US economy could be headed toward recession, economist warns: '100% odds' of global slowdown

The U.S. economy could be barreling toward a recession in the next year, as persistently high inflation and an increasingly hawkish Federal Reserve weighs on growth.

Greg Daco, chief economist at EY-Parthenon, warned in a new analyst note that the odds of an economic downturn in the U.S. over the course of the next year are somewhere between 35% and 40%.

There's an even greater risk of a global downturn.

"A U.S. recession is unlikely in the very near term, but there are several uncertainties on the horizon," Daco wrote. "While I put the odds of a U.S. recession somewhere around 35-40% in the next 12 months, the odds of a material global growth slowdown are close to 100% in the next six months."

While the U.S. economy remains strong in the interim, "cracks are starting to appear in the foundation," he wrote. Sky-high inflation, rising interest rates and depressed financial markets are likely to weigh on consumer spending in coming months. Consumer spending accounts for about two-thirds of gross domestic product, the broadest measure of goods and services produced in the nation.

A man shops at a Safeway grocery store in Annapolis, Md., May 16, 2022.

A man shops at a Safeway grocery store in Annapolis, Md., May 16, 2022.

"With the Fed tightening the monetary policy spigot with increased determination and the global economic outlook turning bleaker, the U.S. economy will grow more susceptible to a downturn in the coming months," Daco wrote.

Economic growth in the U.S. is already slowing. The Bureau of Labor Statistics reported earlier this month that gross domestic product unexpectedly shrank in the first quarter of the year, marking the worst performance since the spring of 2020, when the economy was still deep in the throes of the COVID-induced recession.

The analysis comes amid growing fears on Wall Street that the Fed may drag the economy into a recession as it seeks to tame inflation, which climbed by 8.3% in April, near a 40-year high. Bank of America, as well as Fannie Mae and Deutsche Bank, are among the Wall Street firms forecasting a downturn in the next two years, along with former Fed Chairman Ben Bernanke.

"The Fed is attempting to thread the needle while wearing boxing gloves and a mouth guard, which reduces its degrees of freedom to act without causing damage to the real economy," said RSM Chief Economist Joe Brusuelas, who has questioned whether the central bank will be able to achieve a soft landing.

Policymakers raised the benchmark interest rate by 50 basis points earlier this month for the first time in two decades and have signaled that more, similarly-sized rate hikes are on the table at coming meetings as they rush to catch up with inflation.

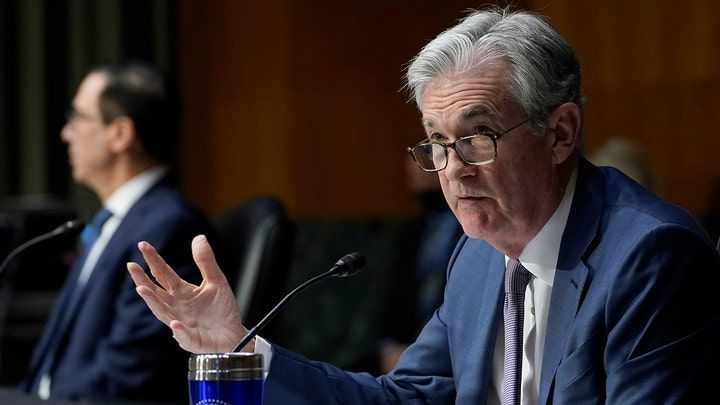

Federal Reserve Chairman Jerome Powell, right, testifies before the Senate Banking Committee on Capitol Hill.

Federal Reserve Chairman Jerome Powell, right, testifies before the Senate Banking Committee on Capitol Hill.

Fed Chairman Jerome Powell has acknowledged there could be some "pain associated" with reducing inflation and curbing demand but has pushed back against the notion of an impending recession, identifying the labor market and strong consumer spending as bright spots in the economy. Still, he has warned that a soft landing is not assured.

"It's going to be a challenging task, and it's been made more challenging in the last couple of months because of global events," Powell said Wednesday during a Wall Street Journal live event, referring to the Ukraine war and COVID lockdowns in China.

But he added that "there are a number of plausible paths to having a soft or softish landing. Our job isn't to handicap the odds, it's to try to achieve that."

Comments