Do you live in one of London’s top-selling postcodes?

Almost two-thirds of London can be classified as being in a buoyant sellers’ market, despite the third national lockdown and slow easing of restrictions — as set out in the Prime Minister’s roadmap this week.

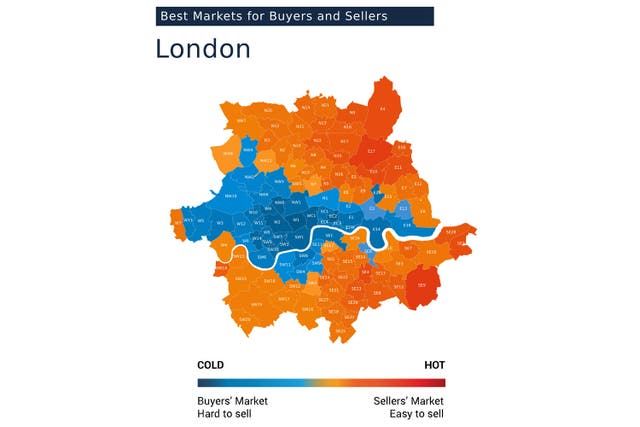

According to new research exclusive to Homes & Property, 61 per cent of postcodes are in a hot sellers’ market with more buyers than properties up for sale, making it easier to flog a home fast.

The analysis by house-selling advice website The Advisory (theadvisory.co.uk) is based on the number of homes sold versus the number advertised per area, this is up from 39 per cent last July to 61 per cent in January.

Its new online heat map, PropCast, reveals which London areas are hot and which are not.

Sellers stall until spring

Following a frenetic 2020, sellers stalled this January. Lots of factors meant people were less likely to conduct viewings: increased rhetoric from the Government on the new variants of the virus, a well-publicised stricter stance by law enforcement to stop people breaking lockdown rules and children being at home.

Bad weather has also pushed some vendors to wait until the spring to launch their homes.

However, on the flip side, Savills reported record numbers of new buyer registrations in January, stoking the demand-supply imbalance.

“If the first lockdown has anything to teach us it’s that buyer demand does not diminish in the lockdown, it just gets deferred and concentrated, causing a further spike when restrictions are lifted,” says Gavin Brazg, founder of The Advisory.

First-time buyers look for family homes

The number of families who moved out of inner London to the outskirts last year opened up stock for first-time buyers, according to Rebecca Stott, advisor to first-time buyers and FoundIt London creator.

For Stott, the busiest price has been about £600,000 as her clients, with help from the bank of mum and dad, try and find a family home rather than the typical first-time buyer flat.

She claims that the market has become very property specific. “Gone are the days that a buyer would purchase in an up and coming area knowing that they could sell after a few years, make a profit and upsize up the ladder, she explains.

“Priorities now are private gardens and rooms that can switch purposes easily. “Even a side gate directly into the garden — in this pandemic era — is really sought-after and can kick start a bidding war,” Stott says.

However, the dash to the home counties by families after the first lockdown has moderated this year, meaning there is more demand than homes for sale.

London’s winter hotspots

Hot property: this map shows the London areas in highest demand

Hot property: this map shows the London areas in highest demand

The PropCast map reveals that the hottest areas with the highest demand are the south-east and north-east clusters, led by Walthamstow.

On the north side of the Thames, the hottest clump stretches up either side of the Lea Valley, including Tottenham, Hackney, Highbury and Islington, and Walthamstow.

The south-easterly band of postcodes identified on the map runs from Woolwich down to Eltham, across to Camberwell and down to the outer edges of Crystal Palace. It includes the likes of leafy Dulwich and the more urban Lewisham.

The coolest areas track the Thames in central London, stretching out east and west with Westminster and Holborn at the bottom of the ranking.

Here we explore 10 of the hottest enclaves across the capital before the property market hits the spring.

Walthamstow and the Lower Lea Valley

In the valleys: along the River Lea Navigation in Walthamstow

Walthamstow offers better value for money than central east London and the best properties sell within four weeks, according to Saima Razaq of Foxtons.

The average two-bedroom Victorian terrace in Walthamstow Central can cost the same as a two-bedroom flat in Islington, Shoreditch or Stoke Newington.

“Walthamstow offers diversity and lifestyle at a reasonable price. Residents arrange street parties in more normal times and there are many coffee shops and restaurants,” says Razaq.

“Our typical buyers are young couples who are selling their flats in the City and buying houses here. We also have a lot of first-time buyers who are typically moving from renting in areas such as Hackney, Dalston and Brixton where buying is not an option for them,” she adds.

To the south of Walthamstow, the formerly-industrial Lower Lea Valley is one of London’s biggest regeneration zones.

A report published earlier this year by consultancy JLL calculated that 105,300 new homes will be delivered in the basin by 2040, with 23,500 to be built within the next five years.

The new residential tower Motion has shared ownership homes over 17 floors and is part of the Lea Bridge and Leyton regeneration masterplan.

Two and three-bedroom apartments are available in the building from £130,000 for a 30 per cent share (peabodysales.co.uk).

Highbury and Islington

£875,000: this two-bedroom flat on Islington’s Theberton Street, through

£875,000: this two-bedroom flat on Islington’s Theberton Street, through

Foxtons’ agent Stuart Harris has noticed the rush to complete before the end of the stamp duty holiday on his patch. “But even though it would be potentially difficult for users to now complete to meet that deadline, we are still continuing to see high numbers of new buyer registrations,” he says.

