Budget 2023: Why more parents face losing child benefit

In 2013, the government changed the rules so people who get child benefit start losing it once they earn £50,000 a year.

Over that decade, rising prices mean the amount you can buy with a £50,000 salary has fallen. This means people are being affected by the policy today who are less well-off than when it was introduced.

Like Geoff, from Whitley Bay, who says he turned down a better-paying job because of this.

"I had an opportunity to take on a new job but basically the extra income that I was going to get from that new job took me over the £50,000 mark," he told BBC Money Box.

He said the combination of losing some child benefit and having to pay some extra childcare costs meant "it just didn't work".

When do you lose child benefit?

Child benefit is paid to families in the UK with children under the age of 16, or under 20 if they are still in types of full-time education or training such as studying for A-levels or Scottish Highers.

You receive £21.80 a week for one child and £14.45 for each additional child. Those amounts are due to rise by 10% in April.

If you earn more than £50,000, your child benefit starts being gradually withdrawn, such that if you earn £60,000, you don't receive any child benefit at all.

It means you lose 1% of your child benefit for every extra £100 you earn.

It's only based on the income of one partner. So if two parents earn £50,000 each they still get full child benefit, but if one earns £60,000 and the other isn't working (or they are a single parent) they don't get any child benefit.

And it's up to parents to inform the taxman when they start earning more than £50,000.

If they don't, they can be fined:

* In 2017-18, 20,281 fines were issued

* In 2018-19, 4,742 fines were issued

* In 2019-20, 1,217 fines were issued

You can work out how much of it you may need to pay back via a tax return using this government calculator. You can also opt not to receive it in the first place.

What about rising prices?

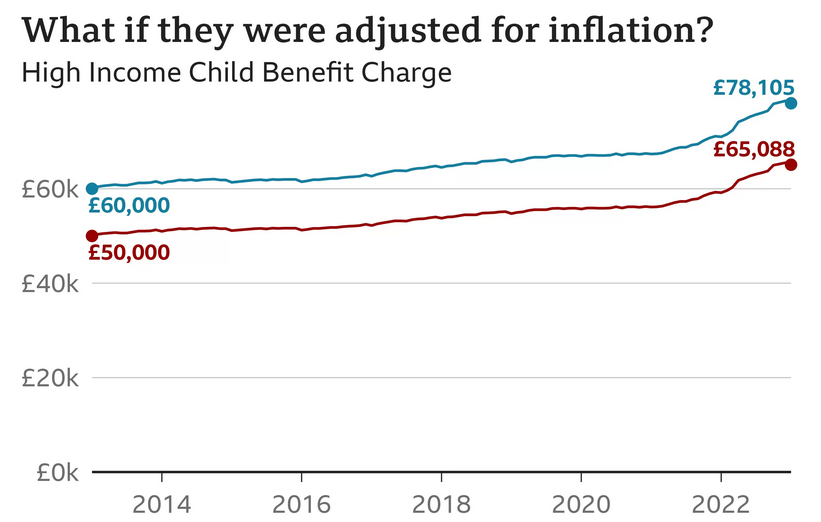

The £50,000 to £60,000 threshold has not changed since the policy - known as the High Income Child Benefit Charge - was introduced by the then Conservative Chancellor George Osborne in 2013.

If the thresholds had been adjusted in line with rising prices since 2013, you would now start losing child benefit when you earn more than about £65,000 and lose it completely from about £78,000.

Not adjusting the thresholds for inflation means that a lot more taxpayers are now being affected, compared with when the policy was introduced. And it means the government is raising a lot more money.

An estimated 26% of families with children in the UK (around two million households) are now losing some or all of their child benefit, according to the economic think tank the Institute for Fiscal Studies (IFS).

This is double the proportion when the policy was introduced a decade ago,

We asked the government if it thought the level of the threshold was too low. Its response did not address the question but talked about how progressive the tax system is.

Another frozen threshold

You usually expect thresholds in the tax system to go up each year. When the thresholds at which people start paying income tax, for example, are not altered it means a considerable tax rise, especially when prices are rising.

And there is a threshold at a big, round number in the tax system, which has been frozen for even longer than the child benefit one.

People don't have to start paying income tax until they are earning more than £12,570 a year, which is called the personal allowance.

The personal allowance itself has risen considerably since 2010-11, when it was only £6,475.

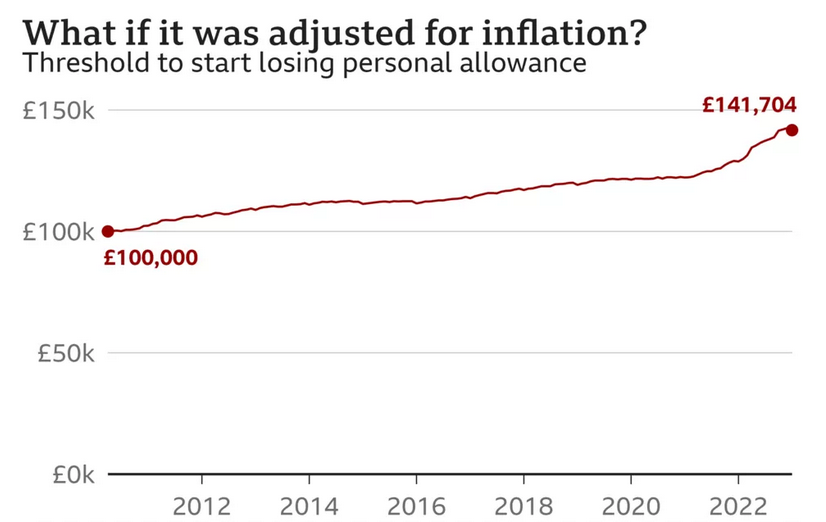

But since 2010, it has started to be withdrawn at a rate of £1 of allowance for every extra £2 earned above £100,000.

It means those earning more than £100,000 a year start paying tax on part of their earnings they did not previously have to pay tax on.

And that £100,000 threshold has not changed since it was introduced by the then Labour Chancellor Alistair Darling.

If the £100,000 threshold had been increased in line with rising prices since 2010, it would be almost £142,000 today.

The IFS says that 530,000 adults (about 1%) had some of their personal allowance withdrawn in the first year of the policy, which has increased to about 1.3 million (2.4% of adults) this year.

We asked the government if it was considering changing the threshold given the number of extra taxpayers and were told that it keeps all taxes under review.