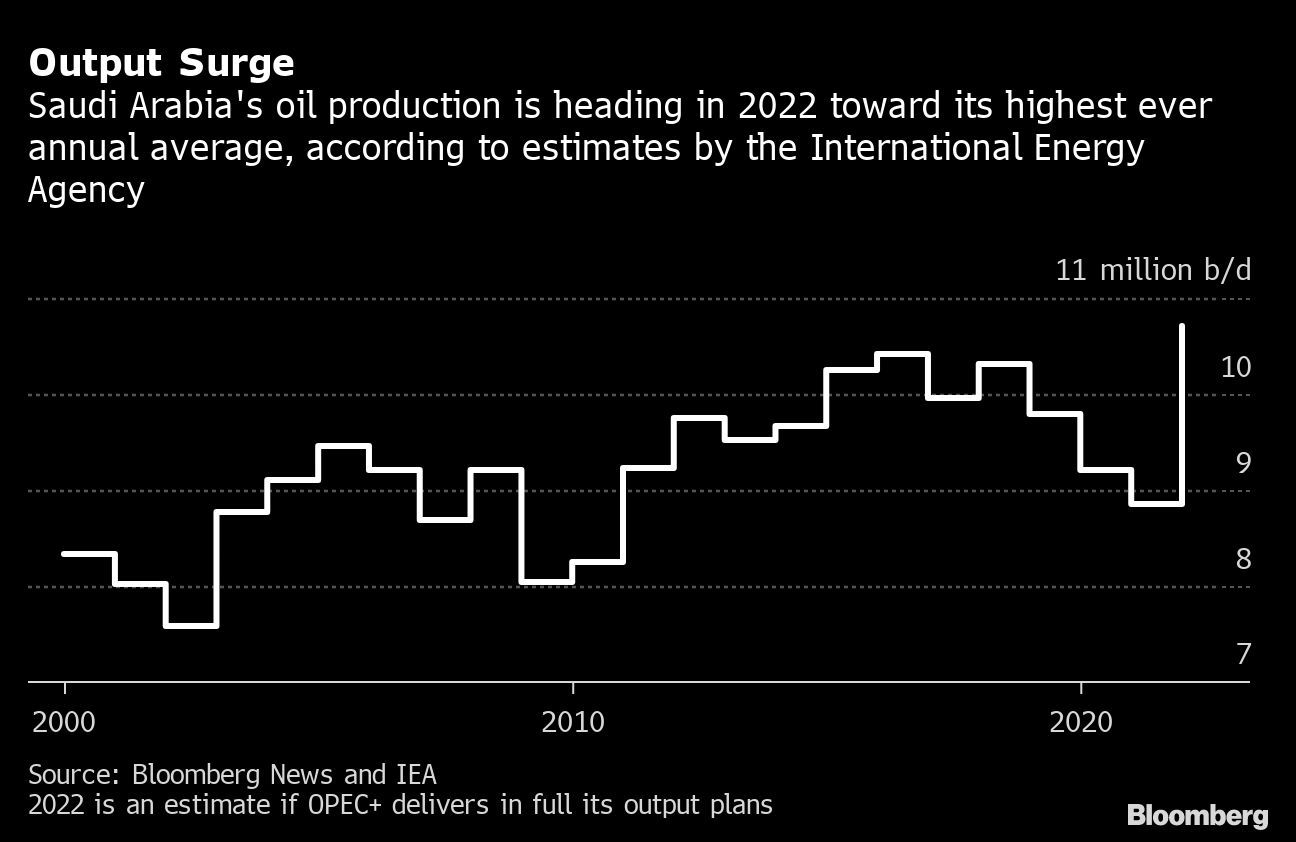

Despite the release of strategic reserves on Tuesday, Brent crude, the global oil benchmark, has climbed back above $80 a barrel and Saudi oil production will hit 10 million barrels a day next month, well above pre-Covid levels.

