Cost of living: Ofgem price cap leads to debate over energy bill support

Ofgem's announcement will not affect what customers pay for each unit of gas and electricity because that is limited by a government guarantee.

But it is likely to show the cost to government of support is lower than was initially expected.

Campaigners say ministers should stop a rise in energy bills in April.

Chancellor Jeremy Hunt previously told the BBC that although the policy remained under review, he did not think the government had the "headroom to make a major new initiative to help people".

How much you will pay

Under the government's Energy Price Guarantee (EPG), a household using a typical amount of gas and electricity in England, Wales and Scotland is currently paying £2,500 a year for energy. Without government support, that annual bill would have been £4,279 since January.

The chancellor has already announced that the EPG will become less generous in April, which means the typical household will be paying £3,000 a year.

Ofgem will announce later on Monday what that bill would otherwise have been from April to July, without the guarantee. Analysts at consultancy firm Cornwall Insight predict that to be £3,295, because of falling wholesale prices.

The government compensates energy suppliers with the difference between the guarantee and Ofgem's cap.

'National act of harm'

The EPG began in October last year, and is scheduled to continue to April 2024. Falling wholesale prices mean the potential cost to the government could be billions of pounds less than initially thought, but still totalling just under £30bn.

Such figures were, and could still be, highly volatile. The government says the "savings" would be money not borrowed, rather than a pot of money available to spend elsewhere. However, the figures have prompted dozens of charities and campaigners to call on the government to reverse the plan for a typical annual bill to rise from £2,500 to £3,000 in April.

The consumer finance expert Martin Lewis described the bill rise as a "national act of harm". Labour and the Trades Union Congress (TUC) have made the same call.

"The government must cancel its imminent hike in household energy bills at next month's Budget. Families across Britain are being pushed to the brink by sky-high bills," said TUC general secretary Paul Nowak.

The Liberal Democrats have gone further and want energy bills to be cut.

Suppliers must write to customers a month ahead of the price rise, so letters would be sent out later this week - which is two weeks before the Budget.

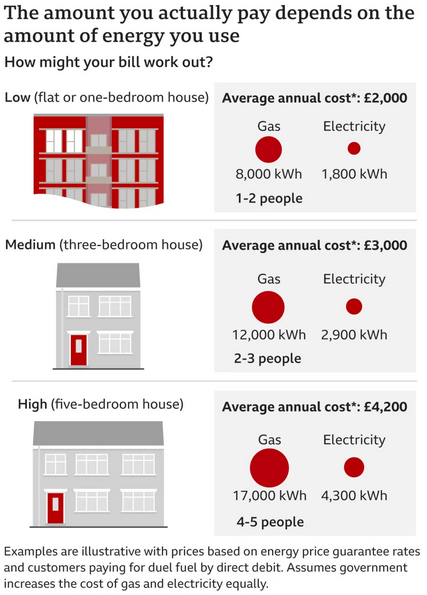

The government guarantee, like any energy price cap, does not limit the total bill. It limits the cost per unit of energy.

This is reflected by showing an annual bill for a household that uses a typical amount of gas and electricity - which in April is set to be £3,000. However, a billpayer living in a small, well-insulated flat will use less energy so pay less. Someone in a large, draughty house will pay more.

The government discounted everyone's bills by an additional £400 this winter - with six monthly discounts on bills of about £67 - but this support comes to an end in April. Lump sum payments have also been available in Northern Ireland, which has a more complex market, including many households using heating oil.

Cost-of-living payments, which can be worth hundreds of pounds, will continue to be paid to households across the UK on low incomes and benefits, as well as pensioners and those with disabilities.

Despite the support, charity National Energy Action estimates that 1.5 million more households will go into fuel poverty (typically spending more than 10% of their income on energy) as a result of bill increases in April.

Standing charges

Ofgem's announcement later will also update households on how much they will pay in standing charges. These are the fixed daily rates paid for having a gas and electricity connection to your home.

Changes to electricity transmission rules, agreed previously, may lead to these charges rising. At present, these stand outside of the government's guarantee, so may lead to a further - but relatively small - increase in people's bills. These vary by region, so the cost will also depend on where you live.

Separately, people who pay for their energy by cash or cheque on receipt of a bill currently typically pay about £250 a year more than those who pay monthly by direct debit. Historically, Ofgem has said costs for these customers were higher for suppliers as they were more likely to miss payments.

Customers on top-up prepayment meters also have a bill that is £55 a year higher than a typical direct debit customer, owing to higher fixed costs.

Ofgem is expected to update the figures later on the difference in bills between the various types of payment.

Future bills

Forecasts suggest household bills would fall below the government guarantee by July and be governed again by Ofgem's cap, due to falling wholesale prices.

This would also lower the amount that the government receives in windfall taxes.

For households, it could also prompt a return of competition among suppliers for fixed deals.

However, Ofgem's boss Jonathan Brearley warned that customers should take care and "do your homework" over how prices might change in the future before making a decision.