On average, a one-bedroom period conversion flat would cost £400,000 to £550,000 and a two-bedroom property from £550,000 upwards. A traditional Victorian family home will start at about £1.1 million.

The redevelopment of the old Arsenal stadium is attracting young professionals to the area and transport links are another draw, says Harris.

The 29-acre Highbury Fields is the biggest park in the area and has tennis courts and Highbury swimming pool.

Central Hackney

£250,000: Claudia Valcaral, 37, and David Norman, 36, bought a 50% share in a resale flat at Hackney’s Pembury Place

Mare Street runs from Hackney Central down to Bethnal Green. The area became industrialised after the Second World War and lots of the original dwellings were lost.

New build infill schemes are popping up now for first-time buyers, such as No.9 Pemberton Place which has one, two and three-bedroom apartments starting from £540,000.

In normal climes, that stretch of Hackney is buzzing and has a foodie scene. Even during the lockdown, take-away coffee, wine and pizza are available at Mare Street Market.

There is a fashion and retail industry cluster too of textiles businesses and independent boutiques that have sprung up around the London College of Fashion site. Hackney Picturehouse and Hackney Central Library add to the cultural quality with London Fields, Regent’s Canal and Victoria Park all a short walk away.

First-time buyers Claudia Valcaral, 37, and David Norman, 36, have bought a resale apartment in the Peabody scheme Pembury Place, close to Hackney Downs station, paying £250,000 for a 50 per cent share.

The couple were renting less than a mile away and didn’t think they could afford to buy in Hackney — but managed to get on the ladder through the shared ownership scheme.

“Location was very important to us,” says Valcaral. Their ground floor flat has a private garden and cycle storage.

Dulwich

That village feel: Lordship Lane in leafy Dulwich

Agents are reporting high demand in Dulwich, a leafy enclave with a village feel and a wide choice of good schools.

“My £1.75 million terraced property with a garden sold for asking price this month after 14 separate viewings over the course of one open day,” one vendor told Homes & Property.

“The lockdowns seem to have been a catalyst for people looking for a change, which is making the Dulwich property market increasingly busy,” says Dominic Butler of Foxtons.

Selling points include the communities of Peckham Rye, Dulwich Village and Lordship Lane, with lots of independent shops, cafes and restaurants. It is surrounded by open green space such as Dulwich Park, Peckham Rye Park, Sydenham Woods and Belair.

“This year we have seen an increase in young families moving into the area, whereas before buyers were mostly made up of single professionals or couples buying their first home.

“You could certainly argue that the stamp duty holiday has injected some life into the south-east London property market with buyers looking for more space,” says Lynburge Rene of Yopa.

Prices in Dulwich range from £300,000 for a purpose built one-bedroom flat, up to £1.5 million for a Victorian terraced house in East Dulwich.

Some of the houses in Dulwich Village can range from £5 million to £7 million, and above.

Brockley and Lewisham

Foodie haven: Brockley Station, near the famed market

Brockley sits between Lewisham and Nunhead, with foodie and cultural venues that pull in people from all over London.

The Time Out award-winning Brockley Market is open on Saturdays for fresh produce which ranges from seafood to charcuterie.

The Fifties-style Rivoli Ballroom hosts jive nights and cinema showings and residents are waiting eagerly for the reopening of the Jack Studio Theatre.

“The property market in Brockley has gone mad over the past month. All the properties I am marketing have plenty of viewings and competitive offers,” says Rene. Brockley is pricier than Lewisham.

New Cross

£325,000: private chef Ceri Jones, 38, is selling her one-bedroom flat in New Cross

£325,000: private chef Ceri Jones, 38, is selling her one-bedroom flat in New Cross

Private chef Ceri Jones, 38, is selling her one-bedroom flat in a period building in New Cross. Wide steps lead up to the front door and her walls are covered in ivy.

Jones teaches cooking online (her Instagram handle is @cerijoneschef) and is wedded to London.

“I grew up in Epsom and I don’t want to leave London. I am looking in Zones 3 and 4 to get a garden and I’ve outgrown my kitchen,” she says.

She is hoping her next place will be in Crystal Palace or Annerley (which is cheaper), Hither Green, Catford or Forest Hill.

Her light-filled, airy flat is on sale with Peter James and listed on Rightmove for £325,000.

Thamesmead

From £297,000: homes at Southmere, a Peabody scheme in Thamesmead

One stop from the Abbey Wood Crossrail hub is Thamesmead, another south-east London area that PropCast data shows is in a sellers’ market.

A 30-year plan will transform it into a sustainable neighbourhood 20 minutes from the West End.

Peabody, the housing association/developer, is set to deliver 8,000 new homes and create 4,000 jobs, while improving access to five kilometres of riverbank, seven kilometres of canals, six lakes, three nature reserves and 350 acres of open space.

Homes at its scheme Southmere are available. The lakeside development will launch on March 27 when wannabe buyers can sign up for one of the one, two and three-bedroom apartments and three and four-bedroom townhouses.

There will be community facilities, including restaurants, shops, a residents’ lounge, library and leisure facilities.

One-bedroom apartments will start from £297,500