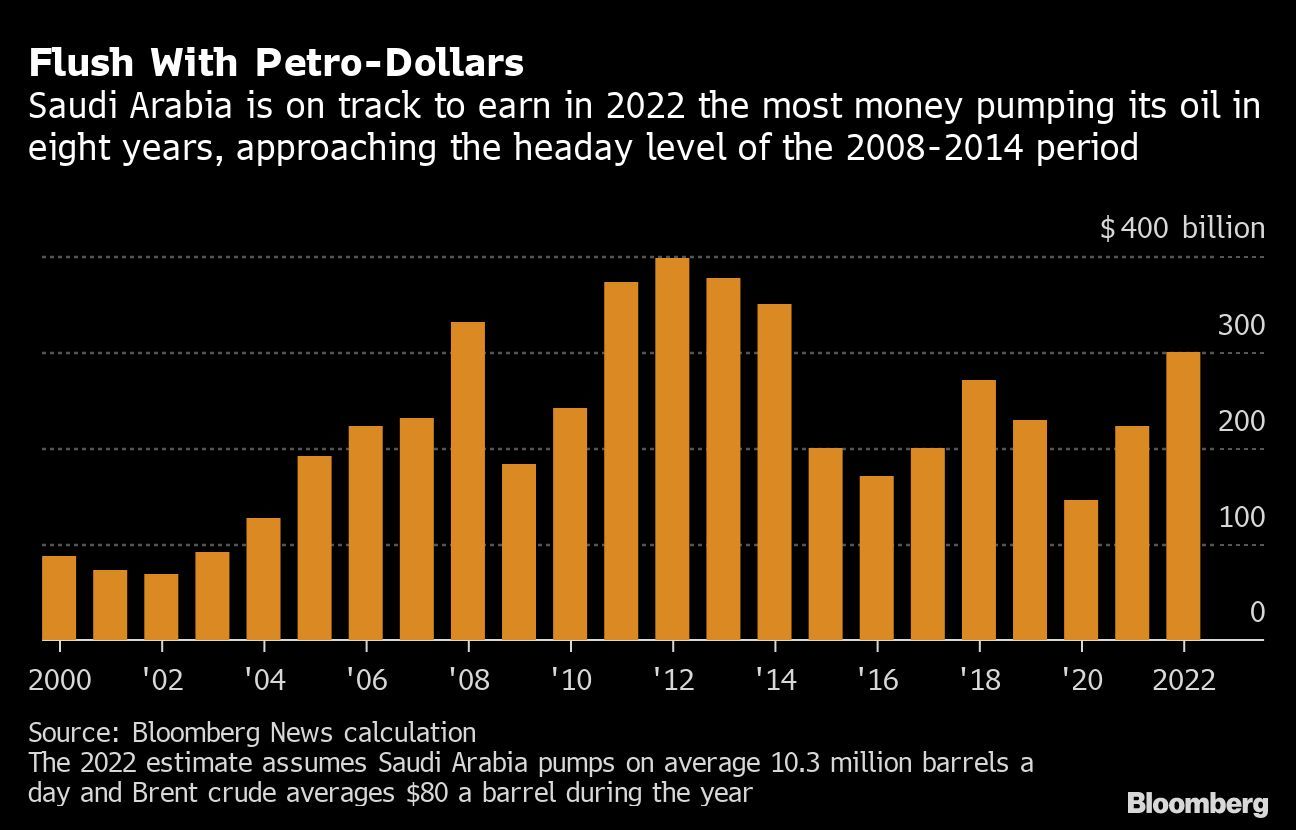

If oil prices and Saudi output stay at current levels, the kingdom's gross oil revenues will top $300 billion in 2022, according to Bloomberg News estimates putting Riyadh on track to enjoy one of its best ever years. It could be even better. The International Energy Agency believes Saudi oil production may average 10.7 million barrels a day in 2022, the highest ever annual average.

Higher oil prices have "strengthened Saudi Arabia's position both financially and politically," said David Rundell, a former U.S. diplomat with decades of experience in the kingdom. "Mohammed Bin Salman's position will become even more secure."

Only a few years ago, the situation was very different.

The prince rose to power after his father King Salman was enthroned in January 2015. Initially as Deputy Crown Prince, and since 2017 as Crown Prince, he inherited a sclerotic economy in a financial mess.

And America was the reason for lots of the Saudi problems. With the support of Wall Street, the U.S. shale boom had transformed oil's balance of power. Texas, and not Riyadh, was in the driving seat of the energy market.

Months before Prince Mohammed rose to power, oil prices crashed under the weight of booming U.S. production. Brent crude plunged from $115 a barrel in June 2014 to $45 a barrel by the time that he'd followed his father into the royal palace in January 2015, and ultimately less than $30 a barrel by early 2016. Saudi Arabia was bleeding money.

Prince Mohammed reacted by cutting spending and launching Vision 2030, a program to restructure the Saudi economy. For a while, Saudi fortunes improved as prices recovered in 2017 and 2018. It helped that Prince Mohammed opened up the formerly closeted economy and removed bans on cinemas and women driving, injecting more of the 21st century into Saudi society. But Khashoggi's death in October 2018 burst the bubble of optimism. A U.S. intelligence report released by the Biden administration concluded that Prince Mohammed probably ordered the killing, a charge Saudi Arabia denies.

After being feted by Western leaders and the heads of some of the world's biggest firms, Prince Mohammed was quickly dropped. Then, oil prices tanked in early 2020 after Covid first struck China and then the world. Saudi Arabia only survived those bad years by running down its stock of petrodollars and borrowing billions to finance widening fiscal deficits. The reserves fell from a peak of nearly $750 billion in mid-2014 to a low of $437 billion earlier this year. Since, it's recovered to $465 billion.

With oil production and prices rising, the outlook has quickly improved. The royal palace planned for a budget deficit of 140 billion riyals ($37 billion) in 2021, but at the end of the third quarter, the shortfall was a mere 5.4 billion riyals, raising the prospect of balancing the books well ahead of a 2023 target. The Finance Ministry declined to comment on whether it expected to balance the budget this year, as some analysts now expect.

"Our economic diversification initiatives are continuing and will be expedited with more resources available," a spokesman said in a statement. Spending targets and taxation rates won't change, but any surpluses will either repay debt or get transferred to one of the kingdom's sovereign wealth funds.

