Cost of living: How interest rate rise will impact your mortgage bill

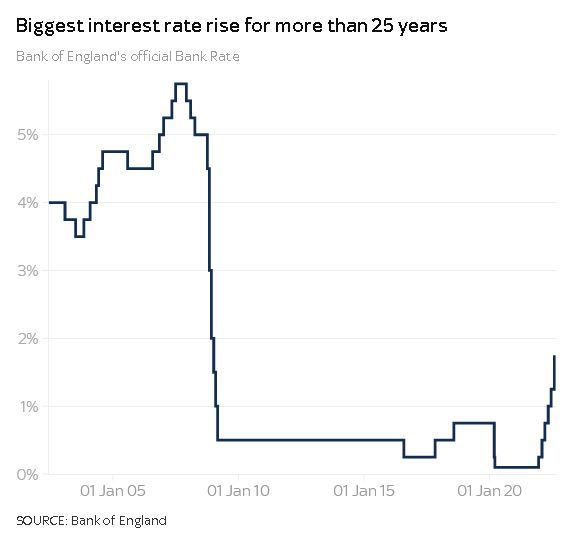

The Bank of England has imposed the biggest interest rate hike since 1995 in a bid to tackle inflation, but is adding significant costs to borrowers in the process.

Consumer finance experts told Sky News there were significant savings to be had by switching to a fixed rate mortgage deal and shopping around for higher savings rates after the Bank rate - used to determine tracker and standard variable revert rate (SVR) mortgage repayments - was raised to 1.75% by policymakers in the City.

It marked the first time in over quarter of a decade that such a hefty increase, of half a percentage point, has been imposed following five previous, but smaller hikes, since December.

It follows hot on the heels of sharp rate hikes by the US Federal Reserve amid a warning from the International Monetary Fund that central banks should be taking an aggressive stance against inflation.

Why is the Bank raising interest rates?

It is all part of efforts to get inflation - currently at a 40-year high - under control under the Bank's remit for inflation to reach a target rate of 2%.

It is worried about domestic pressures, especially a tight labour market pushing up wages.

But it also puts the blame for rate rises squarely at the feet of Vladimir Putin.

The main consumer prices index (CPI) measure of inflation currently stands at 9.4% and the Bank now predicts it will surge beyond 13% this winter as energy prices continue to climb across Europe because of Russian curbs on gas exports to the continent.

Rate hikes are designed to take demand out of the economy - helping cool the hot pace of price growth and wages faster than would otherwise be the case.

I thought the Bank could not control energy costs?

It can't.

The Bank's big problem here is that the energy crunch is a supply issue it can do nothing about.

Its focus is therefore on speeding up the transition to easing inflation, which, for example, has included pleas for wage restraint.

The Bank fears pay settlements in line with inflation, currently being sought by many unions, making inflation even more stubborn to bring down.

So who is left worse off by rising rates?

Any borrower.

The simple fact of life is that if the Bank rate goes up, so do the interest rates paid by businesses and individuals for loans unless they are on fixed-terms.

When it comes to housing, there are still around two million households on tracker and SVR deals which collectively make up about a quarter of the mortgage market.

According to figures from industry body UK Finance, tracker customers now face paying £171.47 more per month than they were doing when rates started to creep up last December.

For SVR customers, the figure is £108.37.

What about fixed rate deals?

The cost is - inevitably - also on the march because the Bank rate is going up.

They key thing here though is current holders of a fixed rate deal will feel no pain until such time their deal expires.

According to the financial product data specialist Moneyfacts.co.uk, the average five-year fixed rate had breached 4% in advance of Thursday's rate hike - from 2.6% in December last year.

It put the average SVR rate at 5.17%.

Moneyfacts said the difference between the average two-year fixed mortgage rate and SVR deal was worth around £3,300 on average in savings annually.

According to UK Finance, around 1.3 million fixed rate deals are due to end this year at some point.

What about business and personal loans?

It is clear that banks are generally demanding an improved rate of return but much depends on the financial circumstances of the customer as levels of risk will be different.

If borrowers are paying more, why are savings rates failing to keep up?

The old adage goes that lenders are quick to punish but slow to pass on any benefits.

Moneyfacts said that average easy access savings rates stood at 0.2% last December and 0.69% at the start of this week.

Given the pace of inflation, at 9.4% currently, savings power remains well and truly eroded.

What can I do to shield myself from rising rates?

The advice is to shop around for financial products with consumer groups, charities and switching services all offering help in finding the most suitable deals.

When it comes to mortgages, affordability criteria are crucial.

Moneyfacts finance expert Rachel Springall said: "Borrowers who have not locked into a fixed rate would be wise to move quickly to secure a new deal as interest rates continue to climb."

She added: "The cost of living crisis, interest rate rises and house price growth could price out would-be buyers if they have little disposable income and subsequently eat into their savings.

"On the other hand, remortgage customers may find they have more equity in their home but will need to get some independent advice on whether they can comfortably afford to switch their deal."