Energy crisis: European gas storage levels at record highs - and it suggests good news for supplies

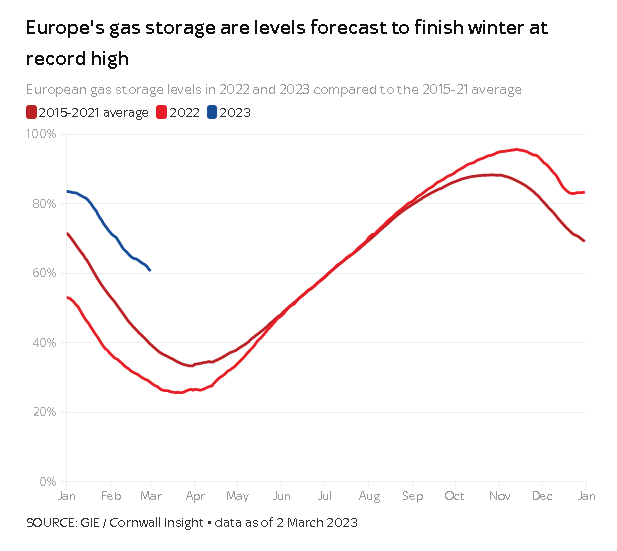

Energy costs could come down as European gas storage facilities are expected to end the winter season at a record of more than 50% full.

Modelling done by energy consultancy Cornwall Insight suggests gas supplies are secure after concerns of shortages following Russia's invasion of Ukraine.

Fuller storage units mean less future demand for gas, which can bring down prices.

Storage facilities across Europe will end winter between 45% and 61% full - an average of 55% capacity - bypassing the previous end of winter record of 54% in 2020.

Following the start of the conflict in Ukraine, European countries raced to reduce their reliance on Russian gas, which pushed up prices and led to concerns about energy supplies in winter 2022 to 2023.

Having a greater amount of gas in storage means more is ready for winter 2023-2024 and less needs to be bought, leaving supplies more secure than in 2022.

It is a doubling from last year.

On 31 March 2022 just 26% of European storage facilities were filled, according to data from Gas Infrastructure Europe.

There was concern that the lights could not be kept on amid gas shortages. In the UK the National Grid's Electricity System Operator had warned in October that planned three-hour power blackouts could be imposed in the event of gas supplies falling short of demand.

To reduce energy demand and cope with potential shortages, EU countries formally agreed a voluntary 10% cut in gross electricity consumption and a mandatory reduction of 5% during peak use hours.

But high gas storage levels this year do not mean prices will drop to lows seen at the end of previous high storage-level winters.

Despite the "considerably more positive" forecasts, the lead research analyst at Cornwall Insight said he was cautious about saying Europe is over the worst of the energy crisis.

"Any single factor can influence the pace and pattern of storage refill, and perhaps more pertinently, change the cost paid to achieve it," Dr Matthew Chadwick said.

"We are certainly not out of the woods yet."

Factors that could bring up energy costs include weather, US exports, Chinese demand and Russian supplies.

While a mild winter helped preserve gas stocks, a summer with heatwaves would bring energy demand for air-conditioning and fans.

Imports of US liquified natural gas in the second half of last year rose significantly as reliance on Russian gas waned. Going forward, however, the US is under domestic pressure to protect consumers from price rises, which could mean less exported to Europe.

Russian gas is still relied on by Europe and will continue to be needed.

The reopening of China, following nearly three years of lockdown restrictions, and the associated economic growth will impact energy markets, the Cornwall Insight report said, though the impact is uncertain.

For those looking to hear good news about bills, Dr Chadwick is not the barer.

"Whatever the outlook for storage levels, the need to compensate for Russian pipeline volumes with expensive and volatile liquified natural gas will keep gas bills higher," he said.

"This, at least for now, is the "new normal", and consumers and economies should prepare for energy costs to remain higher than before the pandemic, and the Ukraine war, for some time to come."

Households can expect prices to be "more muted" than last year, Dr Chadwick said, as the panic from the Ukraine war outbreak subsides.

"What may ease this year is the heightened level of understandable panic that led to hectic energy-buying practices during the autumn of 2022.

"As a result, we can probably expect prices to be much more muted than 2022, despite any uncertainties that may come into play."

Gas storage facilities in the UK include Rough, a facility reopened this year off the Yorkshire coast, and the Stublach onshore facility in Cheshire.