The influx of petrodollars will help Prince Mohammed to spend at home handsomely. The government and sovereign wealth fund, which the prince also chairs, have outlined trillions of dollars of spending on everything from vast new cities in the desert to upgrading the kingdom's creaking infrastructure in a bid to make it a finance, trade and logistics hub for the Middle East.

"Higher oil prices are good for the economy, but not in the old way," said Mazen Al Sudairy, head of research at AlRajhi Capital. In the past, higher oil prices helped the Saudi government fund things like hiring sprees of civil servants to keep unemployment down. Now a surplus is less likely to go into "sticky" spending measures and instead focus on enhancing reserves.

In a bid to put the kingdom, and himself, at the center of regional politics, over the past year he's also patched up a dispute with Qatar and made overtures to arch enemy Iran. In addition to seeking recognition from Biden, the Prince also wants more U.S. help ending the long and expensive war in Yemen. He'd also like more military support to defend itself from drone attacks like the one that knocked out half its oil processing capabilities in 2019.

For all the improvement, the Saudi economy is still heavily reliant on oil. Vision 2030 has made so far only modest progress, and critics believe that many of Prince Mohammed's pet projects, including an entirely new city in the desert called Neom, are white elephants that consume billions of dollars but return little. If the oil market takes a turn for the worse, perhaps because new flare ups of coronavirus cases, Riyadh would be in financial trouble again.

For the time being, however, Saudi Arabia appears to be safe. Its oil alliance with Russia looks stronger than ever, putting Riyadh firmly in control of the market, in part thanks to the guidance of Prince Mohammed's half-brother, Energy Minister Prince Abdulaziz bin Salman.

"The Saudis feel they are on the driving seat of the oil market," says said Helima Croft, commodities strategist at RBC Capital Markets LLC and a former CIA analyst.

Over the last few months, OPEC+ has actually increased output as demand recovers. But Riyadh has made sure the cartel boosted production more slowly than demand recovered, in the process draining global inventories, and lifting prices.

Inventories of crude and refined oil product in industrialized countries have fallen now below 2.8 billion barrels, hitting their lowest level since early 2015. "The world oil market remains tight by all measures," the agency said in November.

Still, Biden has continued to refuse to speak to the Crown Prince, widely known as MBS, despite his desire for lower oil prices to bring down inflation. The refusal has continued even after Saudi Arabia announced its most ambitious green target ever, saying it will reach net-zero emissions by 2060.

"Whatever the U.S. is offering MBS in return, it is just not enough to persuade him to pump more oil," said Neil Quilliam, associate fellow in the Middle East and North Africa program at the London-based think tank Chatham House. "The U.S. has to offer something big to get the Saudis to change course - and that must include a bilateral meeting between Biden and MBS."

But Prince Mohammed hasn't just rebuffed its American ally. Riyadh has argued that OPEC+ is already adding enough crude into the market, in the process rejecting pleas from China, India and Japan for more oil. President Biden and his Chinese counterpart, Xi Jinping, discussed the problem in November during a virtual summit, and agreed to work together to stabilize energy markets.

The following week the U.S. was joined by Japan, India, South Korea and the U.K. in a coordinated release of reserves. China is expected to follow suit.

Saudi officials paint a different version of the energy landscape. While the oil market is tight today, it will loosen significantly from January onward. They argue higher prices are driven by market fundamentals and the biggest shortage is for natural gas and coal.

"Oil is not the problem," Prince Abdulaziz, the energy minister, said after the last OPEC+ virtual meeting in November. "The problem is the energy complex is going through havoc and hell."

Prince Abdulaziz will chair an OPEC+ virtual meeting next week, which will deliver the cartel's response to Biden's use of the strategic petroleum reserve. A lot will depend on whether oil keeps rising beyond $80 a barrel, but OPEC+ can counteract the release by delaying further output hikes.

In October, the who's who of global finance gathered at the Ritz Carlton hotel in Riyadh, granting Prince Mohammed a standing ovation. It was the very same hotel that Saudi authorities turned four years ago into a makeshift prison when it launched what it described as an anti corruption drive that ensnared some of the country's wealthiest people.

The investment summit, which promotes the Saudi wealth fund as a global dealmaker, comes at a time when Riyadh is recycling its newly found oil wealth into trophy assets overseas. The PIF, as the fund is known, recently bought Newcastle United, the British Premier League soccer club. The takeover helps to re-brand the kingdom's austere image as it aims to attract foreign investment and tourists. Earlier this year it took a stake in supercar maker McLaren and secured a deal to bring Formula 1 to the country.

"MBS needs to use today's bonanza to secure Saudi Arabia's economic future by moving as fast as possible into non-oil economic sectors," said Jim Krane, research fellow at Rice University's Baker Institute. "When the oil rents pour in, it's easy to buy extra political support," making the investments the kingdom needs to make to get ahead of "a damaging energy transition," Krane said.

Surviving that transition "is going to be the Saudi mantra," he said. "High oil prices are just the ticket to get this process rolling."