Fed sees credit drawdown looming, shifts towards pause on rate hikes

Banks either hit with sudden deposit outflows or worried about them may become steadily more reluctant to lend to businesses and households, a risk that prompted the U.S. central bank to reset its own expectations for monetary policy as it waits to see how far any contraction of credit may spread and how long it may last.

"We'll be looking to see ... how serious is this and does it look like it's going to be sustained," Powell said at a news conference following the conclusion of the Fed's latest policy meeting. "It could easily have a significant macroeconomic effect, and we would factor that into our policies."

The Fed's policy-setting committee raised interest rates by another quarter of a percentage point in a unanimous decision on Wednesday, lifting its benchmark overnight interest rate to the 4.75%-5.00% range.

But in doing so it recast its outlook from a hawkish preoccupation with inflation to a more cautious stance to account for the fact that changes in bank behavior may have the equivalent impact of the Fed's own rate hikes - perhaps just a quarter of a percentage point, but possibly far more than that.

Fed officials still feel that "some additional policy firming" may be needed, and they penciled in one more quarter-of-a-percentage-point rate increase by the end of the year.

But the more conditional language, replacing a promise of "ongoing increases," amounted to a seismic shift driven by the rapid failure this month of California-based Silicon Valley Bank (SIVB.O) and New York-based Signature Bank (SBNY.O), as well as the Swiss-engineered rescue of Credit Suisse.

U.S. officials across several agencies have been coping with the fallout, debating what new rules or regulations might be needed and whether changes are needed to the U.S. deposit insurance program - a systemwide backstop that failed to stem a deposit run at SVB.

The policy statement and Powell's remarks to reporters also showed Fed officials' rising attention to credit dynamics, something that could actually help them in the fight to tame inflation as long as any changes to the flow of loans does not become disorderly and that more bank failures are not in the offing.

"Financial conditions seem to have tightened and probably by more than the traditional indexes say because ... they don't necessarily capture lending conditions," Powell said. "The question for us is how significant will that be?"

Powell on Wednesday repeatedly voiced confidence in the stability of the U.S. financial system, noting that "deposit flows in the banking system have stabilized over the last week," and that SVB collapsed because "management failed badly," not because of generic weaknesses in the banking sector.

Still, the Fed chief said the collapse showed a breakdown of central bank supervision that needed to be fixed, and was being studied in a review due to be completed by May 1 under the direction of Michael Barr, the Fed's vice chair for supervision.

Yields on Treasury securities dropped following the release of the policy statement. The yield on the 2-year Treasury note , which is highly sensitive to Fed rate expectations, was down more than 21 basis points in the session.

U.S. stocks, which initially surged after the release of the policy statement, fell through the afternoon, with the benchmark S&P 500 index (.SPX) closing 1.6% lower. The dollar (.DXY) weakened against a basket of major trading partner currencies.

'SPOOKED'

The outcome of the policy meeting puts the Fed likely near the end of an aggressive series of rate increases that have dominated financial headlines for a year as the central bank tried to lower inflation from the 40-year-highs hit last summer to its 2% annual target.

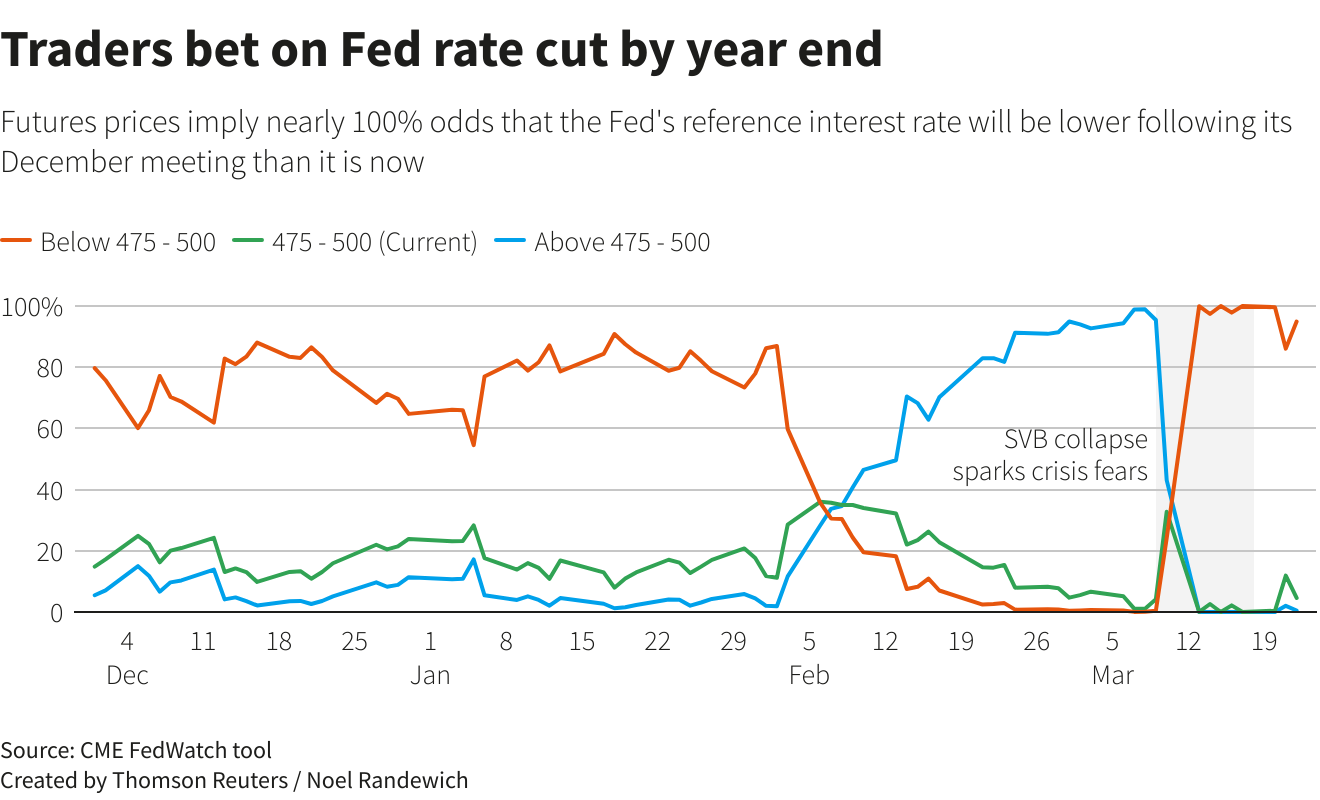

Financial markets went a step further, betting that the Fed won't raise rates any further from here and will be reducing them by this summer.

"That's not our baseline expectation," Powell said in the news conference, adding that "the key is we have to have policies tight enough to bring inflation down to 2%," whether that comes from a higher Fed policy rate or market conditions that tighten on their own.

Still, the turmoil will likely take a toll on GDP growth and the economic outlook.

New economic projections from Fed officials see the unemployment rate rising nearly a full percentage point in the remaining months of the year, to 4.5% from the current 3.6%, with inflation falling only slowly and growth in gross domestic product downgraded from an already sluggish 0.5% to 0.4%.

"The Fed has been spooked by Silicon Valley Bank and other banking turmoil. They certainly point to that as a potential depressant on inflation, perhaps helping them do their job without having to raise rates as aggressively," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder.