BP to 'accelerate greening' as surging energy prices push profits to $12.8bn

Oil giant BP has announced plans to "accelerate the greening" of the company while revealing its highest annual profits for eight years on the back of surging oil and gas costs.

The firm said underlying profits came in at $12.8bn (£9.5bn) for 2021 on the back of $5.7bn loss over the previous 12 months.

The performance was aided by $4.1bn in earnings during the final three months of 2021 - up from the $3.3bn between July and September which prompted boss Bernard Looney to admit the company had become a "cash machine" thanks to the higher oil and gas prices.

It released its figures just a week after Shell faced a backlash on the back of its own gushing annual profits - of $17bn.

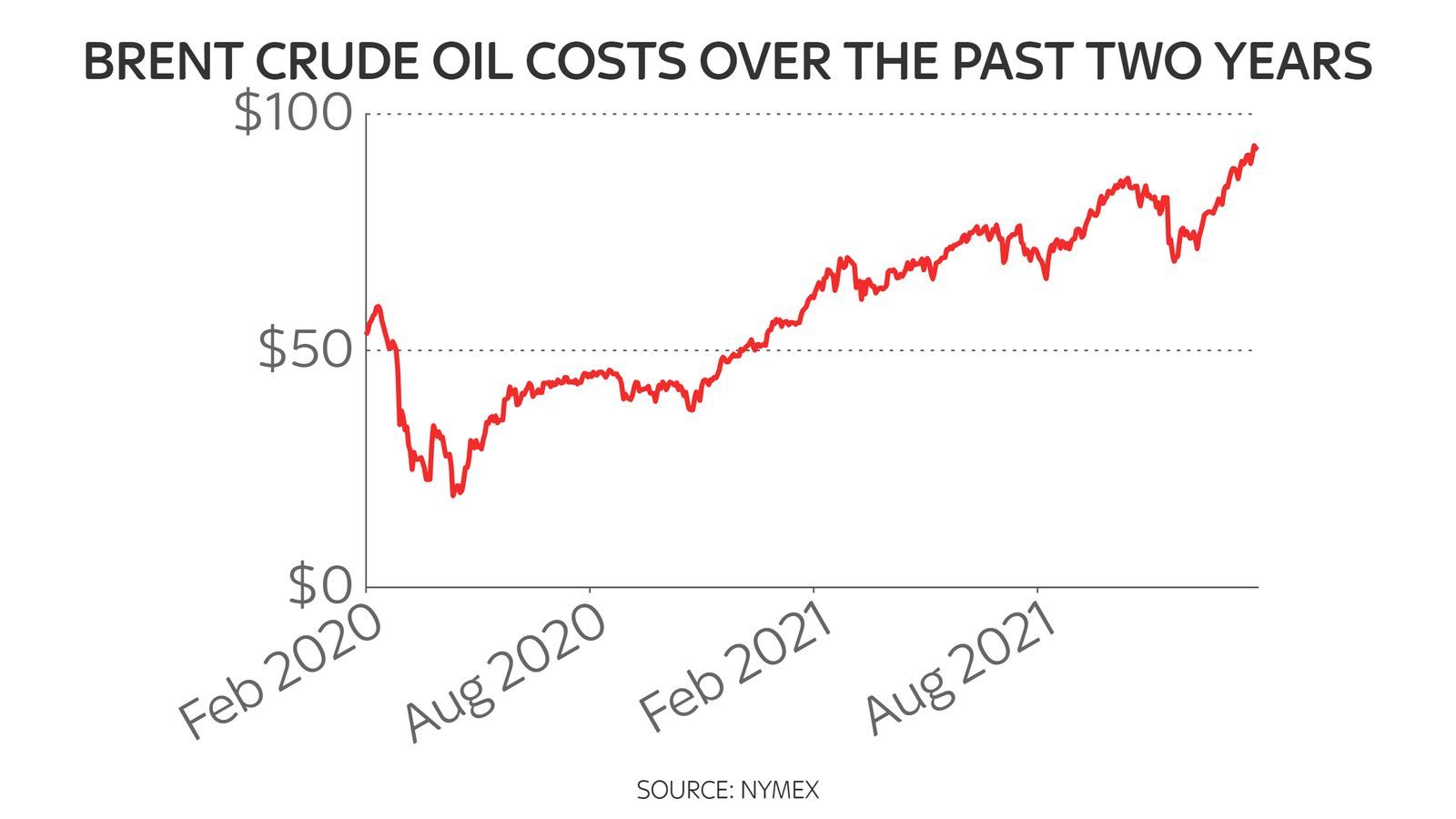

BP has benefited from a four-fold lift in raw energy costs

BP has benefited from a four-fold lift in raw energy costs

While both companies are staples of pension funds, critics accuse them of profiting on the back of misery for UK households following the recovery in COVID-hit wholesale energy prices during 2021 that has sparked demands for a windfall tax.

The price surge has seen Brent crude oil - the international benchmark - lift from lows below $20 per barrel in April 2020 to $93 this week.

Natural gas costs have also gone through the roof to hit unprecedented levels and 22 million UK households were told last week they faced a 54% increase in the energy price cap from April as a result.

Because high energy prices feed into everything we do, the economy is facing a cost of living crunch as goods and services all rise in tandem.

The Bank of England predicted last week that inflation will exceed 7% for the first time in a generation.

BP said on the back of its annual figures that it would spend more on the transition to green energy to boost capacity from renewables and hydrogen.

A key component was a target to be net-zero across its sales - on top of operation and production - by 2050 or sooner.

The company said it was now aiming to cut operational emissions by 50% by 2030, compared with a previous target of 30-35%.

It expected to increase the proportion of its capital expenditure in transition growth businesses to more than 40% by 2025 and aimed to generate earnings of $9-10bn from these businesses by 2030, "driven by five transition growth engines - bioenergy, convenience, electric vehicle (EV) charging, renewables and hydrogen."

Its UK plans included investment in offshore wind in the Irish Sea and off the coast of Scotland while it also committed more money to EV charging points.

Analysis: Profit backlash will intensify

Helen-Ann Smith

Business correspondent

BP’s huge profits of $12.8bn (£9.5bn) are set to be controversial and not just with those voices that make a habit of criticising large corporate takings.

The reason, of course, is that the very forces that have made BP much of its money - record prices for wholesale gas driven by a boom in demand for energy and a shortage of renewables - are the very same forces that are leaving many families facing such desperate financial times.

It was just last week that the Ofgem price cap, designed to protect customers, was raised by 54% - it will mean an average of £700 extra on a household’s annual bill. It had to go up, energy companies simply couldn't balance their books with it remaining so low, but it will plunge an estimated quarter of UK households into fuel poverty at the very time inflation and tax rises are also biting.

Under these circumstances poverty campaigners have described oil and gas profits ‘obscene’.

All this will no doubt accelerate calls for a so-called windfall tax - a one-off tax on these profits with the intention of redirecting that money to struggling families. Labour has thrown its weight firmly behind it.

But the Chancellor is, thus far, resisting. He may have good reason to as a windfall tax would take money away from investments in its net zero targets and could result in companies raising prices further.

The whole industry also made drastic losses in 2020. Windfall taxes too ultimately target shareholders, which in the case of companies like BP are often pension funds rather than rich individuals.

But with the boss of BP describing the business as a ‘cash machine’ many are angry, and argue that doing nothing is plunging people into poverty.

BP said it had completed a "reorganisation", announced in 2020, that cut 10,000 of its 70,000 workforce. Its shares were up by 1% in early deals but later gave up the gains to end 2.4% lower.

Chief executive Mr Looney told investors: "2021 shows BP doing what we said we would - performing while transforming.

"We've strengthened the balance sheet and grown returns. We're delivering distributions to shareholders with $4.15 bn of (share) buybacks announced and the dividend increased. And we're investing for the future."

But shadow energy secretary Ed Miliband said: "BP's results yet again demonstrate the case for a windfall tax.

"The boss of BP described the energy price crisis as a cash machine for his company and the people supplying the cash are the British people through rocketing energy bills."

Liberal Democrat leader Ed Davey said of the results: "The truth is that this is about basic fairness. It simply cannot be right these energy companies are making super profits whilst people are too scared to turn their radiators on and terrified there will be a cold snap.

"The government has said that a windfall tax would harm investment but this is an absolutely bogus argument. These profits have come out of nowhere, no energy company was expecting them, no investor was either."

Mr Looney told CNBC a windfall tax would not address the current crisis.

He said: "We need more gas, not less gas, and therefore we need to encourage investment into the North Sea and not discourage it."